The Sunday Drive - 08/31/2025 Edition [#178]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! It’s the end of Summer, so let’s enjoy an especially leisurely Sunday Drive around the internet.

🎶 Vibin'

Not the usual Vibe this week, for sure. Lately I’ve been thinking a lot about how we manage risk in an increasingly complacent investing environment. So with that on my mind…

I ran across this crazy thing Tina Turner did—without a harness, in heels and at the age of 70, and just had to share it. The footage is from her 50th Anniversary Tour in 2009.

They don’t come any braver than the Queen of Rock and Roll. RIP Queen, you were “Simply the Best”.

💭 Quote of the Week

“Getting old is like climbing a mountain; you get a little out of breath, but the view is much better!“

— Ingrid Bergman

📈 Chart of the Week

There Are More Recipes Than Ingredients

When you walk into a kitchen, you don’t expect the number of recipes to be limited by the number of ingredients in the pantry. Eggs, flour, and butter can be transformed into pancakes, pasta, or pastries. The same is true in today’s financial markets: the raw ingredients—stocks—may be finite, but the number of recipes—ETFs—continues to multiply.

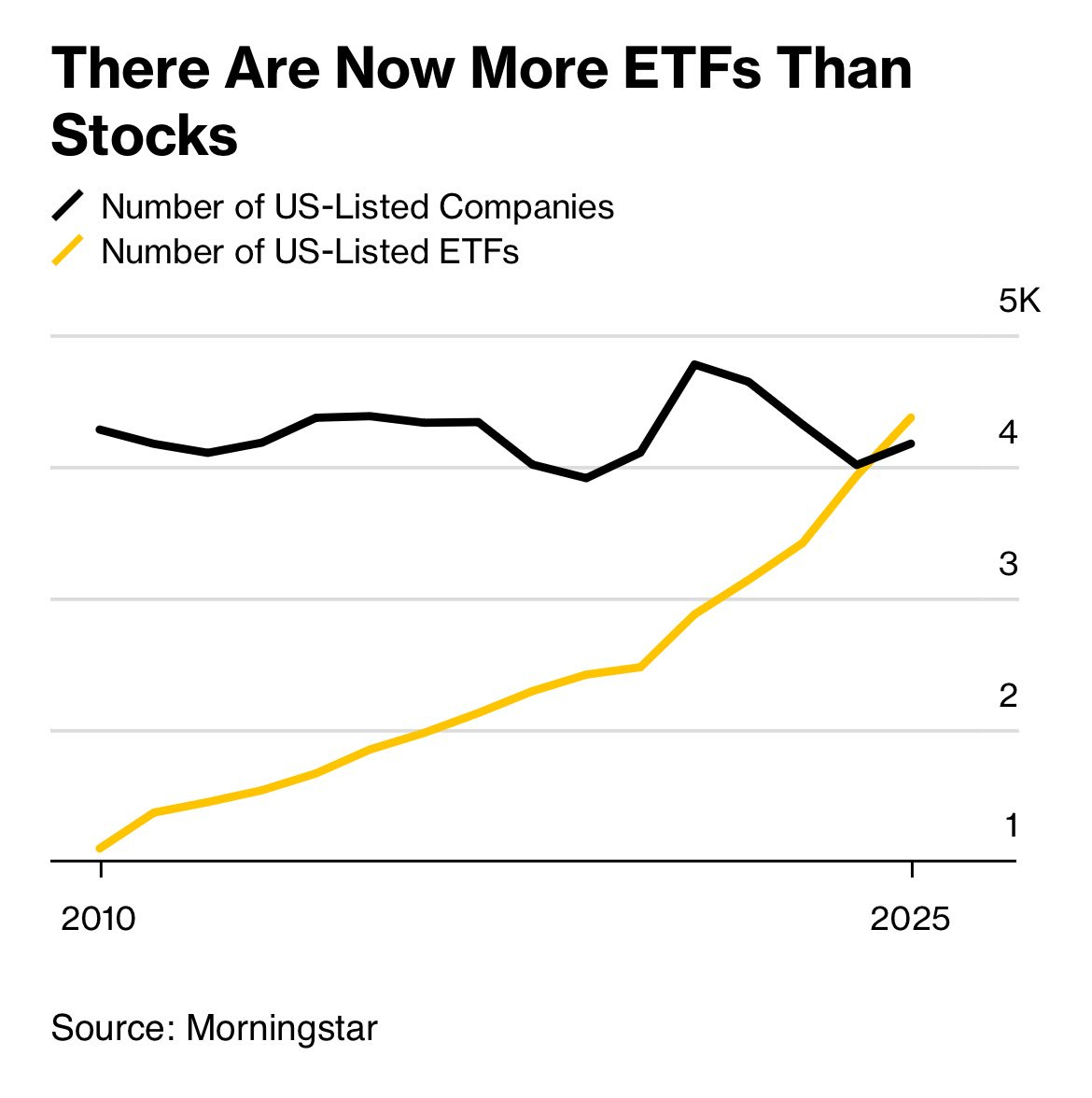

This week’s Chart shows that there are now more U.S.-listed ETFs than there are publicly listed companies. Some see this as evidence of an ETF “bubble,” a sign that too many products are chasing too few investable ideas. But I’d argue the opposite: the proliferation of ETFs reflects not excess, but innovation and accessibility.

The Cost of Innovation Has Declined Significantly

In the early 2000s, launching an ETF was an expensive, complex proposition. You needed a big balance sheet, a trusted distribution network, and a willingness to pay up for custody, compliance, and market making. Today, the barriers are dramatically lower. Platforms like ETF Architect, SEI, Tidal, Ultimus, and others have made it possible for asset managers—large and small—to bring products to market faster and cheaper than ever. The economics resemble software: once the “infrastructure” is in place, the marginal cost of creating a new fund is somewhat minimal.

More Choice, More Precision

Critics argue that there can’t possibly be demand for thousands of ETFs. But demand isn’t uniform—it’s specific. Investors aren’t just buying “the market” anymore; they want solutions tailored to their goals. Some ETFs provide downside hedging. Others target themes like AI, clean energy, or longevity science. Still others provide tax-efficient overlays to traditional exposures. The diversity of offerings is what allows investors to construct portfolios that reflect both their risk tolerance and their worldview.

In other words, we no longer live in a one-size-fits-all investing world. Just as the cookbook industry thrives despite being based on mostly the same ingredients, ETF sponsors are finding creative ways to combine securities into solutions that resonate with investors’ needs.

What It Means for Investors

In my view, having more ETFs than stocks doesn’t mean the system is oversaturated. It means that packaging, distribution, and customization have finally caught up with investor demand. Like recipes, not every ETF is destined to become a household staple. Some will fall flat, some will be fads, and a few will become enduring classics. But the sheer variety ensures that investors—from retirees seeking risk mitigation to institutions managing liquidity—have a menu that’s broader, cheaper, and more innovative than ever.

The pantry hasn’t gotten bigger. But the cookbook certainly has.

Sources: Morningstar, Bloomberg, ETF.com

🚙 Interesting Drive-By's 🚙

💸 The Cost of Tax Mistakes Increases Ten-fold With Every New Wealth Level

📈 Manufactured Housing: The Quiet Outperformer

🤔 Hedge Funds Ramp Up VIX Shorts To Highest Level Since 2022

💡 85 Things I’ve Learned About AI

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.

The fact that ETFs outnumber stocks doesn't seem like that important a fact. Mutual Funds have outnumbered publicly traded listings for over 30 years. I don't remember anyone raising an alarm about that... and those were all actively managed. ETFs include passives.