👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

Most of the time, the Vibe is somewhat related to the theme of the week’s edition of the Sunday Drive. Sometimes though, like this week, I’m just vibin’ to a song that I’ve liked for a long time.

I hope you enjoy Bob Seger’s 1977 hit, Mainstreet. No thoughts…just vibes. 😎

💭 Quote of the Week

“Talent without effort is wasted talent. And while effort is the one thing you can control in your life, applying that effort intelligently is next on the list“

— Mark Cuban

📈 Chart of the Week

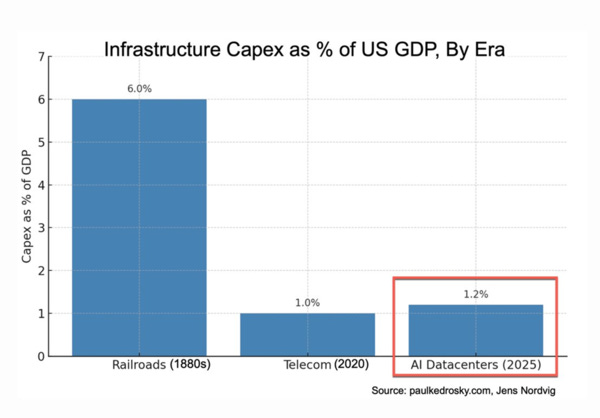

AI is the New Railroad (Sort of)

This week’s Chart puts the current AI data center spending spree in historical perspective. Infrastructure capital expenditures on AI data centers will account for 1.2% of U.S. GDP in 2025—exceeding the telecom buildout of the early 2000s (1.0%) and trailing only the railroad boom of the 1880s (6.0%).

That’s a staggering figure. But what’s arguably even more interesting is how the current cycle is being funded.

Let’s rewind.

The railroad bubble of the late 19th century was fueled by unprecedented access to external capital. Railroads were funded via land grants, bond issuances, and publicly listed equities—creating entire industries in rail finance and speculation. The government subsidized westward expansion and capital markets happily provided the rest.

Unfortunately, much of that capital was ultimately destroyed from the excessive spending which ensued.

A century later, the telecom revolution of the late 1990s and early 2000s was another externally funded infrastructure supercycle. Fueled by dreams of a fiber-optic future, telecom companies raised vast sums through debt and equity offerings. This ended in a spectacular bust. WorldCom, Global Crossing, Lucent: all became cautionary tales in capital misallocation or outright fraud.

Now contrast that with today’s AI arms race.

Meta’s 2024 capex alone is greater than the entire U.S. semiconductor industry’s annual capex. It’s spending more than oil majors and nearly as much as the entire utility sector. And it’s doing this without raising external capital. Meta, Microsoft, Amazon, and Alphabet are financing this boom out of cash flow—enabled by high-margin, ad-fueled businesses and fortress-like balance sheets.

That distinction matters.

When infrastructure booms are externally financed, they historically have tended to overshoot—inviting both capital misallocation and speculative excess.

When they’re internally financed, might the companies be more disciplined? That remains to be seen. The spending is still enormous, but the lack of dilution, debt, or speculative frenzy has muted the market’s concern—for now.

So what’s the takeaway for investors?

First, don’t underestimate the scale of what’s happening. This is not just a hype cycle—it’s a real, hard-asset buildout with national and global economic consequences. The AI capex cycle is now the third-largest infrastructure investment wave in U.S. history—and growing.

Second, the funding structure may help avoid some of the bubble dynamics we saw in telecom or rail. That said, concentration risk is high. If AI adoption doesn’t deliver commensurate returns—or if compute economics don’t scale—we could see meaningful margin compression and poor stock performance, even without a financing bust.

Third, capital markets have taken a back seat in this round. For now, that’s a feature, not a bug. But if the investment cycle broadens—say, into second-tier players without meaningful internal capital resources, public markets will likely get pulled back in.

For now, Big Tech is playing railroad baron with its own money. Investors would be well served to focus more and more on the earnings quality of these companies and be on the lookout for signs of degradation. There is almost always a canary in the capex mine.

Sources: Paul Kedrosky, U.S Bureau of Economic Analysis, Federal Reserve Economic Data, CTIA.

🚙 Interesting Drive-By's 🚙

🎯 From Knowledge Economy to Wisdom Economy

💸 Is Your Job Safe If You Can’t Speak AI?

🤔 Aging Isn’t Just About Decline - How Health Improves As We Grow Older

💡 The AI Revolution vs. Chaotic U.S. Economic Policy

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.