The Sunday Drive - 06/08/2025 Edition [#166]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

The ramifications of this week’s dustup between the POTUS and the world’s richest man are yet to be determined, but the financial markets didn’t seem to be overly concerned. Why is that? 🤷🏼♂️

So this week, I’m vibin’ to Jimmy Buffett’s Volcano, because… I don’t know. 🤔

💭 Quote of the Week

“Knowledge is a process of piling up facts; wisdom lies in their simplification.“

— Martin H. Fischer

📈 Chart of the Week

In the past, we’ve written quite a bit about our expectation of a broadening out of participation in equity market returns beyond the Mag 7. Indeed, that has been happening of late as non-U.S. stocks have been performing better. Small caps not so much, but they are attractively valued and could be due for a catch up rally.

In my view, the Goldilocks scenario for equities in the coming quarters would be a continued broadening and balancing of performance across geographies and market cap, but in the context of reasonable returns for the market as a whole. For this to happen, the Mega-tech names will need to perform decently while the rest of the market closes at least a portion of the performance gap.

Many analysts and commentators talk about how expensive the S&P 500 is, and with a P/E multiple over 25x, that’s not an unreasonable view.

However, the Chart of the Week leads me to consider another metric to add context to current valuations and the potential for the aforementioned Goldilocks scenario.

Free Cash Flow is King

If there’s one financial metric that best captures the health, resilience, and strategic optionality of a business, it’s free cash flow (FCF). Over the past decade, the “Big Six” U.S. tech companies—Apple, NVIDIA, Microsoft, Alphabet (Google), Amazon, and Meta—have transformed themselves into free cash flow machines.

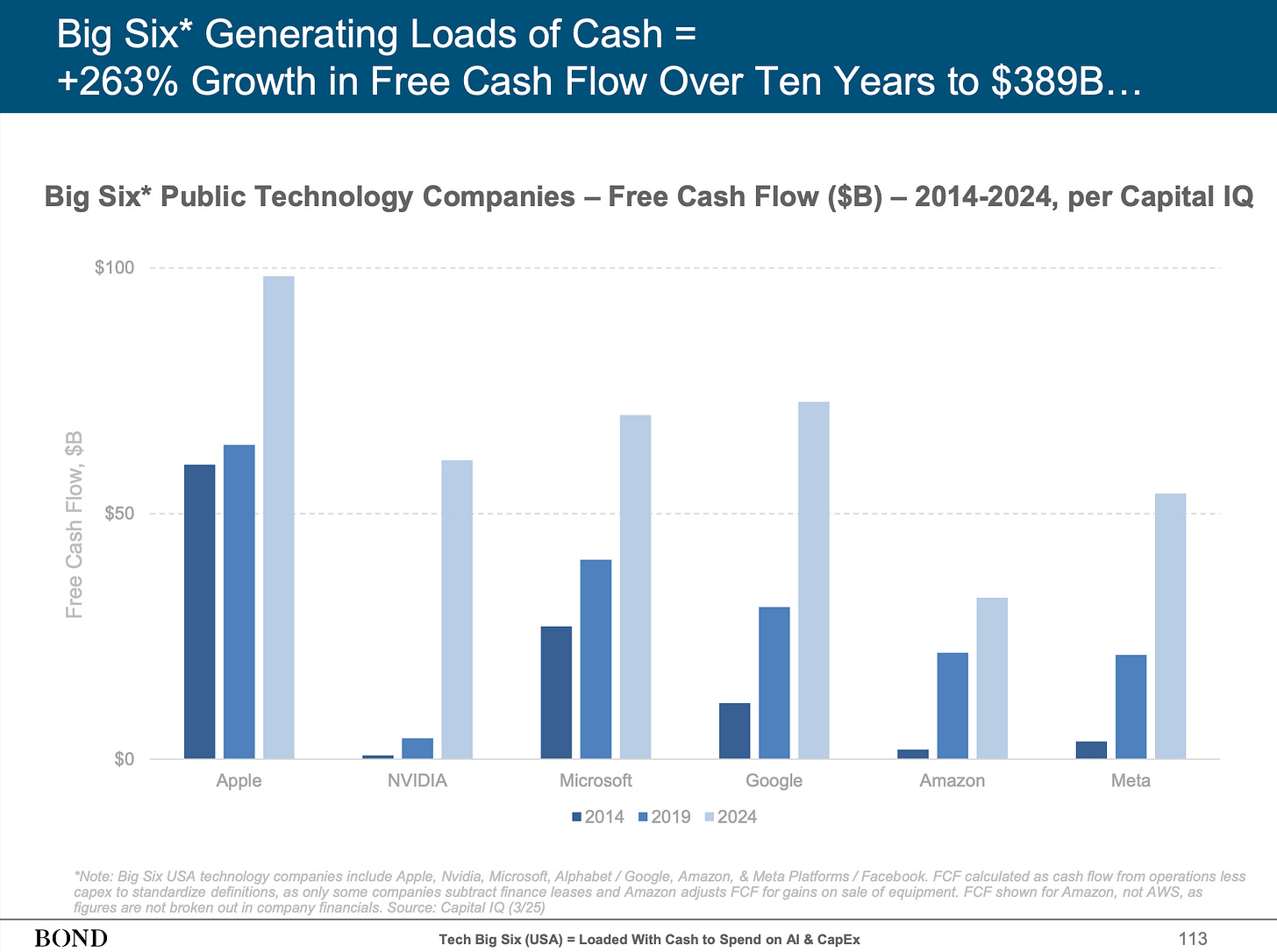

This week’s Chart shows that the combined FCF of these six companies has grown an astounding 263% from 2014 to 2024, reaching a cumulative $389 billion this year.

This isn’t just a historical footnote—it’s a glimpse into the new financial architecture of the tech-driven economy. The growing dominance of free cash flow as a measure of performance, discipline, and reinvestment capacity could reshape how we evaluate durable competitive advantages in the AI era.

A Decade of FCF Expansion

Back in 2014, Apple led the pack with roughly $60B in FCF. Fast forward to 2024, and it’s closer to $100B—nearly one-quarter of the total for the group. Microsoft and Alphabet follow closely, each pushing well above $70B in FCF. Meta and Amazon have shown the sharpest relative growth over the decade, with Meta’s FCF growing more than 10x and Amazon’s more than 6x, albeit off a smaller base.

The true standout here is NVIDIA. With negligible free cash flow in 2014, its projected 2024 output approaches $30B, underscoring the dramatic impact of becoming the dominant supplier of AI infrastructure.

What Drives Free Cash Flow Margins?

Several structural and strategic drivers underpin this growth:

Operating Leverage: Cloud, ad tech, and software businesses all benefit from high gross margins and low incremental costs.

Capital Efficiency: Unlike traditional industrial firms, these companies often require less capital investment relative to revenue to scale, even in light of AI-related capital expenditures.

Platform Economics: Ecosystem control (Apple’s App Store, Google Search, Microsoft Azure) enables pricing power and recurring revenues.

Stock-Based Compensation: Though viewed as controversial by some, SBC often keeps GAAP expenses higher while not directly affecting cash flows.

Looking ahead, AI will continue to be a pivotal driver of FCF growth. While model training is capital-intensive, inference (i.e., deploying models) is becoming more efficient. Firms like Microsoft and Google, which embed AI into productivity software, advertising, and cloud services, stand to expand or at least sustain margins. NVIDIA’s role is even more fundamental—it’s selling the picks and shovels for the AI gold rush.

Valuation Through the FCF Lens

As mentioned, looking at free cash flow yield—FCF divided by enterprise value—is a useful way to think about valuation. Historically, Big Tech has traded at FCF yields of 3–5%. Today, the group as a whole is slightly richer than that. Meta currently offers the most attractive FCF yield of the group at 4.6%, while NVIDIA seems priced to near-perfection at a FCF yield of 1.1%.

Why FCF Could Sustain Valuations

In a world with higher interest rates than in the past decade, with investors more discerning and capital more expensive, free cash flow is the ultimate insurance policy. It funds buybacks, dividends, M&A, the ability to absorb tariffs if needed, and innovation—especially in AI and computing. More importantly, it provides strategic autonomy.

The “Big Six” aren’t just tech giants. They could be considered sovereign financial entities with balance sheets that rival small nations. Their ability to consistently produce—and deploy—free cash flow at scale is what sets them apart.

In a world awash in narratives and noise, free cash flow remains the signal.

Sources: Capital IQ, YCharts.

🚙 Interesting Drive-By's

💡 The Ripple Effects of Trade Uncertainty

📈 The New Nuclear Capital of America: Are You Ready for $10 Energy Bills?

🎯 The Four Phases of Institutional Collapse in the Age of AI

🤔 The Quiet Revolution of “Becoming”

☢️ Test Case: American Wildcatters Pivot to Nuclear

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.