The Sunday Drive - 11/17/2024 Edition [#137]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Spring, NY! 🐎 Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

Many people have varying views on the life and times of Mike Tyson. Personally, I choose to view him through the lens of what he accomplished in the ring. He became the youngest heavy weight boxing champion in history at the age of 20. His career, in my opinion, marked the peak of the heavy weight division and of the sport of boxing itself. Since then, the emergence of MMA and the UFC have taken its place as the purest form of struggle between two people.

It breaks my heart 💔 that Mike Tyson fought Jake Paul this weekend. I did not, and will not, watch it. I think it’s a tragedy that for financial reasons, Mike was forced to fight again at the age of 58.

So to honor “Iron” Mike when he was in his prime and the most devastating warrior on the planet, this week I’m vibin’ to Fight the Good Fight by that other Canadian power trio, Triumph.

💭 Quote of the Week

“The world cares very little what you or I know, but it does care a great deal about what you or I do.“

— Booker T. Washington

📈 Chart of the Week

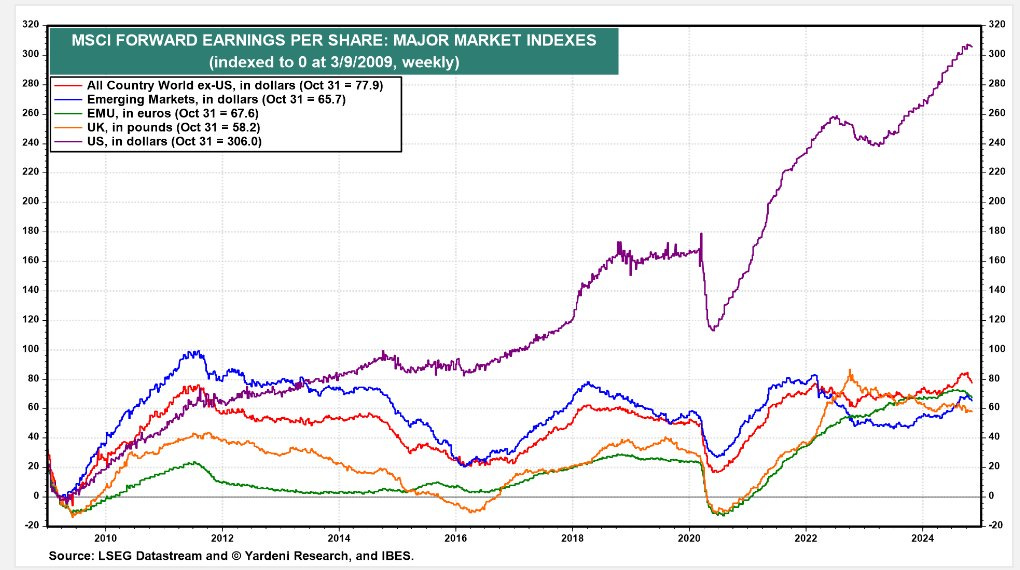

This week’s Chart compares the forward earnings per share (EPS) of various global markets, indexed to a base of 0 on March 9, 2009. This date marks the low point of the 2008-2009 financial crisis, making it a pivotal point for examining growth trajectories across regions over the last 15 years.

Key Observations

U.S. Stock Market Outperformance: The U.S. market, represented by the purple line, stands out for its dramatic rise in forward EPS. This growth has been largely fueled by technology and innovation-driven companies, a robust corporate earnings cycle, and resilient consumer demand, especially post-2008.

European Markets Lagging: The EU (European Union), represented in blue, and the UK (green) show substantially slower growth. These tepid growth rates reflect structural issues in European economies, such as lower innovation investment, demographic challenges, and economic fragmentation within the European Union.

Emerging Markets and All Country World Index: Emerging markets (orange) and the All Country World ex-U.S. (red) have also underperformed relative to the U.S. Emerging markets face unique challenges, including currency volatility, political instability, and greater sensitivity to global commodity cycles.

A Bit of Context: U.S. vs. European Stocks

Over the past decade and a half, the U.S. stock market has consistently outperformed its European counterparts. Several factors contribute to this disparity:

Sector Composition: U.S. markets have a significant weighting in high-growth technology and healthcare sectors, while European markets are more heavily weighted towards traditional sectors like finance, industrials, and energy. These legacy sectors have grown more slowly compared to tech-driven sectors in the U.S., especially post-pandemic.

Economic Resilience and Policy Response: The U.S. Federal Reserve's proactive monetary policy, combined with fiscal stimulus packages, helped support consumer demand and corporate profitability after the 2008 crisis and again during the COVID-19 pandemic. In contrast, the European Central Bank has faced political constraints that limited its response, and Europe’s fragmented political landscape slowed coordinated fiscal actions.

Currency Trends: A strong dollar has also drawn capital inflows to U.S. markets, while the euro has struggled against the dollar, adding to the comparative lag of European returns in dollar terms.

Current Valuation Differences

The U.S. stock market currently trades at a higher price-to-earnings (P/E) multiple compared to European stocks. According to data from Yardeni Research, as of late 2023, the S&P 500 has a forward P/E ratio of around 18-20, whereas the Euro Stoxx 50 trades at a more modest forward P/E of approximately 13-15. This valuation gap reflects investor preference for U.S. companies' growth and stability, especially in technology, but it also signals potentially overvalued conditions for U.S. equities.

European stocks, on the other hand, are seen as relatively undervalued. This valuation discount could present an attractive entry point for investors willing to bet on a European recovery or seek diversification away from the U.S. market.

Where to From Here?

With increased investor interest in diversification given the concentration of the U.S. stock market in the mega-tech names, and potential economic restructuring in Europe, there may be an opportunity for European markets to close the performance gap with the U.S. Key tailwinds for Europe could include a revival in industrial activity, policy shifts favoring green energy, and improvements in tech and healthcare sectors. However, investors should also consider Europe’s structural challenges, such as aging populations and political fragmentation, which could constrain long-term growth.

While U.S. stocks have consistently outperformed and demonstrated strong earnings growth over the last several years, their elevated valuations could signal a plateau in returns. Given the relative undervaluation of European equities and their potential for incremental gains, investors might consider lowering their U.S. exposure in favor of European stocks. Such a reallocation could provide both valuation-driven upside and regional diversification benefits.

**Sources:**

- Yardeni Research: Yardeni.com

- MSCI Indexes: MSCI.com

🚙 Interesting Drive-By's

💡 Steve Jobs emailed himself one year before he died.

🤔 Stay Home vs Go Global from Yardeni Research (related to this week’s Chart)

💰 Why is Warren Buffett sitting on so much cash?

⭐️ The historical correlation between gold and inflation is actually pretty weak.

😳 Federal fiscal burden consumes 93% of America’s wealth.

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners or Cache Financials.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.