The Sunday Drive - 11/02/2025 Edition [#187]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends!

This week, I received the dreadful news that my friend, with whom I share a birthday (seven years my elder), my mentor, and the big brother I never had, must once again pick up his sword and battle the cancer dragon.

To the Dragon Slayer, I say GODSPEED! You keep slaying and all your EV SWANs will keep praying. I love you, my friend. ❤️

Now, let’s try and enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

The world seems to me lately to be giving off a very Dickensian “best of times, worst of times” vibe.

So this week, I’m vibin’ to Styx’s 1981 hit, The Best of Times. It’s a love song actually, but not an especially sappy one, so it seems to fit society’s mood these days.

💭 Quote of the Week

“It’s the repetition of affirmations that leads to belief. And once that belief becomes a deep conviction, things begin to happen.“

— Muhammad Ali

📈 Chart of the Week

Don’t Be Early

One of the most important and timely questions that investors must ask themselves today is “Where are we?” in the current technological transformation we call Artificial Intelligence.

Critically thinking about the answer and getting it right, or at least somewhat right, can create enormous wealth. Or...and this might be even more important these days, prevent its destruction.

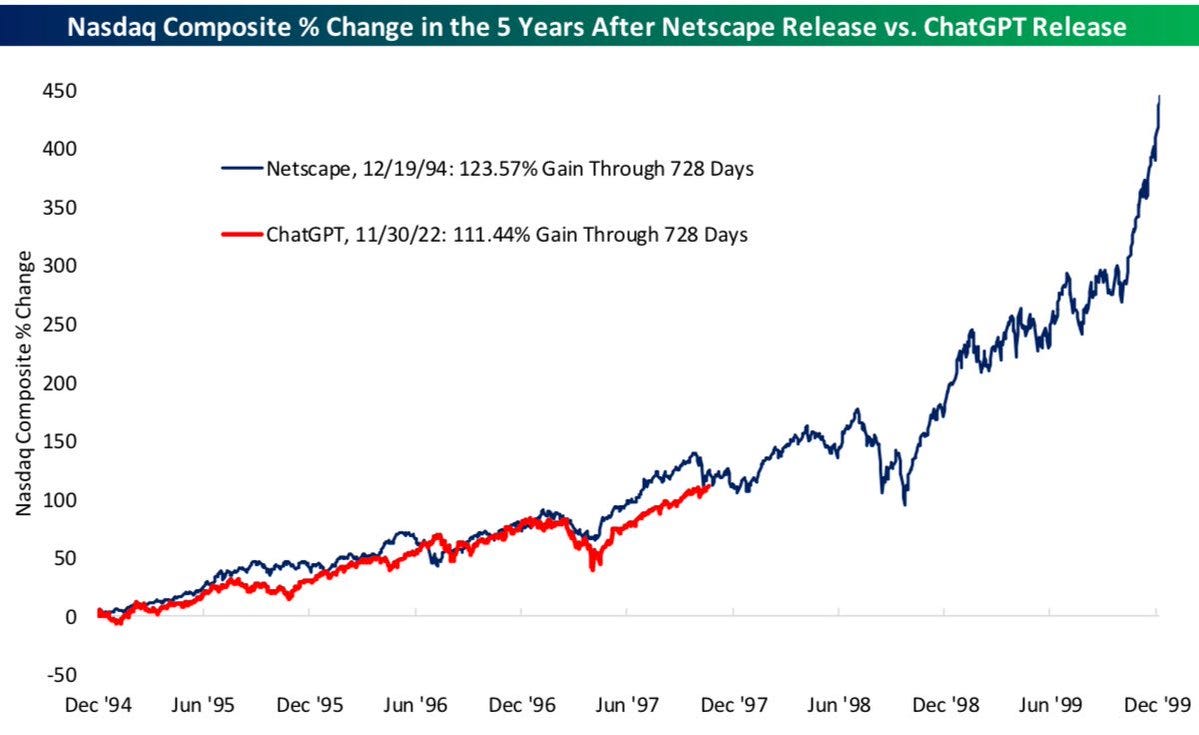

This week’s Chart shows the performance of the Nasdaq Composite Index from the IPO of Netscape in 1994, an event which heralded the start of the commercial internet, through the end of 1999, shortly before the bubble burst.

Overlayed on top of that is the NASDAQ’s performance thus far since the launch of ChatGPT in 2022. The parallel is interesting at least, if not informative.

Calling a top in the AI bubble too soon could cost investors significant returns if the Internet bubble experience is repeated in a similar fashion during this cycle.

Legendary investor, Stanley Druckenmiller shorted $200 million of internet stocks (just 12 of them) in 1999 and lost $600 million in just 3 weeks (link). Yikes! In the end, all 12 companies went bankrupt.

Being right but early is the same as being wrong.

Let me repeat that...

Being right but early is the same as being wrong.

How will we know the “end is nigh”? We won’t. But there will be signs.

It could be that we got one sign this past week, when META (formerly Facebook) reported solid quarterly results and raised their capital expenditure guidance meaningfully -- again. The stock dropped 11.3% the day of their earnings announcement (Source: YCharts).

News that was previously cheered by the market when the big AI spenders, the so-called “Hyperscalers”, would increase their capex plans, now seemed to be punished, at least in this instance.

When we get the same news, but the market has a dramatically different reaction to it, that’s a tone shift to which we really should be paying attention.

Is this the end? I think certainly not.

But it could perhaps be the end of the beginning, and we might just be heading to the next chapter where some measure of capital discipline will be demanded by investors. This may slow down the AI rollout, but I would view that as a positive development which might help us avoid an internet-style boom and bust.

For those who were around for the Netscape IPO, you may recall that the “Internet Browser” was an actual business. Until it wasn’t.

Yet, the productivity driven growth that was powered by the development of the internet over the last 30 years has greatly benefited our economy, indeed the world economy.

ChatGPT is an actual business...for now.

But it’s possible that in the long run, AI as we know it isn’t an actual business, but rather a driver of significant productivity growth akin to the internet which would also benefit the global economy broadly.

🚙 Interesting Drive-By's 🚙

📈 These Are Not Your Parents’ Index Funds

💡 Economic Ideas for Takaichi Sanae

🤔 Private For Longer: Retail (and Hedgies) Not Welcome

🎯 Gen Z Is Rejecting the ‘Everything Is an Emergency’ Approach to Work

❤️ A Nurse Recorded 300 Final Breaths—and Found Only 7 Things That Truly Matter in Life

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.