The Sunday Drive - 08/04/2024 Edition [#122]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Ellicottville, NY. Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

Most readers are aware of the broad span of my musical interests. 😎

This week I’m vibin’ to Rhapsody in Blue. Some folks think this is the theme song for United Airlines commercials. 😂 Well it’s a lot more than that.

Let’s celebrate the 100th anniversary of George Gershwin’s opus. I really liked this version, performed in 1976 by Leonard Bernstein and the New York Philharmonic Orchestra. It’s a long piece, but I encourage you to stick around until at least the 1:30 mark. Enjoy.

💭 Quote of the Week

“It's a rare person who wants to hear what he doesn't want to hear.“

— Dick Cavett

📈 Chart of the Week

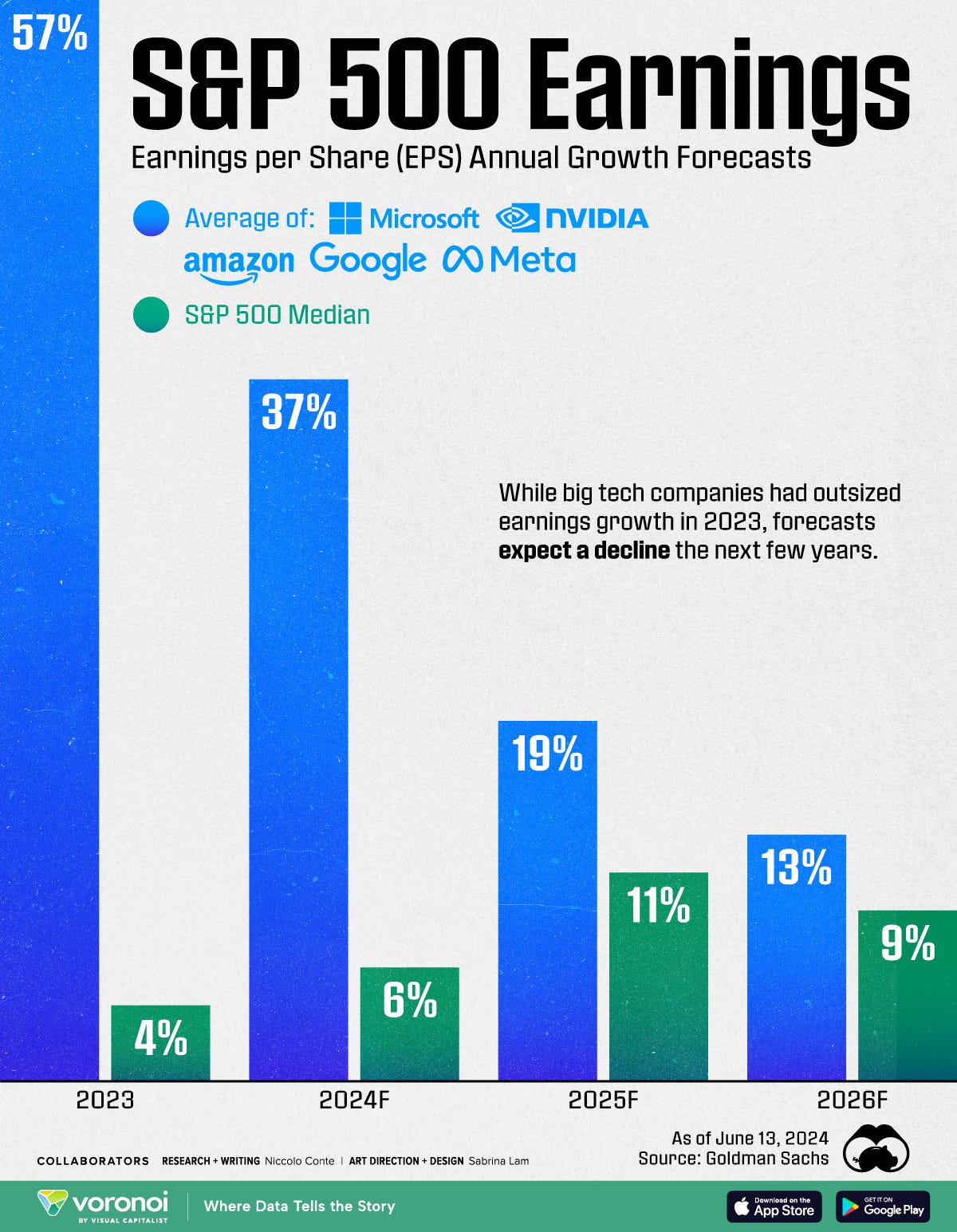

Most folks are aware of the dramatic performance of the largest tech names in 2023 and the first half of 2024. The strength of these stocks propelled the overall market, as represented by the S&P 500, to strong performance even as the more unloved parts of the market were weak performers overall.

What many don’t appreciate about this significant outperformance is that it has been largely driven by earnings growth, not just P/E multiple expansion. This week’s Chart frames it pretty well by showing how much faster the largest names in the S&P have been growing compared to the rest of the market.

However, as we enter the back half of 2024 and start to consider what 2025 earnings growth might look like, the gap in growth rates between the biggest stocks and the rest appears to be starting to narrow, if from nothing else from the law of large numbers. In light of this, it’s reasonable to expect previous market leaders to lag in performance as the previous laggards begin to catch up.

In fact, we’ve already begun to see this broadening of market performance in the last few weeks, though much of that rotation has been driven by investor expectations of lower interest rates in the coming months.

What might we expect from the equity markets in the 2nd half of 2024 and into 2025?

The answer lies partly in what happens during the run up to and aftermath of the November U.S. election. That is typically a time of heightened volatility, and indeed we’ve begun to see that in last few weeks.

The rest of the answer will likely be a function of interest rates, which help determine valuations, and earnings growth, which also helps determine valuations.

Said another way… Earnings growth and valuation are what drive stock prices. Same as it ever was.

🚙 Interesting Drive-By's

💡 The Days Are Long, But the Decades Are Short - from Sam Altman [Link]

🤔 This Isn’t Working For Me, But I’m Doing It So Well - from Chip Conley [Link]

📈 When Humanity Stopped Looking Backward, It Started Moving Forward - from James Pethokoukis [Link]

👋🏼 Are Non-Competes Really Ending? - from Matt Stoller [Link]

💸 Federal Fiscal Burden is 93% of America’s Wealth - from J.D. Agresti [Link]

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners or Cache Financials.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.