The Sunday Drive - 12/14/2025 Edition [#193]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

It’s been a while since we had a good ol’ mashup. Given the time of year, I thought what could be better to vibe to than a Holiday themed one?

So, this week I’m vibin’ to Snoop Dogg and Anna Kendrick’s version of Winter Wonderland and Here Comes Santa Claus, from the Pitch Perfect 2 soundtrack. H/T to Melanie Allison for the great find. Enjoy.

💭 Quote of the Week

“We are more fulfilled when we are involved in something bigger than ourselves.“

— John Glenn

📈 Chart of the Week

A Few Thoughts on Volatility, Part 2

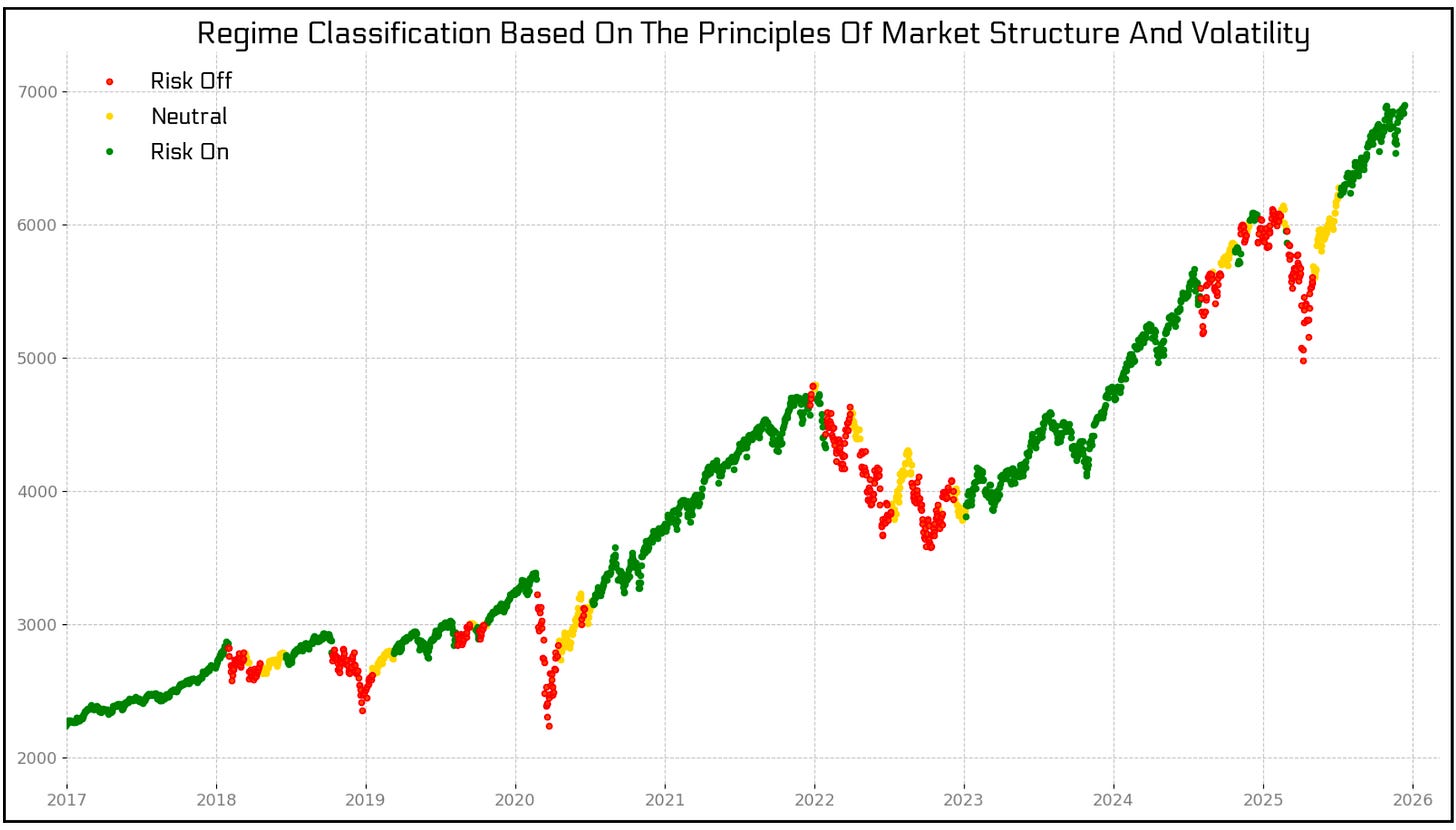

Last week, we focused the Chart of the Week discussion on volatility regimes and the potential benefit of paying attention to trends in volatility rather than on the level of volatility.

Volatility Regimes

With this week’s Chart, we also look at trends in volatility, only this time through the lens of a “risk on / risk off” investing environment. A “risk on” market environment is when volatility is trending lower. A “risk off” environment is when volatility is trending higher. A neutral environment is when volatility is not trending or is range bound.

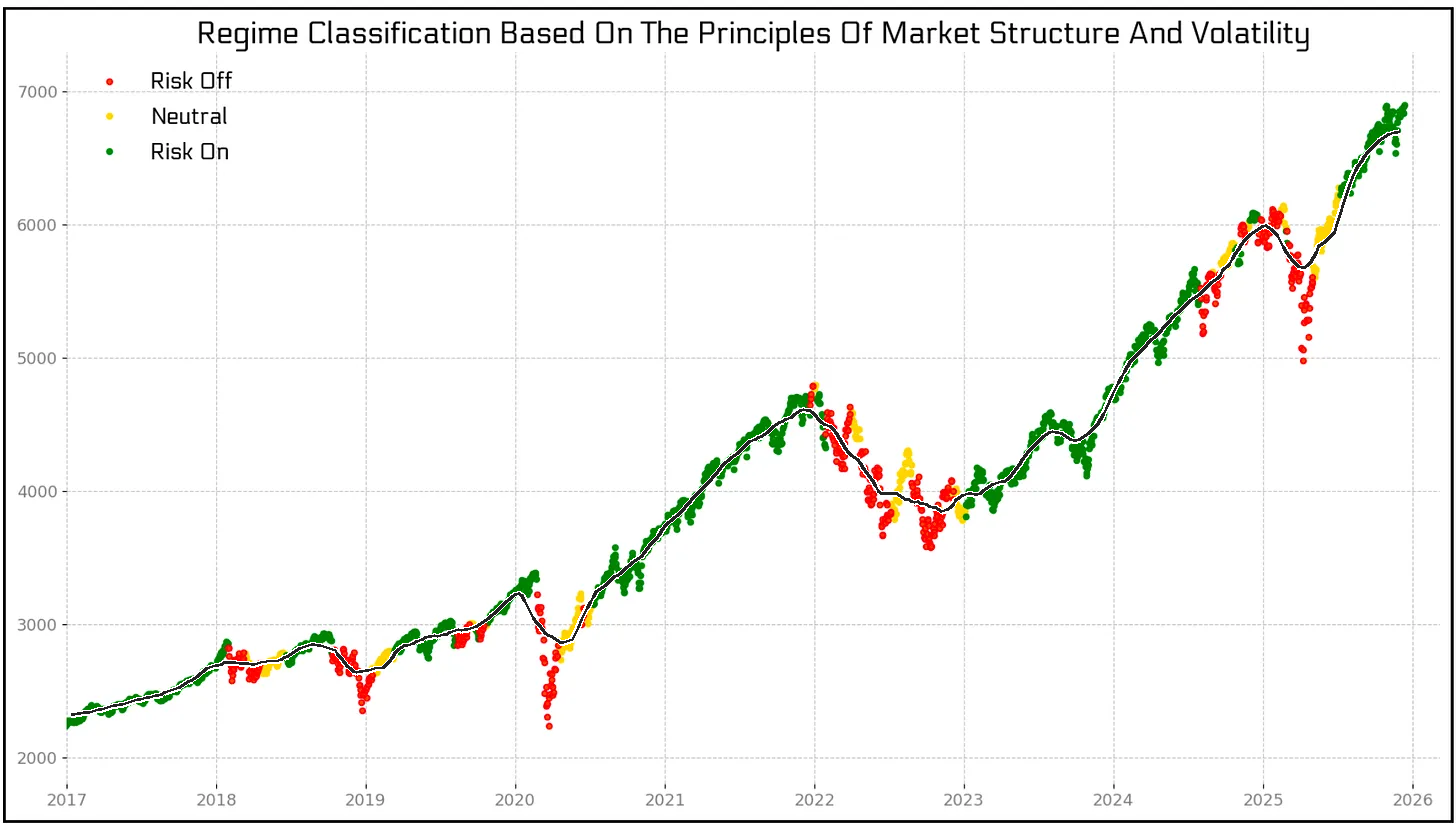

Below is another version of the Chart with the S&P 500 overlayed on the original:

In this version of the Chart, what we see is intuitively obvious. When the environment is “risk on” (green), the equity market performs well, and vice versa when we’re in a “risk off” period (red).

I realize this isn’t particularly interesting or insightful. However, what I do find interesting in the Chart is how the depth and duration of “risk off” periods appears to affect the length and strength of a subsequent recovery.

This was particularly noteworthy during the 2020 and 2025 drawdowns, both of which were severe but fairly short lived. The period following the 2020 drawdown showed an extended up move in the S&P 500. In the aftermath of the 2025 pullback, the same could very well happen as we move into 2026.

Looking Ahead

As we near the end of 2025, we seem to be experiencing more of a Santa Claus Rotation, rather than the typical Santa Claus Rally we often see in December.

I view this as a healthy development whereby equity returns are broadening out. Laggards in more cyclical, value-oriented, and mid to small caps are experiencing a much anticipated catch up period of performance, while the previous leaders - the Mega Tech AI stocks are giving back some of their prior strength.

It’s entirely possible that this dynamic can continue in 2026, with the market growing (at least for now) more skeptical of the profit profile of the AI big spenders, and especially if interest rates continue to come down.

🚙 Interesting Drive-By's 🚙

🤔 The Coming Deflation Shock: Why AI, Demographics, and Policy Are Forcing the Fed’s Hand

🎯 Everyone is Gambling and No One is Happy

💰 The Billionaire War Against Death

💯 The Sovereignty Thesis: How Buffett’s $5bn Alphabet Bet Signals the End of AI’s Colonial Era

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.