The Sunday Drive - 10/05/2025 Edition [#183]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy another leisurely Sunday Drive around the internet.

🎶 Vibin'

Equity markets were up this week.

Government shutdown? The market doesn’t care.

Weakening labor market. The market doesn’t care.

Broadening ICE/Antifa-related conflicts in major cities. The market doesn’t care.

So this week, I’m vibin’ to Icona Pop’s dance hit, I Love It. Please excuse some NSFW lyrics.

💭 Quote of the Week

“’The greatest innovation in history is not the iPhone or the semiconductor; it’s the American middle class.“

— Scott Galloway

📈 Chart of the Week

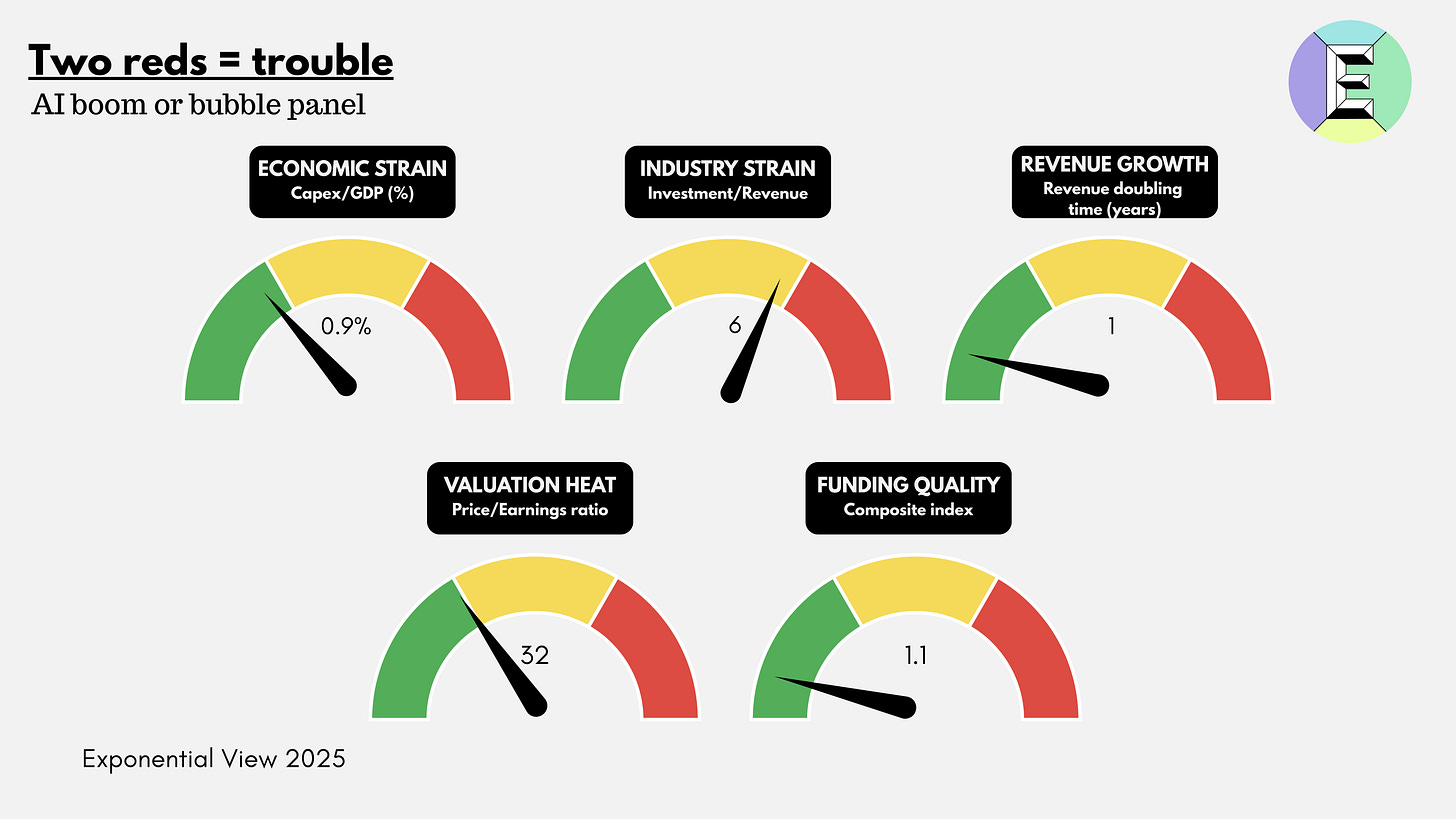

The AI Investment Boom: Gauges for Investors

As you may recall, I’ve recently become increasingly focused on looking for signs that the current AI spending boom is starting to come to an end - looking for canaries emerging from the coalmine of Hyperscaler financial statements.

As a veteran of the 1990s internet boom and bust, having served as an buy-side equity research analyst for a major asset manager in Boston, I’ve tried to consider in what ways this cycle is like that one, and in what ways it is not. I ask myself, “As we sit here in 2025, is it more like 1996 or 1999? I’m increasingly inclined to believe it is more like the former and this spending cycle can potentially run for several more years.

In my research seeking to support or refute that view, I was provided with a “Eureka!” moment when I ran across an article entitled, “Is AI a Bubble?” on the Exponential View Substack. Authors Azeem Azhar and Nathan Warren offer a thoughtful and practical framework containing five gauges that help answer the question posed in the title of their article. I think it can be a very helpful way for us to think about the progression of the current AI cycle. The article is behind a paywall ($$$) and is quite lengthy. If you’re interested in reading the whole thing, email or message me and I’ll send you a PDF version.

Here’s my perspective on the article and the five gauges for AI spending depicted in this week’s Chart:

Economic strain: AI data‑center capex is climbing fast. Morgan Stanley projects AI infrastructure spending could reach $800 billion by 2030, nudging U.S. investment toward 1.6% of GDP. That’s still green by historical standards, but edging into amber. Unlike railways, AI hardware depreciates in dog years, compressing the window to earn a return.

Industry strain: the ratio of capex to revenues is high. Global data‑center spending around $370 billion supported by roughly $60 billion in AI revenues—a six‑to‑one mismatch. That lands in the amber zone. Yet demand is voracious; enterprises book capacity before it’s built and revenues are doubling yearly.

Revenue growth: this gauge is solidly green. GenAI revenues could double this year and continue compounding; some analysts forecast a trillion‑dollar market by 2028. Adoption is still nascent—only about 9% of U.S. firms have a useful AI use case today—leaving ample runway.

Valuation heat: tech valuations are elevated but far from dot‑com extremes. The Nasdaq trades around 32× earnings versus 72× at the 2000 peak.

Funding quality: hyperscalers like Microsoft and Amazon can largely self‑fund, but future spend will require trillions in private credit and securitizations. CoreWeave’s debt troubles illustrate the fragility creeping in.

Conclusion: these gauges suggest a demand‑led, capital‑intensive boom, not a bubble—yet. But if investment tops 2% of GDP, P/E ratios expand toward 60×, or funding quality deteriorates, two needles could flash red. For investors, that means enjoy the ride for now, but keep one foot near the brake.

🚙 Interesting Drive-By's 🚙

💡 Why the 21st Century Belongs to Experience Designers

💰 ChatGPT Just Revealed Exactly What People Prompt. It’s a Goldmine.

🤔 Will Computer Science Become Useless Knowledge?

🍸 Serious Business: The Revival of the Martini

👋🏼 Parting Thought

They say a picture is worth 1,000 words. This pretty much sums up the current economic situation in the US:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.