The Sunday Drive - 09/10/2023 Edition [#75]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY! Let's take it easy and enjoy a leisurely Sunday Drive around the internet.

The Sunday Drive is also published at NewLanternCapital.com.

🎶 Vibin'

No theme this week, just good vibes courtesy of this impromptu duet by Sir Tom Jones and aspiring contestant Bethzienna Williams from the 2019 edition of The Voice UK. Please enjoy Cry To Me from the Dirty Dancing soundtrack.

I hope you have better luck than I have getting this wonderfully catchy tune out of your head.

💭 Quote of the Week

“Only the guy who isn't rowing has time to rock the boat.” – Jean-Paul Sartre

📈 Chart of the Week

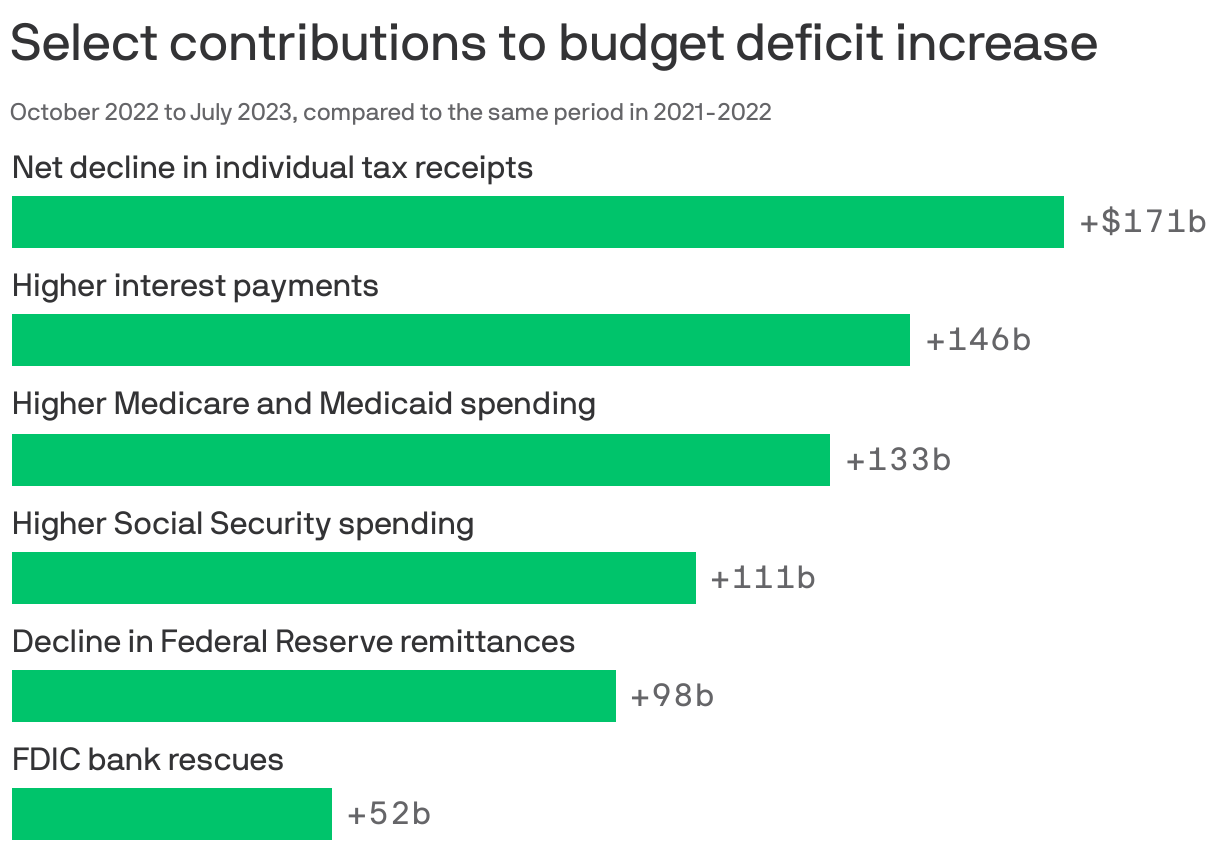

Two things jumped out at me when I found our Chart of the Week.

The first was the significant decline in individual tax receipts. Bear markets raise the deficit because of major declines in capital gains tax payments.

I’m reminded of the flip side of this phenomenon from the late 1990s which was the last time the federal budget ran a surplus. The main reason? Remember the dot-com bubble? Yup… Lots of capital gains paid from the benefits of several consecutive epically strong years of stock market returns.

And…

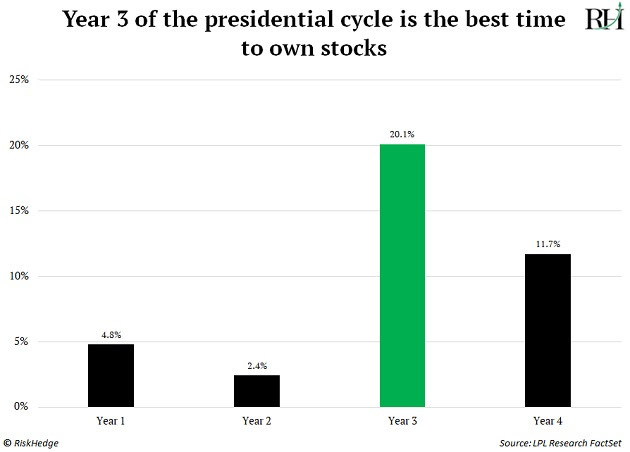

If the historical election market cycle holds for the upcoming 2024 election, the budget deficit could improve quite a bit just from a couple of years of good market returns. 2023 is thus far consistent with that historical pattern.

Unfortunately however, the other item that I found noteworthy and concerning about the components of this year’s larger deficit is just how much the FDIC had to shell out - $52bn - to rescue a handful of banks earlier in 2023.

The likelihood of persistently high short term interest rates for an extended period (see this week’s Parting Thought below) increases bank funding costs. As a result, I don’t think we’ve seen the last of the trouble in the banking sector. If so, this could exacerbate the budget deficit if the FDIC, the Fed, and the Treasury Department continue their new but unofficial “no depositor left behind” policy for rescuing banks.

🚙 Interesting Drive-By's

This week we have articles on Warren Buffett, Intelligence and Longevity:

📈 Buffett would still be ahead of the S&P 500 if Berkshire crashed 99% - from Business Insider

Warren Buffett's Berkshire Hathaway could suffer a 99% crash in its stock price, and it would still have trounced the S&P 500 over a nearly 60-year period. [link]

🤔 Intelligent vs. Smart - from Morgan Housel

Intelligence: Good memory, logic, math skills, test-taking ability, rule-following.

Smart: High degree of empathy, bullshit detection, organization, communication skills, persuasion, social awareness, understanding the consequences of your actions.

Both are important. But there’s a critical difference in how each is valued. [link]

🤓 The Problem of Excess Genius - from David Banks

Geniuses are not scattered uniformly through time and space. Some cultures have many more than one would expect, even after making sensible allowance for imperfect records, biased perspectives and such gross factors as famine, war, and the magnetic effect of libraries and patronage. Obvious clumps of geniuses occur in Athens, from about 440 BCE to 380 BCE, Florence, from about 1440 to 1490, London, from about 1570 to 1640. [link]

🤔 Why I Wrote my Memoir “Radical Curiosity: My Life on the Age Wave” - from Ken Dychtwald

Around a decade ago, my company, Age Wave, oversaw a national study about leaving or receiving an inheritance. In focus groups, participants were uncomfortable with talking about inheritance. Feeling stymied, I told the focus group moderator to “try changing the word from inheritance to legacy.” As it turned out, everyone was eager to share a wide range of feelings about what they hoped to leave behind for their children, grandchildren, and community. Our subsequent survey among thousands of people uncovered four key pillars of legacy. [link]

👋🏼 Parting Thought

Here’s a clip from a future speech by Fed Chairman Jerome Powell after the Fed has “won” the battle against inflation:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.