The Sunday Drive - 09/24/2023 Edition [#77]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY! Let's take it easy and enjoy a leisurely Sunday Drive around the internet.

The Sunday Drive is also published at NewLanternCapital.com.

🎶 Vibin'

If you’ve followed the Sunday Drive for a while, you’ve probably noticed my obvious passion for differentiated performances, interesting mashups, and in particular, surprising or unlikely collaborations.

To paraphrase a quote by Sally Hogshead, “Different is better than better.” This is a window into my professional life as an investment manager - being, or a least trying to be, different, innovative and unique.

In that spirit, this week I’m vibin’ to an amazing performance of Superstition by Stevie Wonder who was joined by the one and only Jeff Beck at the 25th Anniversary of the Rock and Roll Hall of Fame. I hope you enjoy it as much as I did.

💭 Quote of the Week

“Inside of a ring, or out, ain’t nothing wrong with going down. It’s staying down that’s wrong.” – Muhammad Ali

📈 Chart of the Week

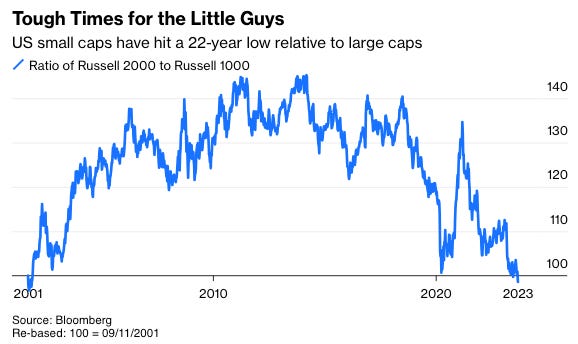

The dramatic performance of the largest stocks in the S&P 500 this year has driven a solid rally in the index year to date, yet masked the poor performance of the rest of the market.

Put in the context of risk vs. reward, with small cap stocks back at historic lows relative to large cap stocks, it is reasonable to assume that we could see a meaningful broadening of the performance drivers of the equity market in the not so distant future.

This isn’t the first time I’ve mentioned this idea in the Sunday Drive, but increasing allocations to small cap stocks is something that, at least to me, could be a very rewarding move. However, if history is any guide, it’s best to be early.

🚙 Interesting Drive-By's

This week we have articles on Options, Human Nature, Private Railways, and Office Space:

📈 The Most Popular Option Trade Turns a $1 Investment Into a $1,000 Stock Bet - from Bloomberg ($Paywall)

There’s an invisible force driving the most popular options trade of the year — one that gives Wall Street pros and day traders alike the power to turn a $1 investment into a $1,000 stock bet.

Investors are wagering on the daily gyrations of American equity benchmarks by dashing in and out of trading contracts that expire within 24 hours — known by the “0DTE” moniker — with less upfront capital than meets the eye. The hidden fuel for the frenzy: Quirks in the ecosystem of the derivatives marketplace that makes these zero-days-to-expiry options look cheap. [link]

🤔 The Paradox of Control - from Casey Rosengren

As humans, our brains evolved to help us better adapt to and control our environment. Other animals deal with winter by migrating or hibernating. Humans? We learned how to tame fire and make jackets out of goose feathers.

Because control is effective in so many situations, we can apply it in places where it doesn’t work. For entrepreneurs, I typically see this come up in their reaction to uncertainty—stressing about what might go wrong and how to respond to various imagined scenarios. [link]

🚊 Meet the First Private US Passenger Rail Line in 100 Years - from AP News

The first big test of whether privately owned high-speed passenger train service can prosper in the United States will launch Friday when Florida’s Brightline begins running trains between Miami and Orlando, reaching speeds of 125 mph (200 kph).

It’s a $5 billion bet Brightline’s owner, Fortress Investment Group, is making, believing that eventually 8 million people annually will take the 3.5-hour, 235-mile (378-kilometer) trip between the state’s biggest tourist hubs — about 30 minutes less than the average drive between the two cities. The company is charging single riders $158 round-trip for business class and $298 for first-class, with families and groups able to buy four round-trip tickets for $398. Thirty-two trains will run daily. [link]

📉 All That Empty Office Space Belongs to Someone - from Rethinking65

At an office in New York’s SoHo, rows of desks sit empty, while a shaggy dog — shadowing an owner nostalgic for work-from-home comforts — wanders the conference rooms. At a tech workplace downtown, a gaggle of 20-somethings divide into teams, calling out, “Who’s on the Orange team?” and, “We’re going to kill it!” as part of a game night enticing them back to in-person work. On the subway, commuters delight in a once-unimaginable indulgence: bag-spreading across two seats.

About a year and a half after Mayor Eric Adams chided workers — “You can’t stay home in your pajamas all day!” — New York’s offices in late August were under 41% of their pre-pandemic occupancy. Just 9% of the city’s office workers were going in five days a week at the start of the year, according to the Partnership for New York City, a business group. Remote-work levels crisscrossing the country are more mixed, with just under one-third of America’s workdays now done from home.

But in New York, the broad feeling across offices is one that locals know well: It’s like sitting on the subway waiting to get somewhere and then feeling the car lurch to a stop. It sits there. Nobody has any idea when it’s going to move again. Passengers eye one another, feeling fidgety and useless. [link]

👋🏼 Parting Thought

The financial markets speaking to the Fed this week:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.