The Sunday Drive - 12/15/2024 Edition [#141]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Spring, NY! 🐎 Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

This week, there’s a different vibe. Normally, we’re vibin’ to a cool tune or an entertaining video. But…

This week, I’m feelin’ The Crazy Ones vibe.

We’re approaching the close of the wild and crazy chapter that was 2024 and look forward to 2025.

I’m excited to think about what the future holds as we think different about ways to help financial advisors tax-efficiently de-risk their client portfolios in ways no others have done before. Stay tuned…

💭 Quote of the Week

“Relentless is really hard to compete with.“

— Jay Bilas

Bonus Quote of the Week

”Modern Monetary Theory is neither modern nor monetary nor theory.”

— Scott Bessent

📈 Charts of the Week

As we look toward 2025, the case for hedging portfolios is becoming more compelling. The two Charts this week paint a clear picture.

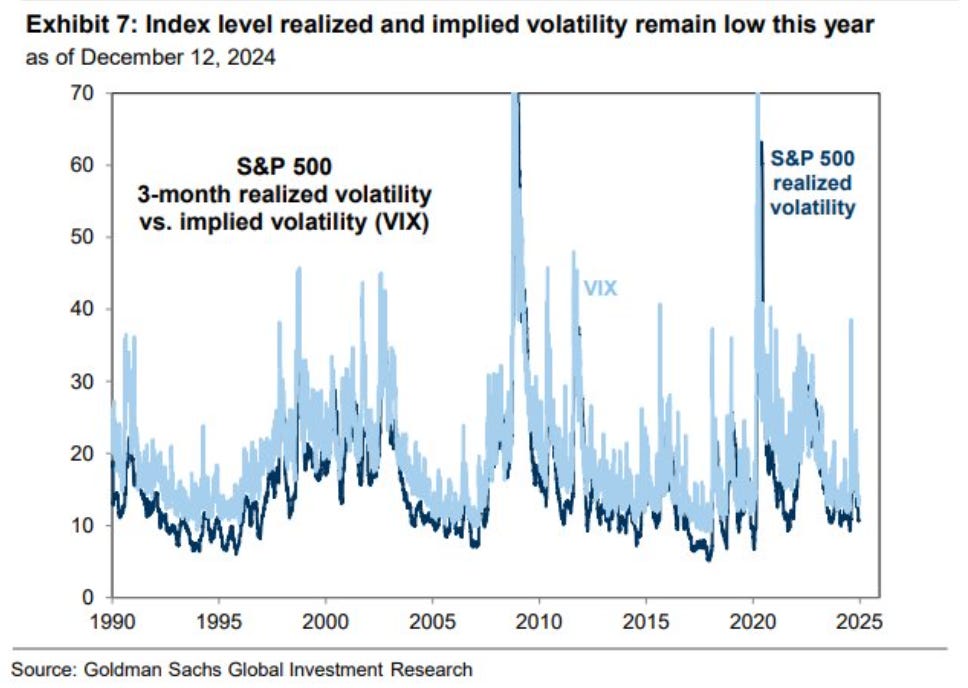

In the first Chart, we see that both realized volatility (actual market swings) and implied volatility (expectations of future swings measured by the VIX) are at historically low levels.

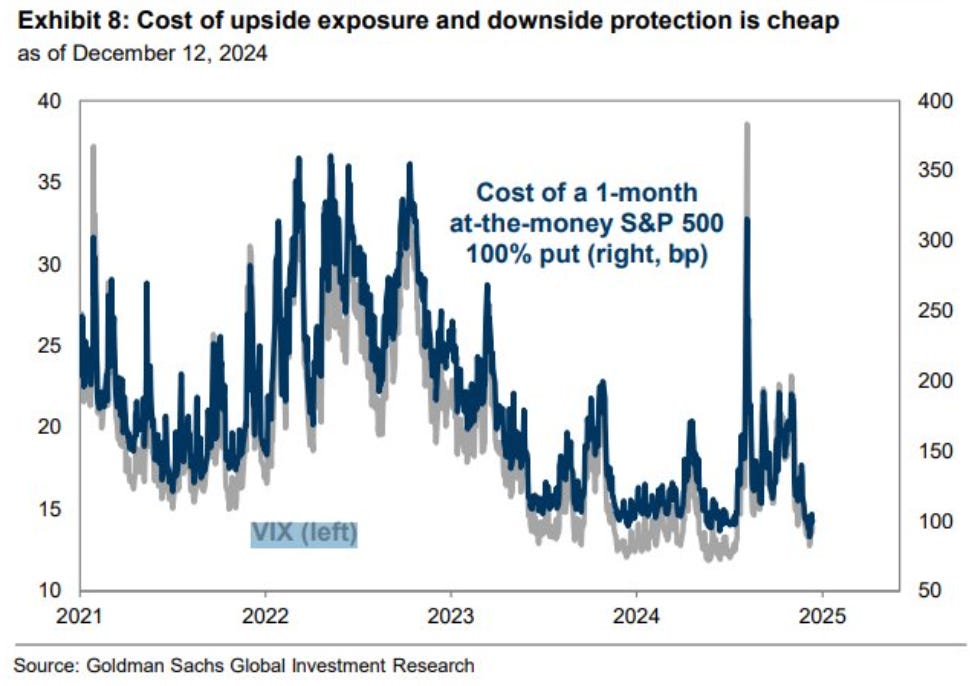

In the second Chart, we find that the cost of protection—the price of a 1-month at-the-money S&P 500 put option—is relatively cheap. For investors, this setup presents a potentially rare opportunity to lock in gains from the past two years without paying a hefty premium.

The stock market’s performance in 2023 and 2024 has been remarkable. For example, the S&P 500 returned 26.3% in 2023 and is up 28.5% year-to-date in 2024, with markets soaring as economic growth defied expectations and corporate earnings came in stronger than forecasted.

But history shows us that periods of low volatility and strong performance often precede heightened market turbulence. Think of it like the calm before the storm—a moment where complacency creeps in and risks are ignored. The low cost of hedging today reflects this complacency, but it’s also a gift for those willing to prepare for the unexpected.

Why Hedge Now?

First, let’s acknowledge the elephant in the room: valuations. The S&P 500’s price-to-earnings ratio has climbed significantly over the past two years, leaving little room for error. If earnings falter in 2025 or interest rates remain stubbornly high, a valuation reset could be on the table. Hedging now protects against such downside risks.

Second, macroeconomic uncertainties persist. The Federal Reserve’s rate-hiking cycle may be paused, but inflation remains sticky in some sectors, and geopolitical tensions continue to simmer. Any adverse event—be it economic, political, or financial—could reignite volatility in an instant.

Finally, the low cost of hedging is hard to ignore. With the VIX trading near multi-year lows and put option premiums subdued, the price of downside protection is as attractive as it has been in years. Essentially, you’re buying insurance during a period where the market believes it’s unlikely to need it. That’s often the best time to act.

Why Not Hedge?

Of course, there’s another side to this argument. Hedging isn’t free, and even at these low costs, it can still be a drag on portfolio performance if markets continue to rise. Given that 2023 and 2024 rewarded risk-takers handsomely, there’s an opportunity cost to allocating capital toward hedging strategies instead of riding the market’s momentum.

Additionally, some argue that today’s low volatility isn’t a sign of complacency but a reflection of market resilience. The global economy, particularly here in the U.S. has shown remarkable adaptability, and technological advancements continue to drive productivity gains.

The Middle Ground

For most investors, the best approach may be a balanced one. Instead of going all-in on expensive, long-term hedges, investors might consider short-term, tactical protection. For example, a 3-month put option can provide a buffer against sudden shocks without a material capital outlay.

Hedging isn’t about predicting the future; it’s about being prepared for it. With the S&P 500 near all-time highs and market volatility at a discount, now is an excellent time to evaluate your risk tolerance and consider layering in some protection. Because if there’s one thing we’ve learned from history, it’s that the best time to buy insurance is when you think you don’t need it.

Sources:

S&P 500 Returns: YCharts.

🚙 Interesting Drive-By's

🤓 Are Active ETFs Truly More Tax-Efficient?

🎯 Asset Allocation Outlook - Negative Correlations, Positive Allocations

🤔 Betting on Homeschooling and Microschooling

💡 Chips Linked with Light Could Train AI While Using Less Energy

📈 BATMMAAN Stocks - Beyond the Magnificent 7.

👋🏼 Parting Thought

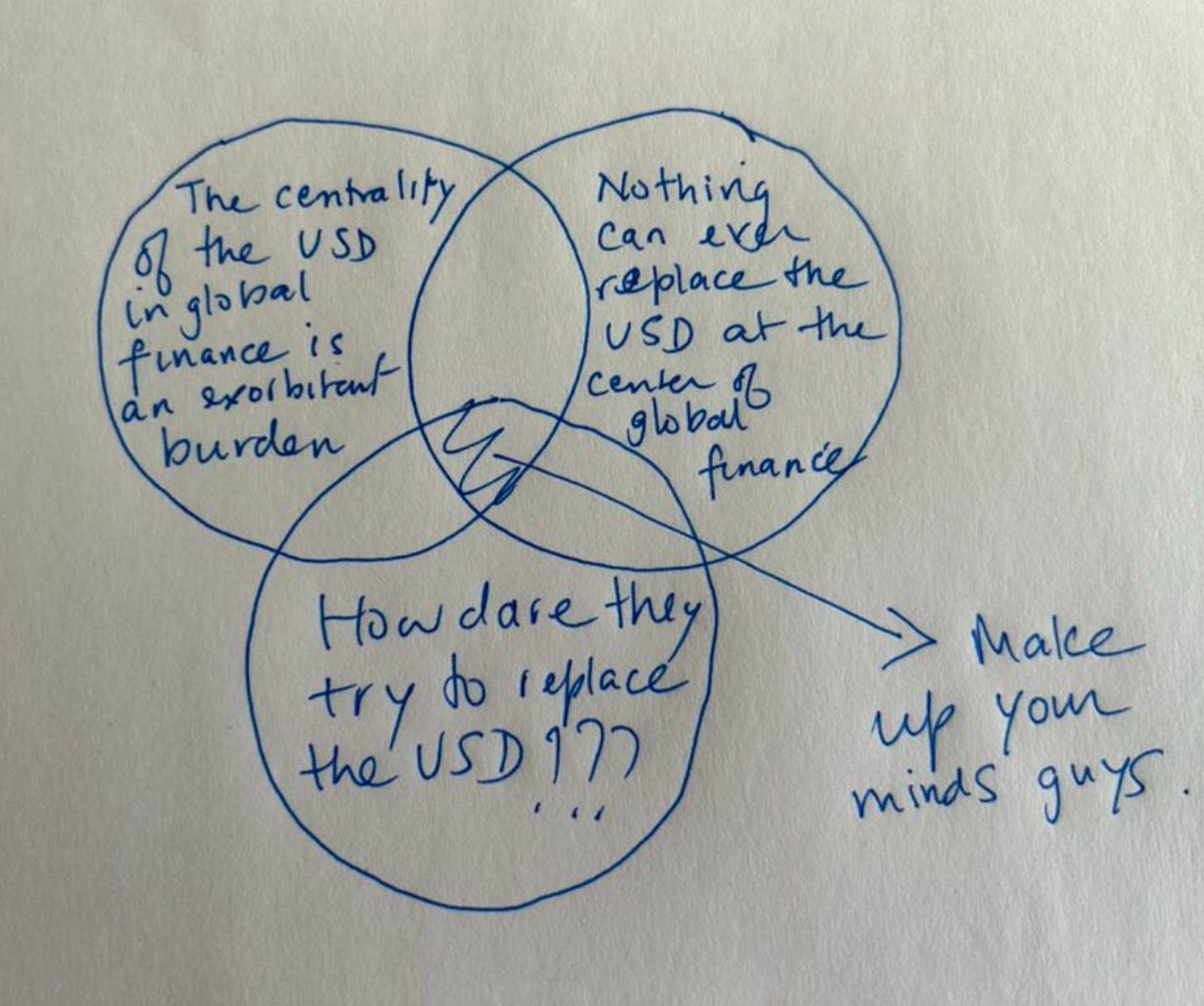

Whither the U.S. Dollar?

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners or Cache Financials.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.