The Sunday Drive - 04/13/2025 Edition [#158]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let's enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

This past week was another wild one. Whew!!

Today, I can’t help myself and I’m vibin’ to Iggy Pop’s Real Wild Child (Wild One). Here’s hoping for calmer seas in the coming weeks.

💭 Quote of the Week

“A successful person never loses. They either win or learn.“

— John Calipari

BONUS QUOTE

”There are decades where nothing happens; and there are weeks where decades happen.” — Vladimir Lenin

📈 Charts of the Week

Volatility as a Diversifying Asset Class

A few weeks ago we wrote about Fat Tails and Fat Pitches (The Sunday Drive).

Then came April 3rd, and as the meme goes:

The past week or so has reminded us of a timeless investment truth: volatility is not just a risk metric — it’s an asset class in its own right.

On April 9th, the S&P 500 registered one of its most volatile sessions ever, joining a list dominated by moments like Black Monday 1987 and the depths of 2008 (Sherwood).

At the same time, the CBOE Volatility Index (“VIX”) fell by over 35%, the largest single-day decline in its history (Creative Planning).

History tells us that periods following sharp VIX declines often deliver superior equity returns over 1–5 years, relative to average market periods.

Volatility Is Not Just Risk — It’s Opportunity

This suggests that volatility events act as “stress tests” that reset investor expectations, flush out leverage, and create asymmetrical return opportunities.

More interestingly, viewing volatility itself as a diversifier — through instruments like options, futures, volatility-targeting strategies, or structured notes — can enhance a portfolio’s robustness.

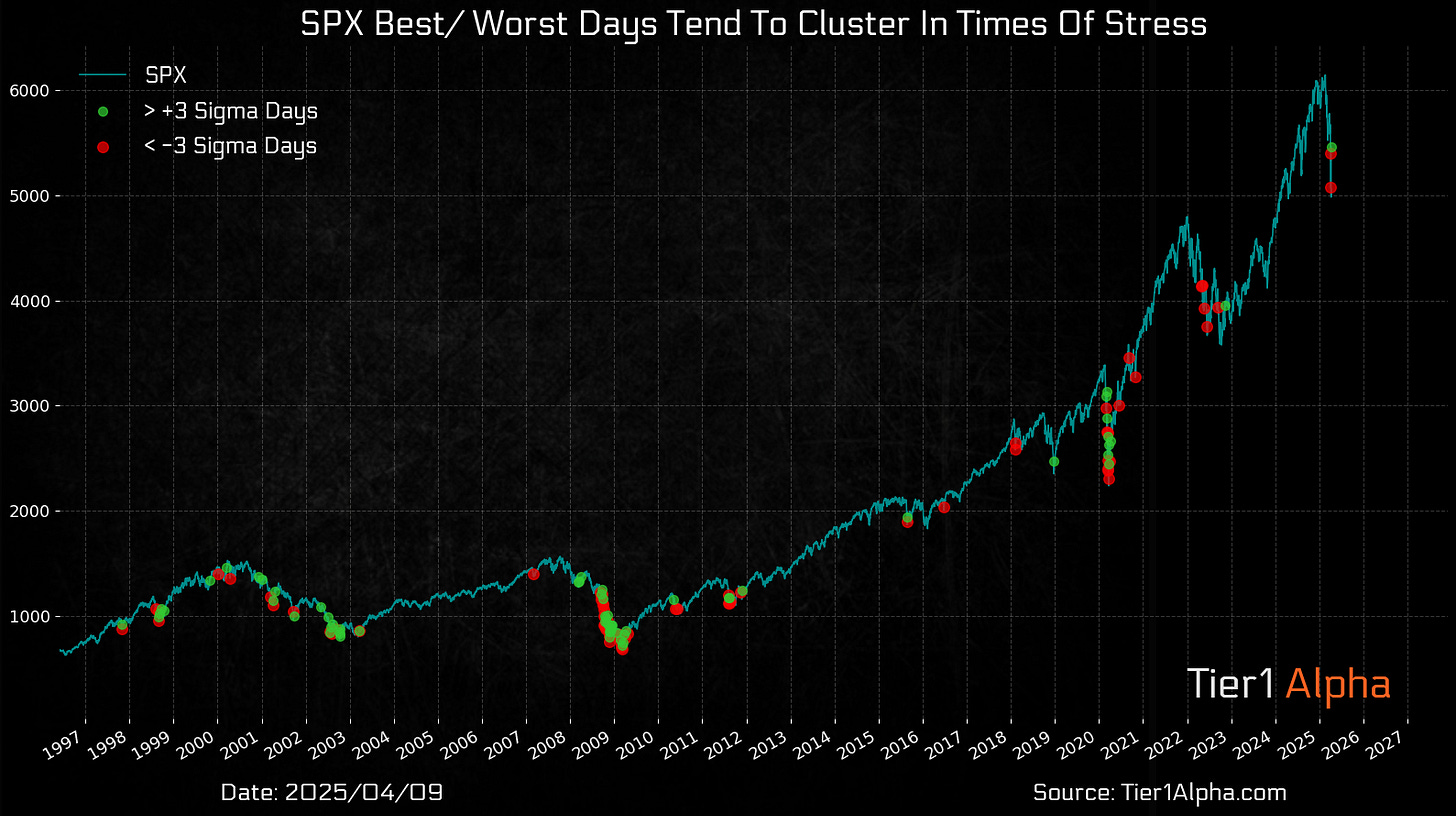

Long volatility exposure tends to outperform precisely when traditional assets falter, as evidenced by how S&P 500 “+/- 3 sigma” (standard deviation) days cluster during crises (Tier1Alpha).

Time to Move Past the 60/40?

Most investors are still trapped in the old “60/40” mindset, relying on asset classes that become increasingly correlated during “tail” events.

Instead, sophisticated investors and asset allocators can think in terms of regimes (The Sunday Drive):

Volatility spikes aren’t anomalies — they are predictable features of a complex, reflexive system.

Taking this view, being long volatility is less about speculation and more about intentional structural diversification.

It’s a contrarian but increasingly necessary framing for an era where financial markets are “organic” and “free-range,” to borrow Sherwood’s apt description.

A Final Thought

In short: volatility isn’t something to fear — it’s something to own.

Sources:

🚙 Interesting Drive-By's

📉📈A Tale of Two Markets - “It was the best of times. It was the worst of times.”

💡 Tariffs and Intangible Asymmetry - There's a fundamental asymmetry between China and America: Ideas spread quickly but factories are built slowly.

💯 Prepping for the 40 to 50 Year Retirement

🤔 Purpose Urbanism - Our cities and offices must learn from the architecture of AI models.

💸 Private Equity Owns Over 10% of All U.S. Apartments

🎯 The Nonlinear Economy - Most of us are playing a game that no longer exists.

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.