The Sunday Drive - 11/30/2025 Edition [#191]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! I hope you all had an enjoyable and calorie laden Thanksgiving holiday. Now, let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

This week we enjoyed Thanksgiving, and personally speaking, I have so very much for which to be thankful: family, friends, great colleagues who are also friends, and good health.

So in the spirit of gratitude, this week I’m vibin’ to the original 1978 version of Andrew Gold’s Thank You For Being a Friend, which was ultimately covered by Cynthia Fee and became the intro song for the hit TV series, The Golden Girls.

💭 Quote of the Week

“Just remember, you can’t climb the ladder of success with your hands in your pockets.“

— Arnold Schwarzenegger

📈 Chart of the Week

Whither Bitcoin?

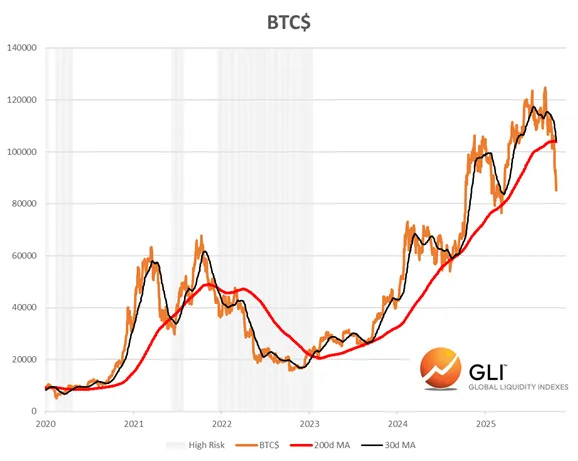

This week’s Chart shows the price of Bitcoin, which has been quite weak of late. We often get questions from advisors about crypto and their appropriate role in client portfolios.

A lot of the discussion tends to be framed as a risk and return question. While Bitcoin and other cryptocurrencies are indeed quite volatile, this recent move seems, at least to me, to be a bit more than just “risk off”.

As I thought more about it, I recalled the old Wall Street adage, “Don’t fight the Fed”. Liquidity is a factor in the valuation of all financial assets, including Bitcoin.

I believe that one of the most persistent misunderstandings about Bitcoin is the view that it trades primarily on “crypto-native” fundamentals: narratives about decentralization, halving cycles, or on-chain activity. Those matter at the margins, but in my opinion, the dominant driver of Bitcoin’s major up- and-down cycles remains global dollar liquidity, especially with regard to the plumbing of the U.S. financial system.

I believe Bitcoin’s weakness in the last few months has less to do with ETF flows or exchange activity and far more to do with a global liquidity drain. When the marginal dollar becomes scarce, every asset priced on liquidity: high-beta equities, especially long-duration tech stocks, and yes, Bitcoin all reprice downward.

I think this summary from Capital Wars captures this dynamic well:

A Global Liquidity drain is causing the current weakness in risk assets like Bitcoin and equities… The shift from ‘Fed QE’ (Quantitative Easing) to ‘Treasury QE’ (massive short-term debt issuance) benefits Main Street with stimulus but hurts Wall Street by draining liquidity… The tension between the Treasury’s need to fund a large deficit and the Fed’s desire to shrink its balance sheet is a genuine and under-appreciated problem for financial markets.

In my view, the most important actors in Bitcoin’s valuation today are not miners or ETF issuers, but the Federal Reserve, the Treasury Department, and the U.S. banking system.

1. The Federal Reserve: Balance-Sheet Policy Still Reigns

Even with rate cuts back on the table, the Fed continues shrinking its balance sheet. Quantitative Tightening (QT) removes reserves from the banking system, and Bitcoin has historically tracked the size, and direction, of those reserves pretty consistently. Liquidity up, Bitcoin up. Liquidity down, Bitcoin down. That relationship has held across multiple cycles.

2. Treasury “QE”: A Misnomer That Still Drains Liquidity

Treasury’s heavy short-term bill issuance pulls cash into the Treasury General Account (TGA), starving the banking system of reserves. As Capital Wars notes, this phenomenon punished risk assets in 2019 (the repo crisis) and is repeating today as deficits remain historically large.

3. U.S. Banks: Sub-Par Reserves Into 2026

Banks are projected to remain in a structural reserve deficit through 2026, which means persistent repo tension and a fragile liquidity backdrop. In that world, Bitcoin trades less like “digital gold” and more like a levered bet on the direction of reserves.

The conclusion one could draw is this: BTC does not lead liquidity; liquidity leads BTC. Until the Fed pauses QT or Treasury shifts issuance toward longer maturities, Bitcoin could continue to struggle.

Sources: Capital Wars, St. Louis Federal Reserve.

🚙 Interesting Drive-By's 🚙

🚀 Data Centers in Orbit: The solution to data center power shortages is the unlimited solar energy in space. The first orbital data centers launch in 2026.

💯 You Don’t Need to Own the Pipes If You’re the Water

💸 Post-Capitalism: The End of Money

🎯 The Denial-Enabler Paradox: How Amazon’s “Cultural” Layoffs Reveal Big Tech’s AI Labor Strategy

👋🏼 Parting Thought

Three days post-Thanksgiving and I am still…

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.