The Sunday Drive - 08/10/2025 Edition [#175]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

This week’s theme is about the importance of investing for the long term in order to benefit from the power of compounding over a long investment horizon. It’s an age-old concept but with equity markets re-approaching all time highs, it’s worth repeating.

So this week, I’m vibin’ to the Eagles’ classic hit, The Long Run. Enjoy.

💭 Quote of the Week

“The value of freedom rests on the opportunities it provides for unforeseen and unpredictable actions.“

— Friedrich Hayek

📈 Chart of the Week

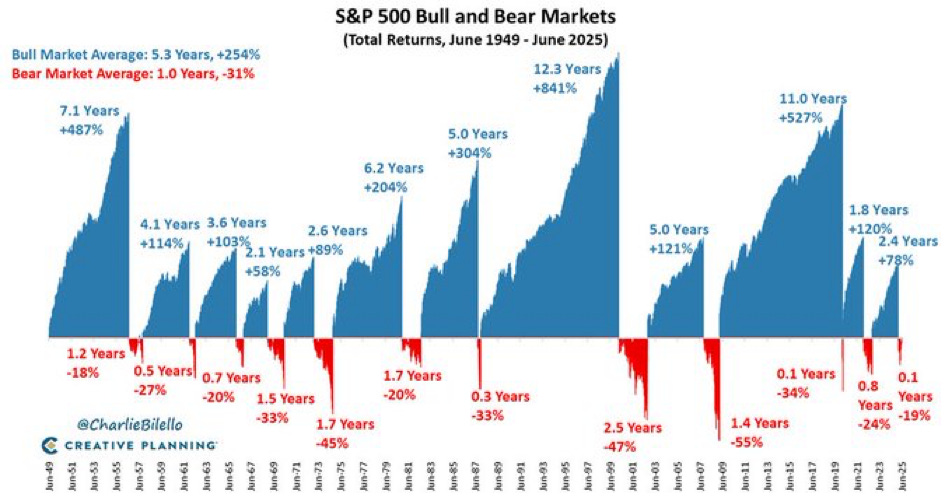

The Importance of Staying the Course

One glance at the history of S&P 500 bull and bear markets tells a clear story: patience pays. The average bull market has lasted 5.3 years and delivered a +254% total return. The average bear market? Just 1.0 year with a -31% decline. In other words, the market spends far more time compounding wealth than destroying it.

And yet, the sting of losses is deeply psychological. Behavioral finance research shows that investors feel the pain of losses about twice as strongly as they feel the pleasure of gains. This often drives the worst possible decision—selling during drawdowns and missing the powerful rebound that typically follows.

History is unambiguous on this point: missing just the first 12 months after a major market bottom can have an enormous impact on lifetime returns. Following the 2008–2009 financial crisis, the S&P 500 surged over +68% in the first year of recovery. Those who sat on the sidelines waiting for “clarity” missed a chunk of the very returns that fuel long-term compounding.

That compounding is the quiet but relentless driver of wealth creation. A dollar invested at the start of the 1982 bull market grew more than 14x by the peak in 2000. Even through subsequent bear markets, reinvested dividends and market growth have produced exponential increases in wealth for those who stayed invested.

The lesson is as old as the market itself: downturns are temporary, but the upward drift of equities over decades is persistent. Successful investing requires enduring short-term discomfort to capture long-term gains. Selling in fear interrupts the compounding process, turning temporary losses into permanent ones. The real risk isn’t staying in—it’s missing the recovery.

Sources: Creative Planning, Behavioral Economics, SP Global

🚙 Interesting Drive-By's 🚙

📉 Will Data Centers Crash the Economy?

📈 AI Revenue Goes Mobile (and why ‘Will Data Centers Crash the Economy?’ is the Wrong Question

💸 The $2 Billion Marketing Boost That Helped Mainstream ETFs

🤔 Entrepreneurs, Which Kind of Business Do You Run?

💡 Energy Department Announces First Pilot Project for Advanced Nuclear Fuel Lines

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.