The Sunday Drive - 10/22/2023 Edition [#81]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY! Let's take it easy and enjoy a leisurely Sunday Drive around the internet.

The Sunday Drive is also published at NewLanternCapital.com.

🎶 Vibin'

It’s a dreary weather and mellow vibes sort of weekend here in Saratoga Springs. So this week, I’m vibin’ to one of my all time favorite artists and one of her greatest hits. For your Etta-fication, please enjoy A Sunday Kind of Love from the inimitable Etta James.

💭 Quote of the Week

“You don’t have to wait to be confident. Just do it and eventually the confidence will follow.” – Carrie Fisher

📈 Chart of the Week

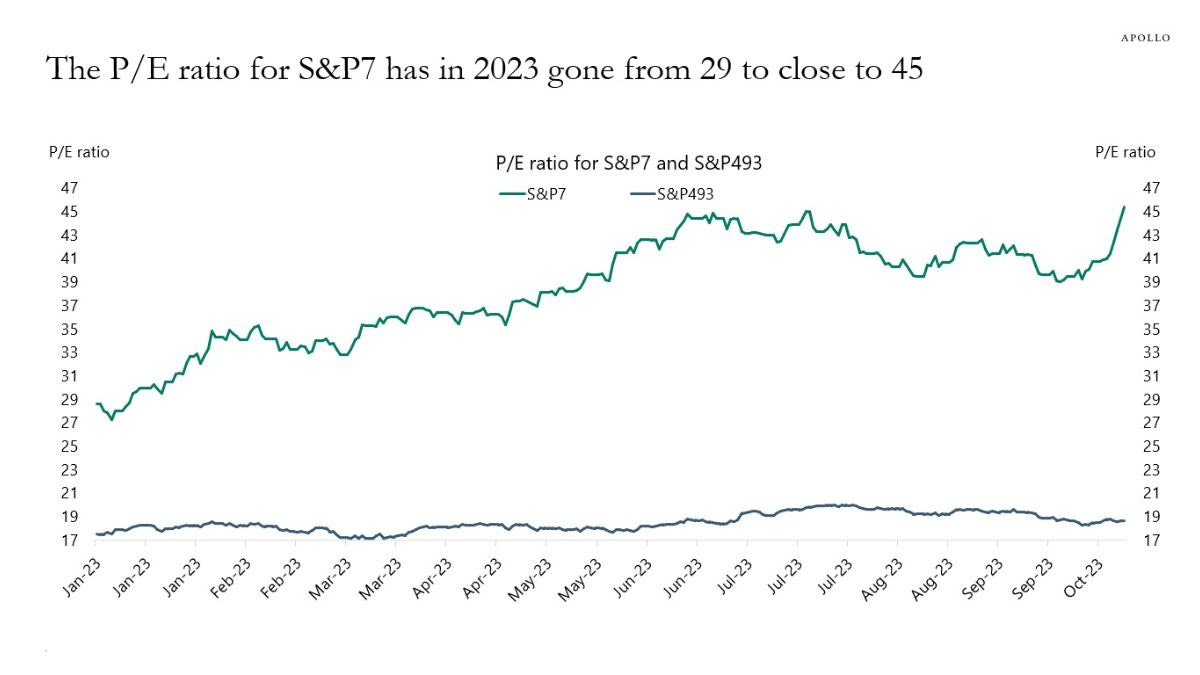

Many say that the equity market is “expensive”, but a look under the hood show a tale of two stock markets. The so-called Magnificent 7 - the seven largest companies in the S&P 500 index have driven positive performance for the index year to date, masking a “hidden bear market” in the other 493 stocks in the index.

There are good arguments to be made that the premium P/E multiples for the S&P7 are justified given their strong balance sheets and growth characteristics. However, as often happens, stocks can move too far to the upside just as they can on the downside.

With extended valuations in the largest stocks in the S&P500, it’s possible that they pullback significantly to correct to more appropriate P/E multiples.

However, I believe given the relatively attractive valuations of the rest of the market, it’s also possible, if not probable, that the participation in equity performance broadens out to include smaller stocks while the S&P7 move sideways for a while to “grow into” their current valuations.

I would also caveat the above by saying that either of these scenarios will be significantly impacted by the action in the bond market. If long term interest rates settle down and find a peak, then I believe that the second scenario above will show itself in the coming year. If not, then 🤷🏼♂️.

🚙 Interesting Drive-By's

This week we have articles on Business Success, IRAs, Problem Solving, and Aging:

💡 The New Force That is Driving Business Success - from Ivan Misner

Imagine a world where you can tackle the greatest, most challenging problems with a proven approach that leads to unmatched success. That is the premise and the promise of The Third Paradigm: A Radical Shift to Greater Success, the new book I co-wrote with Dr. Heidi Scott Giusto and Dawa Tarchin Phillips. In the following excerpt, we discuss the state of the relationships between businesses with their competitors, their customers, and their internal teams.

We live in an age of sweeping conflict, widespread skepticism, and intense anxiety. Contention feels pervasive. Balanced discourse is a thing of the past, and pundits constantly tell us what's wrong with society. People complain like it's an Olympic event, and gurus in the marketplace obsess over the massive problems they see in the world. Negativity seems to be the norm.

However, we believe there is hope. There is an answer, and it starts with focusing on the solutions. When people focus on problems, they become world-class experts on "the problem." When they focus on solutions, they can become world-class experts on "the solution." We believe "the solution" to today's massive challenges lie within the 3rd Paradigm.

As a reference point, a paradigm is a philosophical framework or discipline within which theories and laws are formulated. We believe we are entering the era of the 3rd Paradigm. [link]

🤔 Should You Leave an IRA to a Trust? - from Rethinking65

Traditionally, many IRA accountholders designate family members as beneficiaries of their retirement accounts. Naming a beneficiary avoids the probate process and allows a seamless transfer of assets to the intended recipient without ambiguity. But for some IRA owners, and the wealth managers they work with, it might be more worthwhile to designate a trust instead.

Utilizing a trust retains many of the same benefits that come with naming an individual person as a beneficiary. However, a trust offers additional control over how and when the money within the account will be distributed after death. In this scenario, the trust assumes the role of primary beneficiary for the IRA while the intended recipients, often family members, are the beneficiaries of the trust. [link]

🤓 Complex or Complicated - from Seth Godin

Complicated problems have a solution, and the solution can often be found by breaking the complicated portions into smaller pieces.

And complicated problems often have an emotional component, because there are parts of the problem we don’t want to look at closely, or deal with personally.

If you’re lucky enough to be handed a complicated problem, know that effort and guts can often get you where you’re going.

If it’s not a problem, it might be a situation. A complicated situation has no clear solution, no win-win, no easy way forward. It’s simply a situation to be dealt with.

But this is very different from a complex problem.

Complex problems aren’t actually problems at all. They are non-determinate systems, systems that change based on how we engage with them. Push on one part of a complex problem and a different part will change the system. Healthcare, climate and technology systems are all complex problems.

When facing a complex problem, it helps to embrace the fact that we’re dealing with a system that shifts over time. One where the rules and the solutions evolve in non-predictable ways. [link]

💯 The Evolution of When We Are Old - from Chip Conley

80 is the new 60. A half-century ago, “old” was 60. Today, it’s 80. This isn’t just your point of view; this reflects a massive survey of the norms and perceptions of health and ability.

An Age of Engagement. When asked the most significant difference between people over 60 today and those of a generation ago, respondents who were 50+ described today’s 60-year-olds as more active (79%) and more open-minded and curious (58%).

Useful, not Youthful. 83% of adults aged 65+ say it’s more important to feel useful than youthful in retirement. Today’s older adults want a continued sense of purpose and meaning in their lives.

We need to retire the word “Retirement” because it doesn’t mean what it used to. In the past, retirement meant being less active, and even the technical use of the word defined going into seclusion. When asked what best describes retirement today, 66% described it as a hopeful new chapter in life. Only 16% described it as a time of rest and relaxation, and just 6% saw it as a time to wind down.

Legacy isn’t Money, it’s Values. The majority of respondents (65%) said that the most important things to pass down are values and life lessons. Only 22% said financial assets and/or real estate were most important. [link]

👋🏼 Parting Thought

How the markets are making me feel right about now:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.