The Sunday Drive - 11/09/2025 Edition [#188]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

The longer that the government shutdown continues, the more nostalgic I am for a time when we actually had a functioning Congress that, you know, passed laws and stuff.

So this week, I hopped in the Way Back Machine to vibe to a real oldie from 1953, Bring It Back by Wynonie Harris.

💭 Quote of the Week

“The ordinary human being does not live long enough to draw any substantial benefit from his own experience. And no one, it seems, can benefit by the experiences of others. Being both a father and teacher, I know we can teach our children nothing . . . Each must learn its lesson anew.“

— Albert Einstein

📈 Chart of the Week

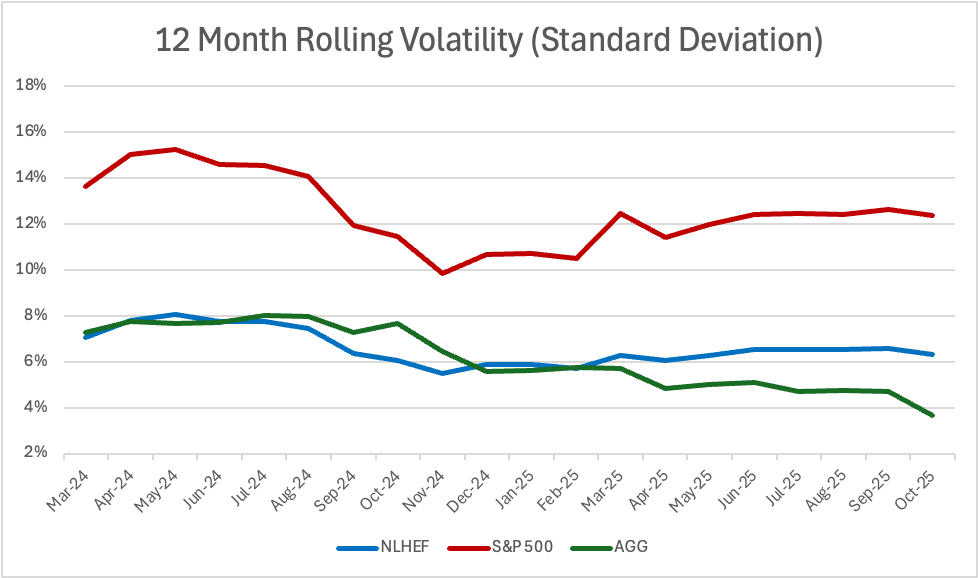

This week’s Chart shows the 12 month rolling volatility of the S&P 500, Bloomberg U.S. Aggregate Bond Index, and the New Lantern Hedged Equity Fund since the Fund’s inception on April 1, 2023.

I launched the Fund as an equity-based alternative to an investor’s bond allocation. Currently, it is only offered to accredited investors, but we are making plans to launch the same strategy as an ETF some time in 2026. If you’d like to learn more about the Fund or its strategy, just reach out to us at info@newlanterncapital.com.

Okay, promo’s over, now on to the discussion.

Sleepy Stocks and Even Sleepier Bonds

Over the last 100 years or so, stocks have had a annualized standard deviation, the statistical measure of volatility, that generally ranged from 12% to 20%, averaging 16-17%. (Data source: YCharts).

By the same token, bonds have historically shown volatility in the 4% to 10% range, averaging 5-6%, or slightly less than half the volatility of stocks.

With the exception of 2022, the post-pandemic performance of stocks, in particular the S&P 500, has been well above their long-term average. Stock market volatility has trended down to the bottom end of its historic range.

After the inflation and rate shocks of 2021 and 2022, bond volatility has also slowly drifted down and is now below its longer term historical range.

This is despite all the things that many investors think the bond market should be worried about, e.g. runaway fiscal spending, stubbornly elevated levels of inflation and the fear of additional tariff-related inflationary pressure, as well as federal government debt levels that now exceed 100% or U.S. GDP.

Since stocks have performed very well the last years, it’s understandable that stock market volatility is low and investors seem complacent.

Bond returns on the other hand have been fairly muted, yet bond investors also appear complacent. It seems that the bond market isn’t really telling us anything.

I see two scenarios that could play out in the coming year or two.

One, the U.S. goes into recession, long term interest rates come down, and bonds perform quite well, especially compared to stocks

Or, inflation continues to creep higher and so do rates, and bonds perform very poorly.

The weight of evidence suggests to me that in either scenario, bond market volatility is poised to move higher and risk-adjusted returns will not compare favorably to other asset classes.

🚙 Interesting Drive-By's 🚙

💡 The ~$10 Trillion Silver Tsunami: Who Will Run America’s Small Businesses?

🤔 Gen Z and the End of Predictable Progress

💰 Why Taylor Sheridan Is Worth a Billion Dollars

🎯 I Turn 65 Today. I’m Not Retiring

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.