The Sunday Drive - 09/29/2024 Edition [#130]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY. Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

I’m waxing nostalgic this week, bringing the Wayback machine to 1989 (the year I met my wife) and digging Lyle Lovett’s appearance on the Johnny Carson show.

I’m not sure if it was Lyle’s signature Afro/Mullet, the support of the amazing Francine Reed, or just the sheer uniqueness of his songwriting that made this performance so memorable. Hey, he landed a marriage to Julia Roberts shortly thereafter, so he must have been doing something right.

This week I’m vibin’ to Lyle Lovett’s live performance of Here I Am and She’s Hot to Go. Enjoy.

💭 Quote of the Week

“It's nice to elect the right people, but that's not the way you solve things. The way you solve things is by making it politically profitable for the wrong people to do the right things.“

— Milton Friedman

📈 Chart of the Week

When I ran across this week’s Chart, I experienced one of those eye-popping moments of surprise that one sometimes gets in life. 😳

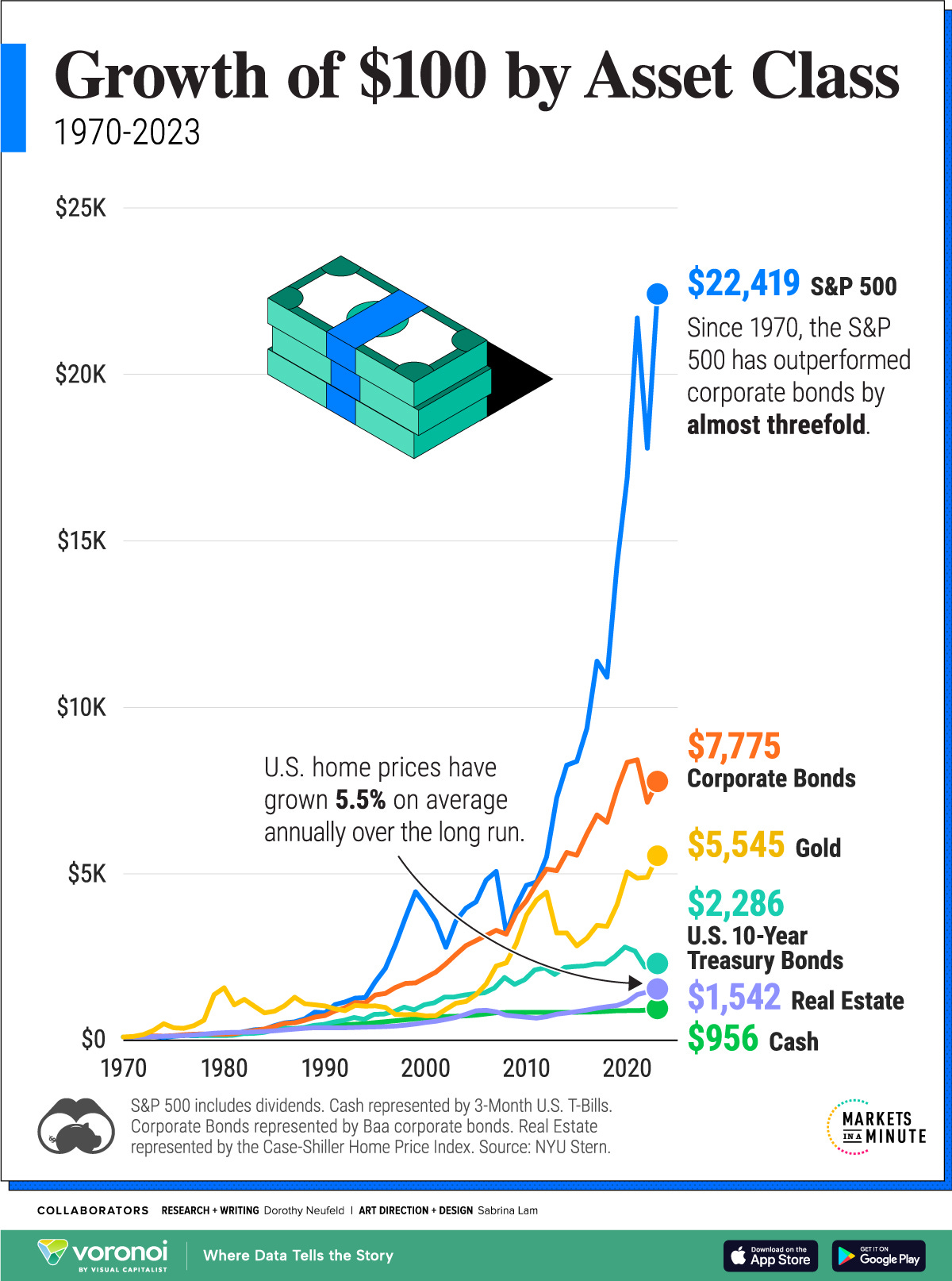

It is intuitively obvious to most folks that stocks outperform other asset classes over time, but the sheer magnitude of the S&P 500’s performance (blue line) relative to bonds, gold, real estate and cash over the last 50+ years is breathtaking.

It also invites a few questions:

Why would anyone invest in any asset class other than stocks?

Based on the historical performance of stocks, that's a reasonable question to ask. However, other asset classes can provide diversification benefits, which lowers the overall risk of an investor’s portfolio, admittedly at the cost of lower investment returns.

But, it’s important to point out that historical relationships between asset classes are not constant and do not always hold through different economic environments.

Long term readers of the Sunday Drive as well as investors in my fund are very familiar with my strongly held view that the most effective risk management tool is not diversification based on historical relationships. In my opinion, the better tool is… math.

Hedging stock positions using options and other similar instruments to not just lower, but actively manage the overall risk of a portfolio - as expressed by the volatility of its return stream, can be a much more reliable and predictable way to invest, in my opinion.

What happened 15 or so years ago that accelerated the outperformance of stocks as compared to the prior three decades?

The short answer is the Great Financial Crisis of 2008-9.

The longer and more technically accurate answer is the monetary policy response to the GFC by central banks, most notably the Federal Reserve Bank here in the U.S.

To counter what could very well have been an existential threat to the global banking system at that time, the Fed and other central banks deployed a number of increasingly creative monetary stimulus programs. They also lowered interest rates to never before levels.

This new interest rate regime also played a significant role in the recovery of the overall economy and its return to growth.

Stocks, in fact all financial assets, are valued on the basis of the present value of their long term expected cash flows. The lower the interest rate used to discount those cash flows, the higher the asset’s intrinsic value. The biggest impact of the historically low interest rates was on stock valuations because of their (theoretically) infinite lives and perpetual cash flow streams. This was particularly true as the stock market climbed its way up from the very low levels of early 2009.

The post-GFC interest rate policy, and a subsequent follow-on version in response to the COVID pandemic of 2020, made stocks more attractive than other asset classes, and their performance showed it.

What should we expect from stocks and other asset classes in the future?

In my view, nothing has really changed the likelihood that stocks will continue to outperform other asset classes over the long term.

However, it is reasonable to assume that stocks could give back some of their outperformance in the near to intermediate term. That might come by way of a material drawdown in the equity market, or - and this is obviously preferable for most folks - it could be that other asset classes catch up while stocks are flattish for a while.

Or….

This could be totally wrong. Stocks could continue their meaningful outperformance and never look back. After all, stocks are where innovation, growth, and productivity are most directly reflected.

🚙 Interesting Drive-By's

💡 Why Generalists Own the Future - from Dan Shipper [Link]

🤔 Is Health the New Wealth? - from Chip Conley [Link]

📉 The Contentapocalyspe is Coming - from Scott Bradlee [Link]

💰 The One-Person Billion-Dollar Company - from Evan Armstrong [Link]

🌆 Not Going to Work - from Dror Poleg [Link]

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners or Cache Financials.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.