The Sunday Drive - 07/13/2025 Edition [#171]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! It’s been a rough week of lugging around a heavy heart in the aftermath of the tragic flooding in Kerr County, TX - home to many members of my family. May God walk with all of those affected, and especially with the souls who were lost to the water. 💔

Let’s try to enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

As most of you know, I’m a fan of derivative creations: mashups, creative covers, and unexpected collaborations. In search of a pick-me-up, I ran across this post/video and have been vibin’ to it ever since.

I’ve looked high and low on YouTube so I could embed it here. Substack doesn’t allow for embedding X (FKA Twitter) videos. Alas, that’s the only place I can find it so I grabbed a screenshot. HERE is the link to the Twitter post, or you can click on the image below (be sure to unmute).

The original Twitter post references the “girls” in the video, but it actually only has ONE extremely talented young woman and a very creative example of compositing, a filmmaking term of art. I hope you enjoy vibin’ to this rendition of the Beatles, Ob-La-Di, Ob-La-Da.

💭 Quote of the Week

“We try to measure what we value—and end up valuing what we can measure.“

— Sari Azout

📈 Chart of the Week

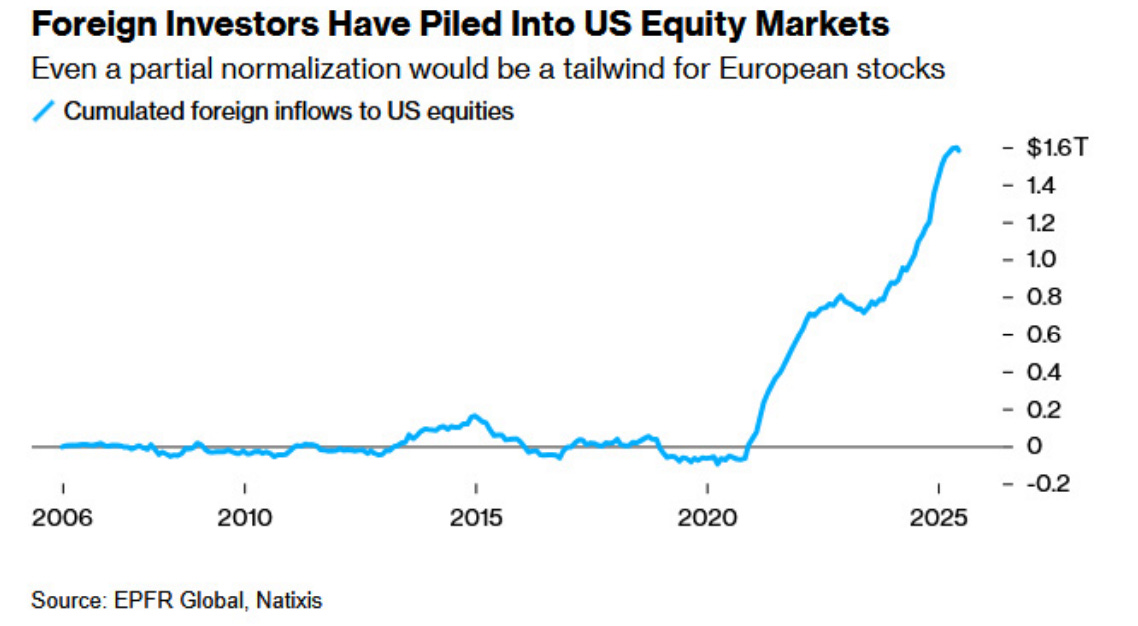

Foreign Flows and the Outperformance of U.S. Equities

Since the pandemic low in early 2020, U.S. equity markets have had one of the most remarkable rallies in history. While much of the attention has gone to Big Tech, AI, and the sheer dominance of the “Magnificent Seven,” there’s been another, less-discussed driver at work: a tidal wave of foreign capital pouring into U.S. stocks.

This week’s Chart shows that cumulative foreign inflows into U.S. equities have surged by over $1.6 trillion since 2020—an unprecedented rise after more than a decade of relatively flat positioning. The steepness of this curve speaks to a global investor base seeking refuge in what it perceived to be the most resilient and innovative equity market during a time of macroeconomic chaos. Strong dollar dynamics, relative earnings growth, and America’s deep, liquid capital markets only enhanced that narrative.

But here in 2025, the tide could very well be shifting.

Year-to-date, non-U.S. equity markets, particularly in Europe and select emerging markets, have meaningfully outperformed the U.S. market. While there are many drivers behind this outperformance (including more attractive valuations and the rotation into global cyclicals), part of the explanation may lie in a simple rebalancing: foreign investors are no longer allocating fresh capital into U.S. stocks at the same breakneck pace. In fact, some may be reversing course and reallocating to under-owned international names.

If even a portion of the $1.6 trillion in cumulative foreign inflows were to be repatriated or reallocated, U.S. equity markets could face a meaningful headwind. Consider that net inflows have accounted for a significant portion of the marginal bid driving valuations—particularly in large-cap growth stocks. A return to pre-pandemic foreign positioning would not only reduce demand but could potentially spark valuation compression, particularly if domestic flows can’t fully backfill the gap.

The bottom line: while U.S. equity leadership has been durable over the last half decade, it’s also been liquidity-driven. And that liquidity has increasingly been global.

Investors would be wise to watch the direction of cross-border flows—because just as they can push markets higher, they can just as easily go the other way.

Sources: Natixis (via Bloomberg), J.P. Morgan

🚙 Interesting Drive-By's 🚙

📈 Free Market Economics is Working Surprisingly Well

📉 Seniors Outnumber Children in 11 States and Almost Half of All Counties

🤔 From Dollar Dominance to the Slop Machine

💡 The Baby Boom Built Housing - Now, Birth Rates Are Falling

🎯 Is Biohacking the New Red Convertible of Midlife?

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.