The Sunday Drive - 09/14/2025 Edition [#180]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s try and enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

Given the tragic events of the last week and the anniversary of 9/11, I really struggled with finding a song that would set an appropriately somber tone. There were a number of good candidates, but none felt more right than this one. So, this week I’m vibin’ to The Beatles classic, Let It Be.

💭 Quote of the Week

“When you tear out a man’s tongue, you are not proving him a liar, you’re only telling the world that you fear what he might say.“

— G.R.R. Martin

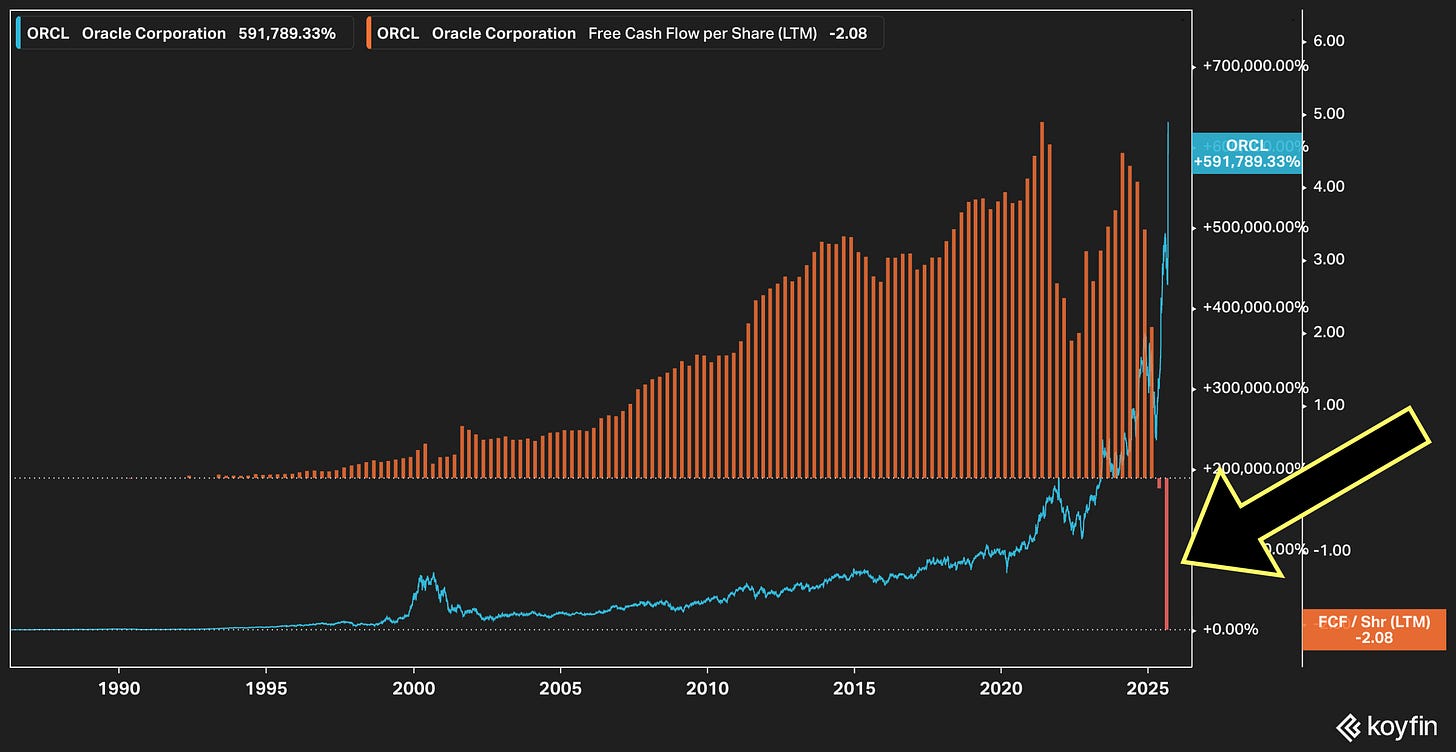

📈 Chart of the Week

The Oracle of Austin

This week’s Chart helps build on last week’s musings about being on the lookout for a Canary in the Coalmine. That comment was in the context of META’s $29bn debt issuance taking the company from a net positive cash position to net cash negative, and the company’s willingness to degrade its balance sheet for the sake of the AI capital spending horserace.

The above Chart shows that for the first time in their history, Austin, TX-based Oracle Corporation (NYSE: ORCL) is free cash flow negative - and in a MAJOR way! Capex is up 13-fold over the last five years (Source: Yahoo Finance). It costs a lot to compete with the Big Boys in the Cloud.

This week ORCL reported quarterly results, and they missed on both revenue and earnings.

The stock was up 40% on the day. 😳 🚀

Why?

Because the company also announced they’d struck a $300bn deal with OpenAI to provide cloud computing services over the next several years. That’s great, right?

Well… This cynical old former Telecom analyst (during the dot.com era) smells something…smelly.

Analysts ask questions and I have a few:

How did the 4th player win this business over the Big 3 providers: Google, Microsoft, and Amazon? (Potential Answer: It’s quite possible that they “bought the business” with very poor economics.)

Why didn’t OpenAI spread that commitment across the group and not concentrate such a large bet on ORCL? What gave them the confidence that ORCL could deliver on the service to which they committed?

What gave ORCL the confidence that OpenAi could actually pay for the services for which they contracted? (Potential Answer: They can’t without external financing.)

How will ORCL finance all the billions of incremental capital expenditures required to provide the services under this new contract? (Potential Answer: With the stock up 40% in one day, if ORCL’s CFO is worth their salt, they’re already making plans for a secondary offering to sell new shares of stock to the public.)

As I wrote last week, I think I’m likely very early in worrying about canaries in coalmines, and this cycle could very well last for several more years. But something will eventually slow down this “Mother of All Semiconductor Cycles” known as the AI spending boom.

Experience has taught me that trouble usually surfaces first in balance sheets and cash flow statements. So that’s where I’m growing increasingly watchful.

🚙 Interesting Drive-By's 🚙

💸 Boomer Candy: The Hidden Costs of Buffered Funds

💡 What Would Yale Do If It Were Taxable?

🚗 Ford Motor Company (1929) - Shortening the Production Cycle

🤔 You Only Get “Old” When You Believe These Myths About Aging

🤓 The Future of Starlink Direct to Cell

👋🏼 Parting Thought

To my Brother in Christ, Charlie Kirk, may you Rest in Peace. ✝️💔

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.