The Sunday Drive - 10/08/2023 Edition [#79]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Ellicottville, NY! It’s Fall Festival weekend (the festival formerly known as OctoberFest 🍺) so Eville is LIT!

But…. We can still take it easy and enjoy a leisurely Sunday Drive around the internet.

The Sunday Drive is also published at NewLanternCapital.com.

🎶 Vibin'

The last couple of weeks have presented some wonderful professional collaboration opportunities which I hope to be free to speak openly about soon. I couldn’t be more excited about the future of New Lantern Capital.

In the spirit of these partnerships, this week I’m vibin’ to Come Together by the Beatles.

💭 Quote of the Week

“My model for business is The Beatles. They were four guys who kept each other's negative tendencies in check. They balanced each other and the total was greater than the sum of the parts.” – Steve Jobs

📈 Chart of the Week

Many investors believe that a portfolio of stocks and bonds offers better risk-adjusted returns than a portfolio of only one of the two. This is because stocks and bonds are negatively correlated most of the time (Y axis), meaning that their values tend to move in opposite directions at times which provides diversification benefits.

However, as the Chart of the Week shows, that reliable negative correlation typically only exists when inflation (X axis) is low (see the circle). During times of higher inflation, stocks and bonds are typically positively correlated and a portfolio holding both loses the benefits of diversification.

With higher inflation, this is what investors have experienced in a pretty painful way over the last couple of years.

I’m of the opinion that due to demographic and labor force changes, among other factors, it is highly unlikely that the Federal Reserve will be able to reach their (entirely arbitrary) 2% inflation target. Rather, I expect that over the next decade or more we will likely experience 3% inflation, at best.

If that turns out to be the case, then investors or their advisors will need to rethink traditional approaches to portfolio construction. The tried and true 60/40 portfolio just won’t cut it anymore.

🚙 Interesting Drive-By's

This week we have articles on AI, Banking, and Crypto:

💡 Wanted: High Performers for the Last Job You’ll Ever Have - from Dan Shipper

Here’s the idea: I think there’s an opportunity to start an agency that recruits extremely talented people to train AI by promising them it will be the last job they’ll ever have.

Agency employees will do client work, like engineering, design, or copywriting. They will also record and label the entire process from start to finish as input to model fine-tuning. The agency’s goal is to progressively phase out each employee by training the model on their work. And the employees are in on it! Everyone wants to be replaced because—if it works—they get to keep their salary and upside in the form of dividends, for the life of the business. [link]

📁 Jamie Dimon Says the Next Generation of Employees Will Work 3.5 Days a Week and Live to 100 Years Old - from Yahoo Finance

JPMorgan CEO Jamie Dimon is shaking off doomsday predictions about what AI means for humanity — instead laying out how he sees the technology vastly improving businesses and the work-life balance of their employees.

Even Dimon — a fierce advocate of long-established career norms such as working hard and in the office — says future generations of employees could work a day and a half less every week, thanks to AI.

As well as the working week shrinking from five to three-and-a-half days a week, Dimon also predicts that staff in the future could live to 100 years of age. [link]

🤔 Rethinking Moral Hazard: Government Protection and Bank Risk-Taking - from Soci-Economic Review

Note: This is a fairly wonky paper, but I found the very counter-intuitive results of their work to be very interesting and worth sharing.

Why do firms take excessive risks that result in failure? Moral hazard theorists argue that the answer lies in the risk-boosting effects of the government safety net, which insulates firms from market discipline. We revisit this conventional wisdom by examining how exposure to government protection has contributed to recent trends in bank risk-taking in the USA. Drawing from insights from economic sociology, we highlight an additional way that exposure to government protection can shape organizational behavior: by reducing resource-based profitability pressures that can spur risky behavior. Using panel data analysis of risky US bank behavior between 1994 and 2015, we find that bank exposure to government protection was more often associated with less risk-taking than more of it. This pattern contradicts the predictions of moral hazard theory but aligns with the predictions of our own institutional-resource theory. We discuss implications for economic sociology and financial economics. [link]

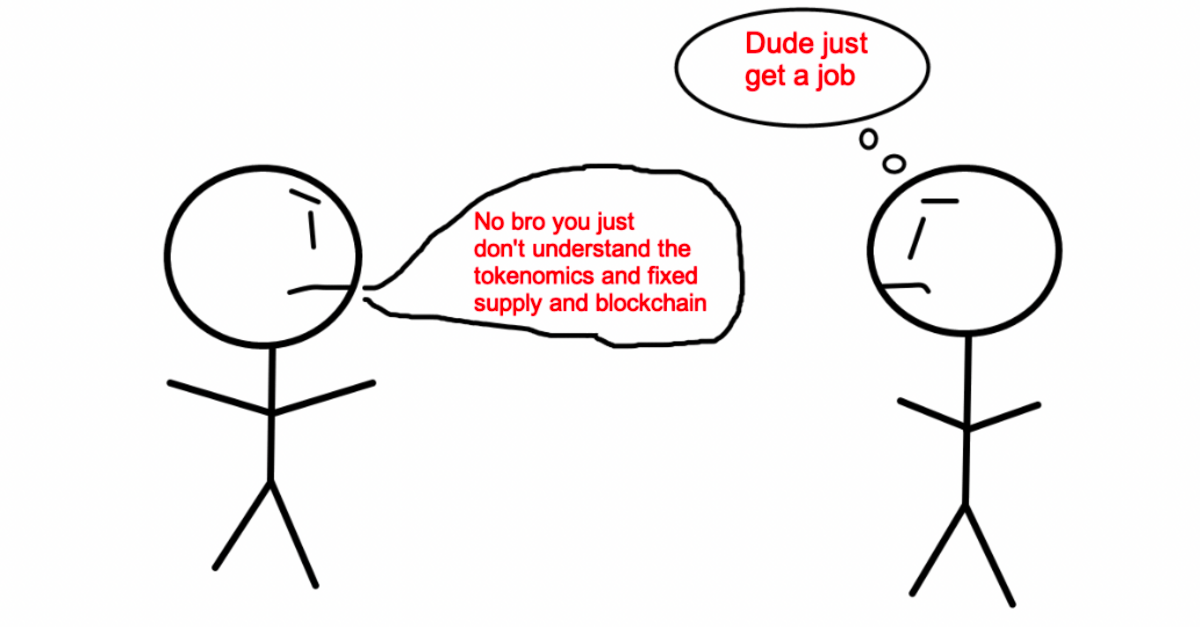

🤓 Magical Internet Money - from Jack Raines

A few thoughts on crypto in the wake of the Sam Bankman-Fried trial. [link]

👋🏼 Parting Thought

It’s peak fall foliage season in Upstate NY. Don’t blink.

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.