The Sunday Drive - 07/30/2023 Edition [#69]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY! Let's take it easy and enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

This week, my wife and I celebrated our 31st wedding anniversary. I could only imagine back in 1992 just how lucky I was to have found this wonderful woman to build a life with. ❤️

To honor her and our marriage, this week I’m vibin’ to Amazed by Lonestar from their 1999 album, Lonely Grill.

💭 Quote of the Week

"Where there is love there is life." – Mahatma Gandhi

📈 Charts of the Week

This week, we have three charts which speak to the health of the U.S. consumer and the resilience of the U.S. economy.

In 2008, there were 4 million homes listed for sale.

In 2019, there were 1.8 million homes on the market.

In 2023, the number of houses for sale is just about 1 million, fewer than at any time since the National Association of Realtors began tracking them.

For those who keep waiting for our economy, particularly the housing market, to be clobbered by the higher interest rates engineered by the Federal Reserve to tame the inflation of 2021-2023, I would say they’re likely to continue to wait (for Godot?)

I would point to two figures that make our housing market less sensitive to higher borrowing rates compared to other countries.

95% of mortgages in the U.S. are “fixed rate”, and most of those are 30-year mortgages. Nearly all mortgages outside the U.S. are variable rate of some sort.

40% of mortgages currently outstanding in the U.S. were originated in 2020 and 2021 when rates were the lowest in history.

The fact of the matter is that many, many people have mortgages that are at below market rates and that is one of the main reasons why there are so few houses for sale.

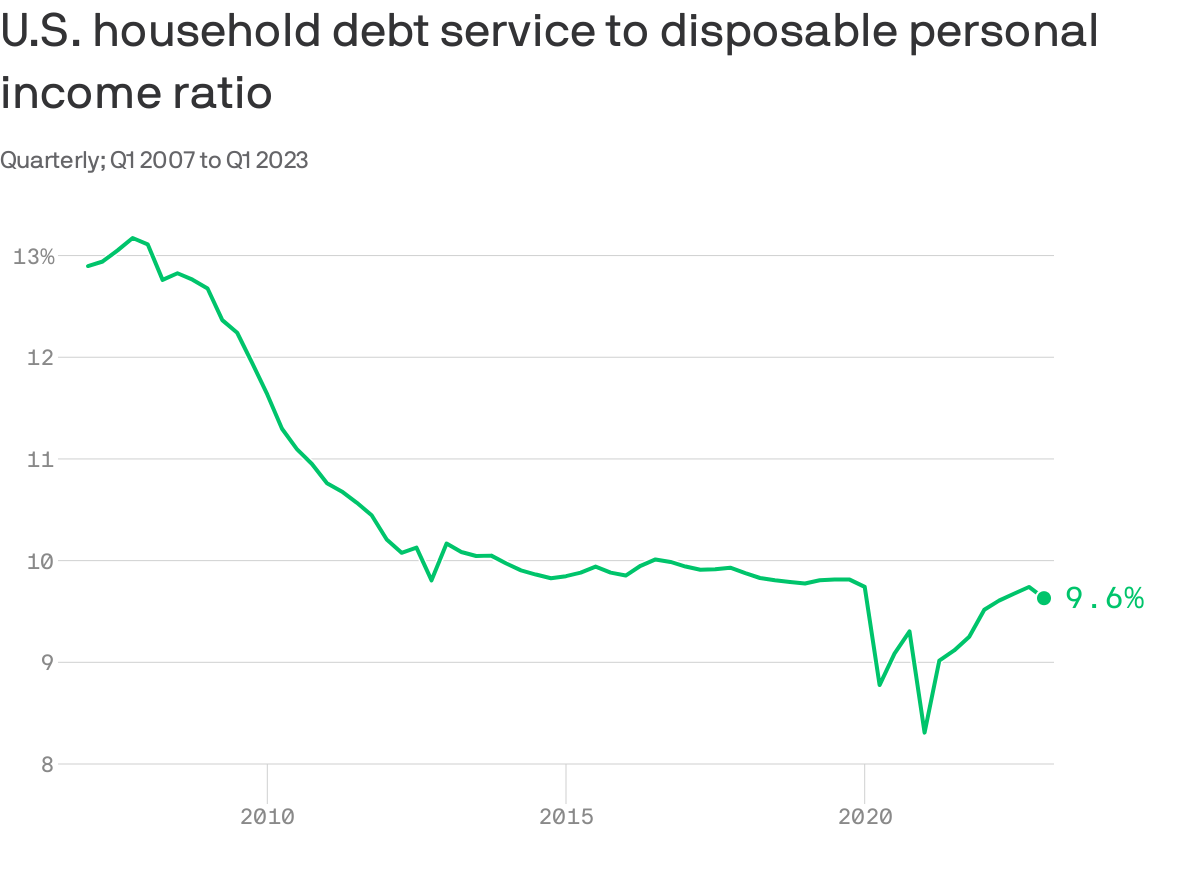

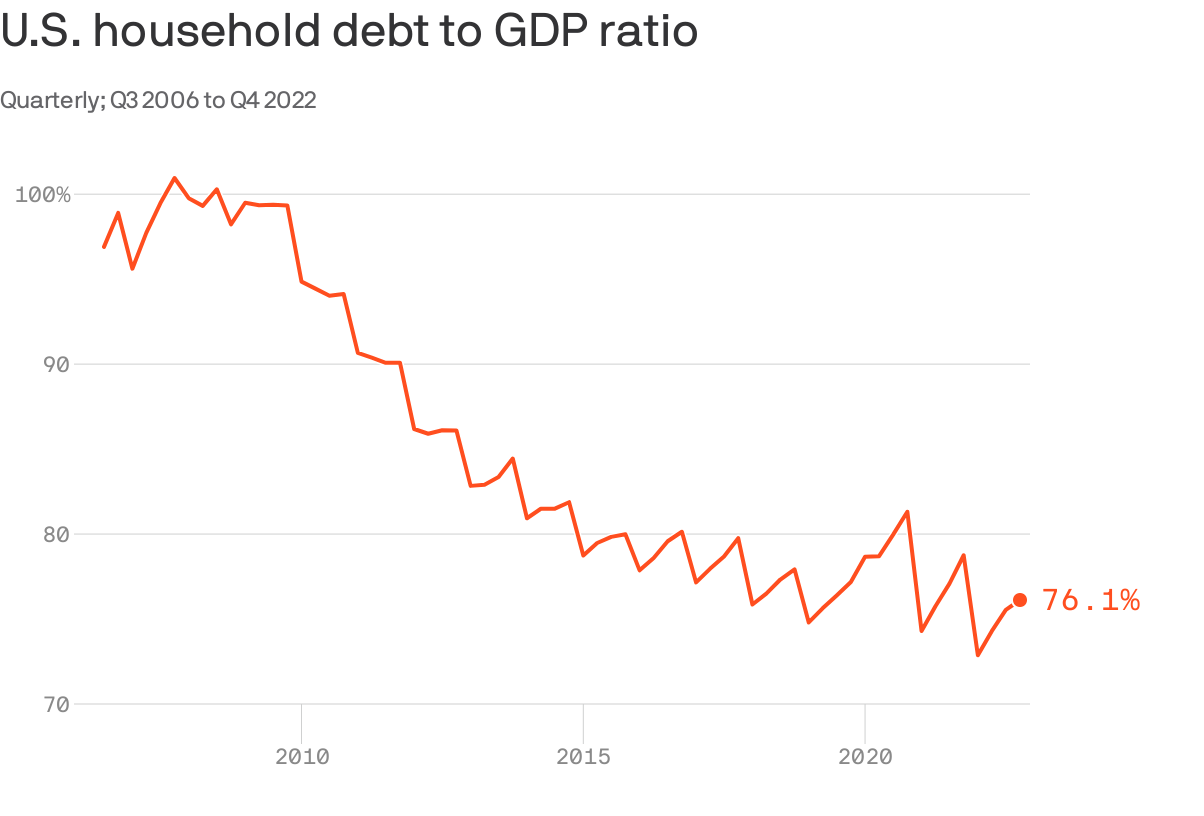

The second two charts show how significantly the U.S. consumer re-financed, paid down debt, or both in the last decade or so, at least relative to household income or GDP. On the whole, the consumer’s collective balance sheet is in pretty decent shape.

Of course, there is a breaking point for the consumer and the economy if the Fed raises rates high enough. But for the time being, our economy seems to be able to withstand the current rate environment.

That said, interest on U.S. government debt will start to be affected by the current high rates fairly soon. I suspect that will be the catalyst for lower rates sometime in 2024, not the recession that has thus far been avoided.

🚙 Interesting Drive-By's

This week we have articles on the workplace and workforce:

🤔 Living (Near) Your Life - from Dror Poleg

More people can work from anywhere, or at least live farther than the office, thanks to flexible and hybrid work policies. As a result, people can be more deliberate about where they spend their time, which means where they are is a stronger indication of who they are, who they'd like to see, and what they're interested in. As "where" becomes less critical for work, it becomes more important for life. [link]

👍🏼 Some Career Advice to a Modern Elder - from Chip Conley

Question posed to Chip:

“As a person of ‘significant’ experience, how do I write/position myself as someone who can make a pivot to an assignment in an organization that would fulfill a "meaning and purpose" objective of mine? I'm pretty sure that someone who views my credentials and reads the fact that I can use my considerable "commercial" experience in a mission-driven organization or NGO might simply interpret me as too old or too expensive.” [link]

📈 No More Fridays - from Molly Lipson of Business Insider

A real-world experiment experiment just proved that we should all shift to a four-day workweek. [link]

💡 Gen X is Now in Charge - from Emma Goldberg of Rethinking65

The average age of incoming CEOs is around 54. While American government remains squarely in the hands of baby boomers — and while its leadership, at least in certain branches, becomes noticeably older — corporate boardrooms are undergoing a transition. It’s Gen X’s moment, that generation most known for being crowded out of sweeping cultural age analyses by millennials on one end and boomers on the other. [link]

👋🏼 Parting Thought

Looking forward to the end of the hottest July ever…

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.