The Sunday Drive - 11/16/2025 Edition [#189]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

As markets continue to work off some of their speculative excess from earlier in the year, we saw a choppy, sloppy week with most asset classes down, including the top heavy S&P 500.

So for no particular reason, this week I’m vibin’ to Billy Joel’s classic, Don’t Ask Me Why. Cuz… 🤷🏼♂️

💭 Quote of the Week

“In real life, things fluctuate between pretty good and not so hot, but in the minds of investors they go from flawless to hopeless.“

— Howard Marks

📈 Chart of the Week

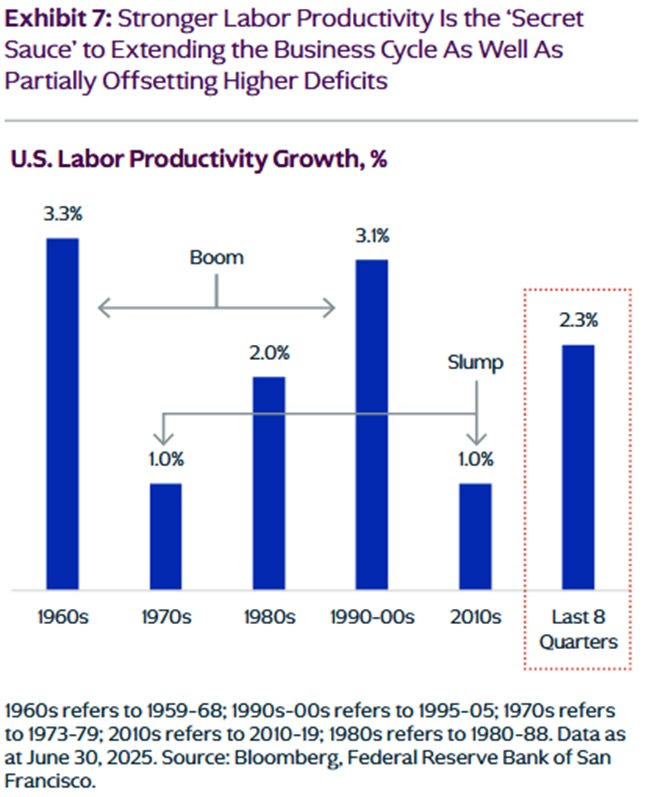

The Next Productivity Boom Is Upon Us

We’re seeing quite a lot of hand-wringing lately by investors concerned about equity valuations and the pace and sustainability of capital spending by the AI Hyperscalers.

However, this week’s Chart highlights the silver lining of the AI spending boom which will likely benefit the economy more broadly over the coming years, perhaps by quite a lot. I thought it was worth talking about.

Productivity is the not-so-secret ingredient that can keep an expansion alive long after the consensus expects it to fail. It’s also one of the few forces that is perhaps powerful enough to offset higher deficits, higher interest costs, and demographic drag.

The Chart of the Week shows three distinct “boom” periods in the post WWII era, the 1960s, 1980s, and the most recent eight quarters. Each one emerged from a unique mix of new technologies, capital formation, and policy regimes, but all share a common pattern: powerful general-purpose technologies, rapid diffusion, and an investing cycle large enough to show up in GDP numbers.

The present moment has echoes of both prior booms, but with a notable twist. Like the 1960s, we’re seeing the emergence of a large-scale investment cycle, this time in data centers, grid infrastructure, transmission, and automation. And like the 1980s, a genuinely new technology, AI, has moved from hype to measurable economic impact far faster than prior general-purpose innovations.

Three forces stand out:

AI has already reached the workflow layer.

Copilots, retrieval systems, and AI-assisted service processes have moved from pilot projects to widespread usage. This appears to be the fastest productivity diffusion of any modern technology in history.

Forced digital adoption during the pandemic laid the groundwork.

Cloud migration, automation of manual workflows, and remote-work infrastructure compressed a decade of change into two years. The payoff for that capex is hitting now.

Labor scarcity is accelerating the move to automation.

With demographics working against us, firms are investing in robotics, automation, and AI to compensate, not to displace workers but to maintain output.

This combination: a general-purpose technology combined with a large capex cycle and a tight labor market, is historically rare. It is pretty much the same setup that produced the 1960s and 1980s productivity booms.

If the emerging buildout in energy and power infrastructure continues, this cycle might not just be durable; it could end up a lot larger than today’s consensus expects, and could offset many of the fiscal and monetary challenges that lie ahead for the economy.

🚙 Interesting Drive-By's 🚙

💡 What Jason Fried Learned From 26 Years of Building Great Products

🤔 Peter Thiel: Capitalism Isn’t Working For Young People

🎥 Ghosts in the Balcony: A Cross-Country Trip to 58 Theaters

🎯 Inside Cursor: 60 Days with the AI Coding Decacorn

💪🏻 Saratoga: The Moment the Revolution Stood Tall

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.