The Sunday Drive - 10/19/2025 Edition [#185]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy another leisurely Sunday Drive around the internet.

🎶 Vibin'

Sometimes you run across a song from the past and are reminded how extraordinarily talented some artists are. That’s what happened to me this week. No theme—I’m just vibin’ to a beautiful song, beautifully sung. I hope you enjoy Barbra Streisand’s amazing performance of The Way We Were, from the 1973 movie of the same name. RIP Robert Redford.

💭 Quote of the Week

“’In my experience, each failure contains the seeds of your next success—if you are willing to learn from it.“

— Paul Allen

📈 Chart of the Week

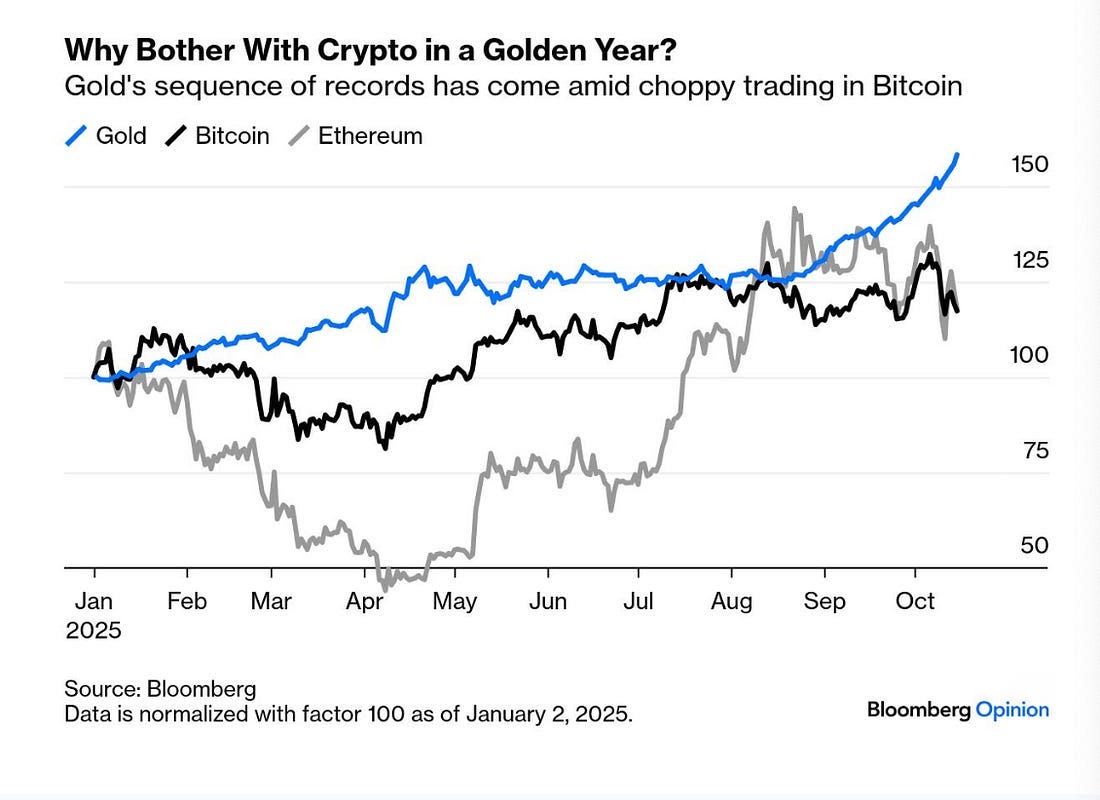

Following on last week’s Debasement Trade discussion, this week’s Chart shows the year-to-date performance of gold, Bitcoin, and Ethereum. It shows quite a divergence thus far in 2025. Gold’s relatively smooth and steady climb has stood in sharp contrast to the choppy and volatile trading patterns of the two leading cryptocurrencies.

Many regard cryptocurrencies, Bitcoin in particular, as “digital gold”—a decentralized non-physical store of value meant to hedge against the devaluation of the U.S. dollar and other fiat currencies. But this year, it’s the old-fashioned kind of gold that’s actually doing most of the heavy lifting.

Volatility is the key differentiator. Over the past decade, gold has typically exhibited annualized volatility in the 10–15% range, whereas Bitcoin has often swung between 50–80% annually. Ethereum’s volatility has been even higher.

This year’s pattern reflects that history: gold has trended steadily upward, while Bitcoin and Ethereum have zig-zagged wildly. For investors looking for a stable hedge against currency debasement or geopolitical shocks, that difference in realized volatility is not a rounding error—it’s the whole story.

Historically, gold has benefited from “flight to safety” flows during periods of macro uncertainty—think the Global Financial Crisis, the Eurozone crisis, and the pandemic shock. Crypto, by contrast, has yet to prove itself as a reliable defensive asset in those kinds of environments. In fact, Bitcoin has at times behaved more like a high-beta equity proxy than a hedge.

That doesn’t mean crypto shouldn’t have a place in many investors’ portfolios. One could argue that both gold and crypto might serve complementary roles. Gold offers lower volatility (than crypto) and stronger historical defensiveness. Crypto, by contrast, potentially offers asymmetric upside but at the cost of much higher drawdown risk.

My own view is that gold remains a classic hedge against inflation and currency debasement, while crypto—at least for now—is more of a high risk, speculative investment.

Sources: Federal Reserve Bank of St. Louis (FRED), CoinMetrics, Bloomberg.

🚙 Interesting Drive-By's 🚙

💡 The Need for a Third Agricultural Revolution

📉 Are We on the Edge of a Demographic Crisis?

📈 Is Valuation Dead in the Age of AI?

🤔 The Rise of Skynet: Ghosts in the Machine

🎯 Penn State Researchers Have Developed the World’s FIrst Silicon-free Computer

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.