The Sunday Drive - 09/07/2025 Edition [#179]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy an especially leisurely Sunday Drive around the internet.

🎶 Vibin'

Summer has ended, at least vibe-wise, and we are now moving into the Fall, which although a lovely time of year in the Northeast, is also typically a more volatile time in the markets.

With that in mind, I’m especially interested in looking for risks that could derail the strong equity market performance we’ve experienced the few years.

My working hypothesis is that trouble could eventually begin to surface in the financial health of the Mega-tech names. Heresy, I know.

META’s recent $26bn debt offering, which took the company from a net cash position to a net debt position is an example of what I’m beginning to worry about. I acknowledge that I’m likely very early on this, but one never knows when the market starts to reflect concerns about changes in balance sheet strength.

“Nothing to see here, citizen. Move along.”

So this week, I’m vibin’ to The Police and their 1980 hit, Canary In A Coalmine.

💭 Quote of the Week

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.“

— Will Rogers

📈 Chart of the Week

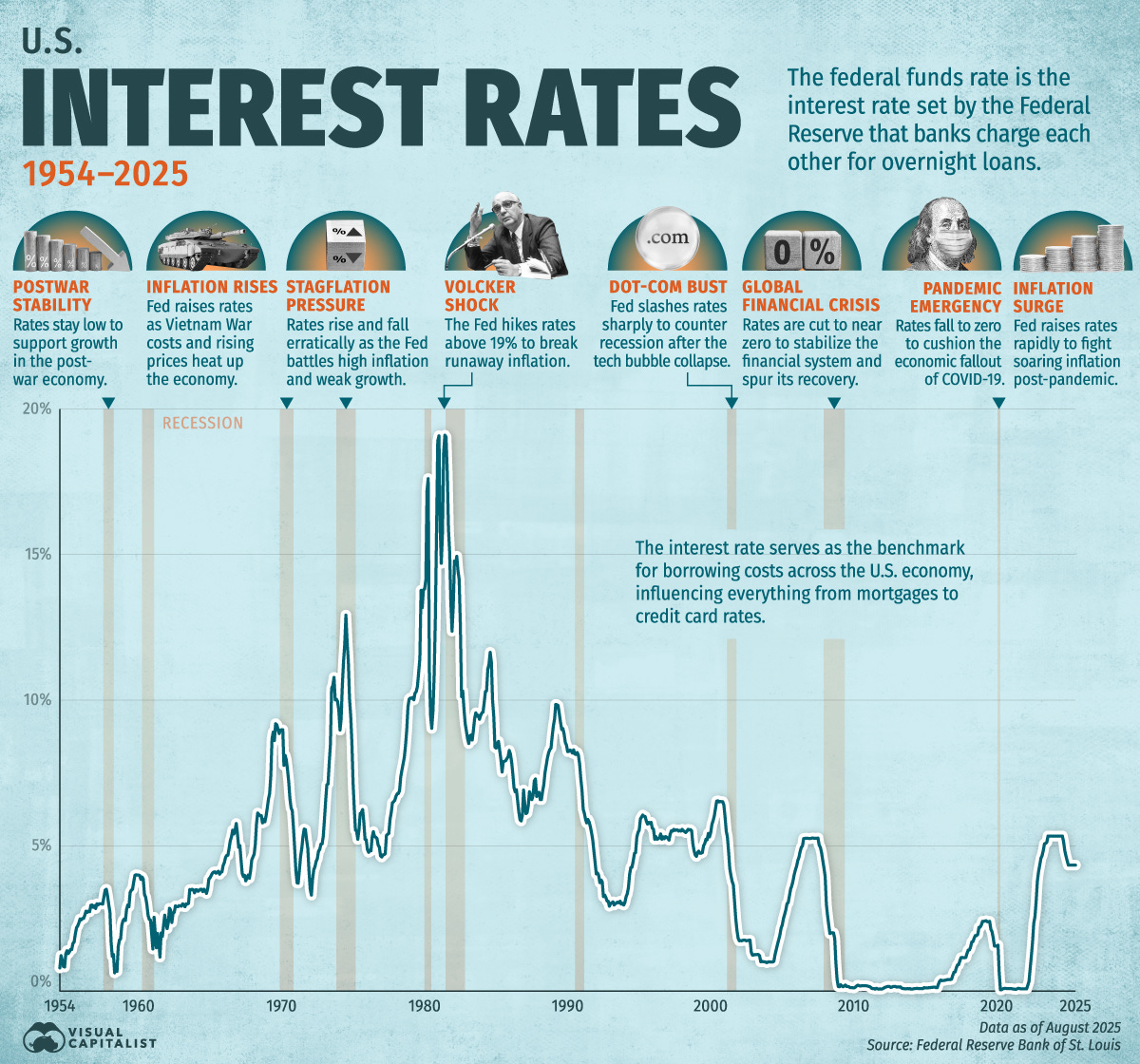

Interest Rates - Some Historical Perspective

This week’s Chart shows the Fed Funds rate over most of the post-WWII period and provides some useful historical context to the current interest rate discussion.

This past week, we had yet another weak employment report and the unemployment rate is now at a four year high. In my opinion, this leaves the Federal Reserve with no excuse to not resume lowering short term interest rates.

A couple of things stand out to me from this week’s Chart.

First, although the rate tightening cycle of 2022 was very rapid, the ultimate rate level doesn’t seem terribly demanding by historical standards. In my view, after a decade and a half post the Great Financial Crisis, with near zero short term rates, investors had been lulled into a sense of that being the norm. Over the course of time, we can see that this period has been anything but normal.

The other takeaway from the Chart I find worth pointing out is that every rate easing cycle, at least in the years depicted, has been associated with a recession, some deeper and longer than others, but recession nonetheless.

Will we have a recession in 2026? I have no idea. 🤷🏼♂️

But, I will say this. There are elements of the economy today that make it very different from the past:

Demographics and an aging workforce,

AI-driven productivity AND job loss,

Very high levels of government debt and entitlement obligations, and

Lower labor intensity in many industries.

How this all nets out, in terms of economic growth in the next few years, is the debate that investors will be having amongst themselves.

I don’t have the answers, but I’m trying hard to think of the right questions to ask.

🚙 Interesting Drive-By's 🚙

💸 Advisors Still Risk Missing Out On Generational Wealth Transfer

💡 Why This Economy Feels Weird and Scary

📈 The Longevity Divide for Midlife Americans

🤔 Apollo’s Moonshot - Random Walk

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.