The Sunday Drive - 08/24/2025 Edition [#177]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

At the Federal Reserve meeting in Jackson Hole, WY this past week, Chair Jay Powell’s speech represented a modest tone shift away from his previously hawkish stance. Specifically, the Fed softened their language regarding the 2% inflation target.

It seemed to be enough for the equity markets to react positively on Friday after a pretty squishy week up to that point. I guess Jay-Pow told investors what they needed to hear. So this week, I’m vibin’ to What You Need by INXS. Enjoy.

💭 Quote of the Week

“The definition of a partner is someone who shares your level of risk.“

— Sam Zell

📈 Chart of the Week

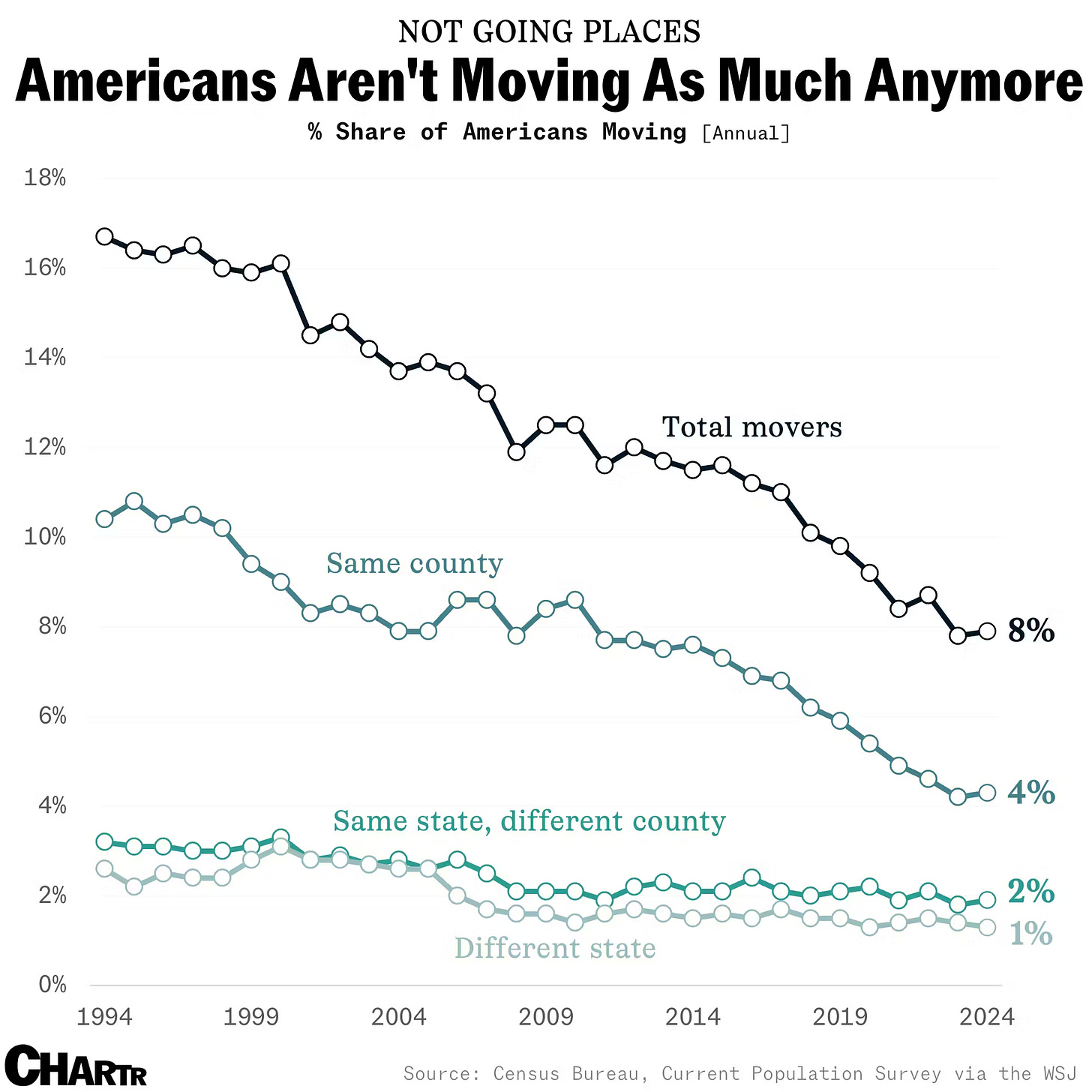

This week’s Chart tells a clear story: mobility in America has been in steady decline for the past three decades. In 1994, roughly 16% of Americans moved each year. Today, that number has been cut in half, with only about 8% changing addresses. What’s behind this striking shift?

First, the economic angle. Housing affordability is at its worst levels in decades. Rising mortgage rates and soaring home prices have created a “lock-in” effect, particularly for homeowners who refinanced at historically low rates in 2020–2021. Trading a 3% mortgage for a 7% one simply isn’t appealing, so people stay put. On the rental side, escalating rents in many metro areas have the same freezing effect: fewer options worth the cost of moving.

Second, the labor market has changed. In the 20th century, people often moved to chase jobs. But with the rise of remote and hybrid work, geography has become less critical. At the same time, the types of jobs that drive interstate migration—manufacturing, construction, resource extraction—have been shrinking as a share of total employment. Today’s knowledge work is far more portable without a U-Haul.

Third, demographics matter. The U.S. population is aging, and older Americans are far less mobile than younger cohorts. Younger generations are also marrying later and having children later, which historically were catalysts for moving. The result: fewer life-stage moves.

Finally, there’s a cultural component. Surveys suggest Americans are increasingly rooted—more connected to local communities, extended families, and familiar schools. Stability has value, and in an uncertain world, people may be choosing it more deliberately.

For investors and policymakers, declining mobility has broad implications: slower regional labor reallocation, stickier housing markets, and less dynamism in the economy overall. America may still be a land of opportunity—but increasingly, people are pursuing it without leaving home.

Sources: Business Insider, Wall Street Journal (August 15, 2025), Federal Reserve Bank of Richmond.

🚙 Interesting Drive-By's 🚙

📈 Our Own Gilded Age - by Niall Ferguson

💯 Knowledge Work is Dying - Here’s What Comes Next

“We are entering the largest re-skilling moment in human history. The Industrial Revolution re-skilled 100 million workers. This one affects over 1 billion. And unlike past transitions, this time it’s not just about new skills, it’s about cultivating human depth.”

💸 The Latest Worst-Case Retirement Withdrawal Rate

💡 Google Announces First Nuclear Site to Power Its Data Centers

👋🏼 Parting Thought

I’ve found that 80% of life’s problems can be solved with this flow chart:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.