The Sunday Drive - 12/21/2025 Edition [#194*]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! First, please accept my apology for the errant distribution earlier this past week of the template I use to create each week’s edition of the Sunday Drive. I am very grateful for your time and attention each week and hope you’ll forgive me for adding unnecessary clutter to your email inbox.

Christmas comes later this week and I hope all you have a wonderful Holiday. 🎄

Let’s enjoy a Yuletide-inspired Sunday Drive around the internet.

🎶 Vibin'

In keeping with the Holiday spirit, this week I’m vibin’ to one of my favorite renditions of a classic. For those who celebrate, I wish you a very Merry Christmas. Please enjoy Josh Groban’s O Holy Night.

💭 Quote of the Week

“You only go around once, but if you play your cards right, once is enough.“

— Frank Sinatra

📈 Chart of the Week

Recession Fears in 2025: From Panic to Perspective

If you wanted a real-time case study in how markets process uncertainty, overreact, recalibrate, and eventually move on, 2025 has certainly delivered.

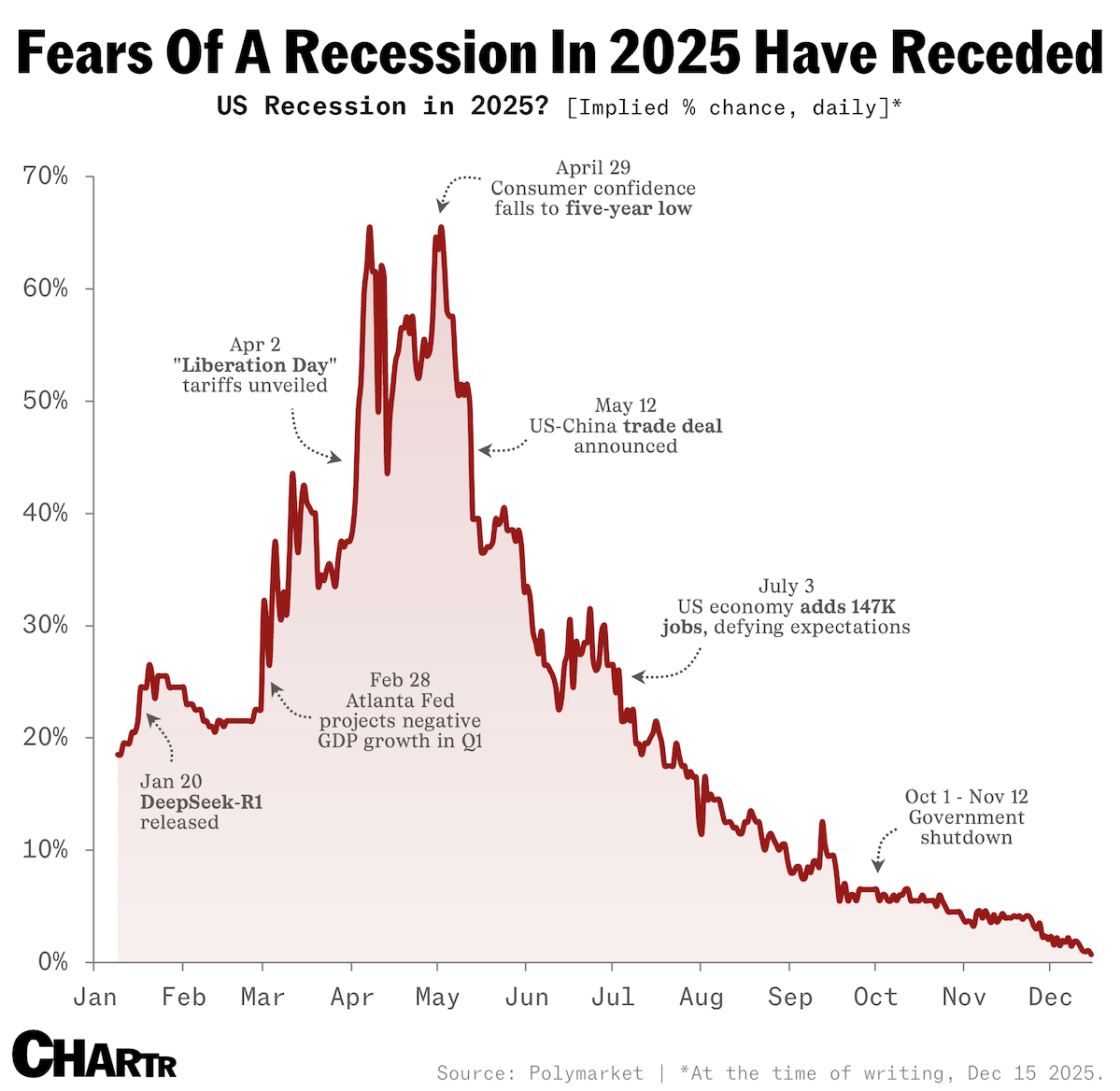

This week’s Chart tracks the implied probability of a U.S. recession during 2025, derived from prediction-market pricing. It’s an unfiltered window into investor psychology, one that tells us as much about narrative risk as it does about economic reality.

At the start of the year, recession odds hovered around 18–20%. Not low, but hardly flashing red. This reflected lingering unease from late-cycle dynamics: restrictive monetary policy, elevated real rates, geopolitical noise, and the ever-present fear that this time tightening would finally break something.

The Spring Panic Trade

Then came spring.

Between March and late April, recession odds surged above 60%, briefly touching ~70%. This wasn’t subtle. It was a full-blown panic phase, driven by a clustering of headline risks rather than a sudden collapse in fundamentals.

Tariffs announced on Liberation Day re-ignited trade-war trauma, one of the few policy tools with a historical track record of, in many minds, self-inflicted economic damage. At nearly the same time, consumer confidence fell to a five-year low, reinforcing the idea that higher prices and policy uncertainty were finally biting. Add in the February 28 update from the Atlanta Fed, which projected negative Q1 GDP growth, and the narrative wrote itself: stagflation, policy error, recession.

Importantly, markets weren’t reacting to realized deterioration; they were discounting possibility. That distinction matters. Prediction markets don’t ask “are we in a recession?” They ask “what are the odds something goes wrong from here?” In the spring of 2025, the list of things that could go wrong felt especially long.

The Fever Breaks

The inflection point arrived in mid-May with the announcement of a U.S.–China trade deal. This wasn’t about incremental GDP math. It was about removing a left-tail risk that markets had aggressively priced in.

Once the worst tariff fears were taken off the table, recession odds fell sharply and never looked back.

From that point forward, the data did what it usually does outside of actual recessions: it stabilized. Payroll growth in early July surprised to the upside, with 147,000 jobs added, undercutting the idea that the labor market was rolling over, at least on a broad basis. Financial conditions eased. Credit spreads behaved. Equity markets resumed acting like equity markets.

Even the October–November government shutdown, a classic headline-friendly growth scare, barely registered in context. Recession odds continued grinding lower, finishing the year near 2%.

The Lesson (Again) and a Peak at 2026

The most important takeaway isn’t that recession fears were wrong. It’s that markets are exquisitely sensitive to policy-driven uncertainty, especially when starting from a late-cycle, high-rate environment.

In 2025, the economy never fell apart. But for several months, investors were forced to handicap outcomes with asymmetric downside and limited visibility. When that fog lifted, so did recession fears.

This is why narrative discipline matters. Spring 2025 rewarded those who could separate volatility from deterioration and resist extrapolating worst-case scenarios from short-term noise.

This week’s Chart reminds us that markets don’t just price fundamentals—they price fear. And fear, almost always, is mean-reverting.

As we stand on the edge of a new year ahead, some complacency seems to have crept into market expectations. 2026 could very well be a year of volatility of the sort we haven’t seen in recent years.

Why? Because the market doesn’t seem to be expecting it.

In my experience, investors would be well advised to remember this old adage: “When you least expect it, expect it.”

Sources: Polymarket, Atlanta Federal Reserve, U.S. Bureau of Labor Statistics, Conference Board.

🚙 Interesting Drive-By's 🚙

🤔 Macroeconomics From Outer Space: Why Satellite Imagery Now Beats the Fed

💯 The Discomfort Premium: The Operating System For Lives That Compound

💡 What Becomes Valuable When AI Makes Creative Work Easy

🧐 The End of (Demographic) History

🎯 Rural Revolt Over Data Centers Threatens AI Expansion

👋🏼 Parting Thought

The Reason for the Season:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.

Really liked the framing here @Mike Allison ‘markets price fear’ is the cleanest summary of this year I’ve ever seen. The policy/left tail risk point was solid.

This is such a clean way to visualize how prediction markets get whipsawed by policy uncertainty. That 18% to 70% swing in spring wasn't about fundamentals breaking, it was the market trying to price something that felt uncomfortably binary with tariffs. I remember trading through similar setups where volatility gets bid up not becuase anyone has better information, but because the distribution of outcomes gets wider and everyone's models suddenly need bigger error bars.