The Sunday Drive - 07/27/2025 Edition [#173]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

This weekend, my wife and I celebrated one third of a century of marriage. Yep… 33 years ago, we made official what we both instinctively knew when we first met - that we were meant to build a life together. I am truly blessed to have this wonderful woman and our two children in my life.

So this week, I’m vibin’ to a live version of my fellow Texan, Delbert McClinton’s Thank You Baby. Enjoy.

💭 Quote of the Week

“If you wait, all that happens is that you get older.“

— Larry McMurtry

📈 Chart of the Week

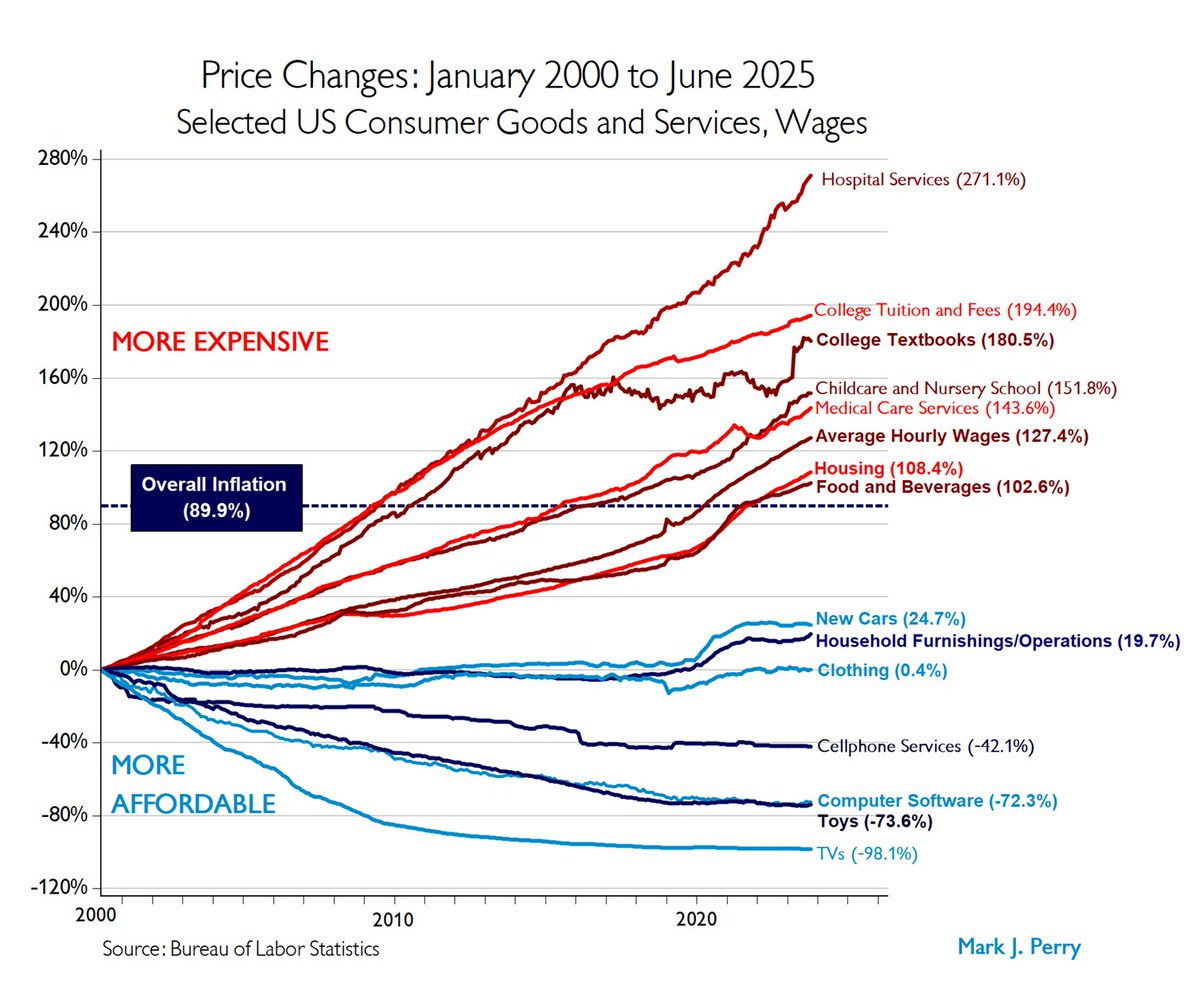

Inflation Is Just a Number

This week’s Chart makes a powerful visual argument: not all inflation is created equal. Over the past 25 years, price increases have varied wildly across different categories of consumer goods and services. Some things, like hospital services, college tuition, and childcare, have become painfully more expensive. Others, like TVs, toys, software, and even cellphone services, have gotten dramatically cheaper.

So if we say inflation has risen 2.6% per year since 2000, or a cumulative 89.9% in the last two and half decades, what does that really mean?

The truth is, inflation is not one number. It’s the net result of two fundamentally different stories: the cost of goods, and the cost of services. Going forward, both are likely about to enter a new chapter—with potential implications for consumers, markets, and policymakers alike.

Goods Have Gotten Cheaper—But That May Be Ending

Since 2000, physical consumer goods have largely become more affordable. TVs are down nearly 98%, toys by 74%, and even new cars—despite headlines of pandemic price spikes—are only up about 25%. Globalization, technological deflation, and supply chain efficiencies kept prices in check, if not in decline.

But that’s starting to change.

The Trump administration’s newly proposed tariffs—potentially as high as 10% across the board, and even higher for certain imports from China—could reverse decades of downward pressure on goods prices. The Peterson Institute estimates similar tariffs from 2018–2020 added 0.5% to 0.6% to core goods inflation back then. A broader, more aggressive package could push that higher—particularly for categories like electronics, appliances, and auto parts that rely heavily on foreign inputs .

Meanwhile, conventional wisdom suggests that aging demographics—particularly in the U.S., Europe, and East Asia—could reduce labor supply, raise wage costs in manufacturing, and slow productivity growth. That could add another inflationary layer, especially if reshoring or “friendshoring” of production leads to higher-cost domestic output.

However…

One also has to account for potentially lower, or slower, demand for consumer goods in light of the same aforementioned aging demographics.

So, after years of disinflation, goods may soon start adding to inflation again, not subtracting from it—but perhaps not to the degree that many folks fear.

Services Have Been the Inflation Story—and AI May Finally Rewrite It

Where goods have deflated, services have exploded. Hospital services are up 271% since 2000. College tuition: +194%. Childcare: +152%. These aren’t outliers—they’re reflections of a broader truth. Labor-intensive services, especially those in healthcare and education, have seen relentless cost growth.

But this is where things could get interesting.

Artificial intelligence is rapidly becoming a deflationary force in many services. Already, we’re seeing AI assist radiologists, write legal briefs, tutor students, and even perform rudimentary therapy. Over time, this technology could bend the cost curve in areas where human capital was once thought to be non-substitutable. Goldman Sachs projects AI automation could reduce service-sector labor costs by up to 20% or more over the next decade .

Demographics may reinforce this trend. As the population ages, demand will likely shift toward services that can scale—remote diagnostics, elder care automation, virtual education. If AI is integrated effectively, it could mitigate labor shortages and reduce pricing pressure in these high-cost sectors.

This won’t happen overnight. But if AI does for services what globalization did for goods, the inflation math starts to look very different.

Netting It Out: A New Inflation Regime?

So what happens when you combine these two forces?

Tariffs and labor constraints could push up the price of goods. AI and automation may flatten or even reduce the cost of services. These opposing vectors may largely cancel each other out—at least in the aggregate.

This suggests that headline inflation may stay in a range close to current levels—somewhere between 2% and 3% annually—even as the underlying drivers shift. Importantly, this may mask significant sector-level volatility. Investors, consumers, and policymakers should be more attuned to component inflation than the composite number.

Inflation, after all, is just a number. But what that number hides—and reveals—is becoming more and more important.

Sources: Peterson Institute, Goldman Sachs, Bureau of Labor Statistics via Mark Perry

🚙 Interesting Drive-By's 🚙

🎯 Why Are We Pretending That AI Is Going to Take All the Jobs?

💯 Zero-Sum Thinking and the Labor Market

💸 Structured Equity Products: Marketing Success, Investment Failure

🤔 AI Phobia Is Just Fear That “Easier” Equals “Cheating”

💡 Why AI Data Centers Are Putting the Fiber Industry Back in the Spotlight

👋🏼 Parting Thought

It was a pretty tough week for Gen-X. 💔💔💔

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.