The Sunday Drive - 05/26/2024 Edition [#112]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY. It’s Memorial Day weekend and the unofficial start of the summer season. Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

No theme for this week, just a great song from the early days of MTV - back when they actually played music videos in case you’re old enough to remember that. 😂

This week I’m vibin’ to Money for Nothing by the Dire Straights from their 1985 album, Brothers in Arms. A fun fact that you may not know… The familiar voice you hear singing backup vocals is none other than Sting, lead singer of The Police. Please forgive the risqué moments in the video. It was 1985, you know. Enjoy.

💭 Quote of the Week

“To be contrarian, in a world where people don't believe in anything, is to have well-defined beliefs and to anchor them.”

– Peter Thiel

📈 Charts of the Week

I found the Charts for this week to be interesting and perhaps helpful in thinking about how narrow and top heavy many of the equity market indices have become.

The universe of publicly traded companies has shrunk by 43% since 1996, a time many remember as roughly the height of the internet bubble.

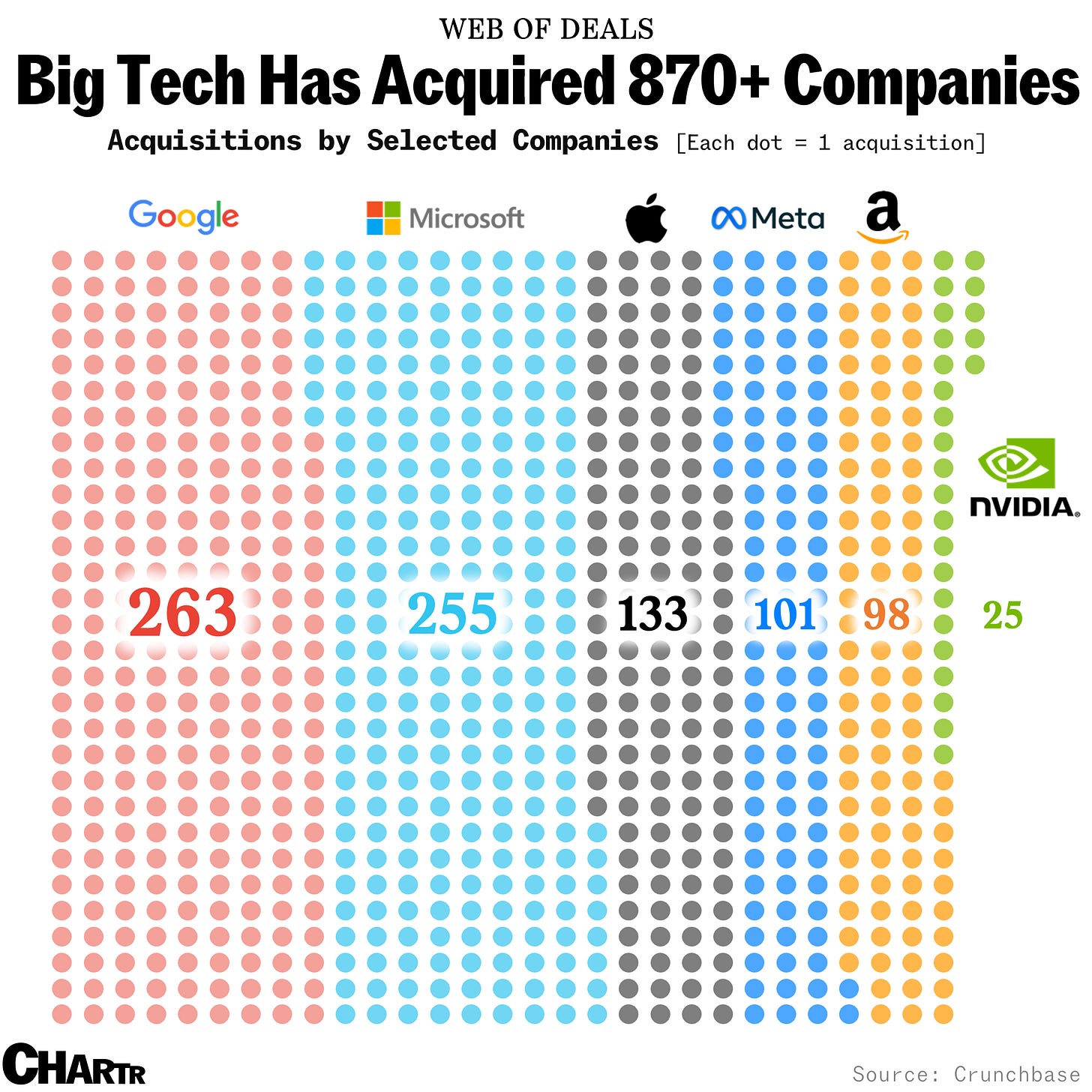

Much of the decline in the number of public equities over time has been driven by M&A.

In fact, of the roughly 3,350 public companies that have disappeared since the mid 1990’s, 875 of them were acquired by just six (!) companies: Google (Alphabet), Microsoft, Apple, Meta (formerly Facebook), Amazon, and Nvidia.

What are the investment implications of this more narrow opportunity set of stocks?

How should we think about the role of passive vs. active equity investing, and within that, the role of stock selection as a driver of equity returns?

What about the role of public vs private equity investing?

What about the role of options and other derivatives?

How should we think about cryptocurrencies and other digital assets, and their place (or not) in portfolios?

I’m not proposing any answers here. I am just thinking about the continuing evolution of markets and market structures, and what the right actions might be in light of that evolution.

🚙 Interesting Drive-By's

💯 America is Outgrowing Other Rich Countries - from James Pethokoukis [Link]

💡 This is the Best Career (Life) Advice I Ever Got - from Ryan Holiday [Link]

🤔 Banks in Disguise - from Marc Rubenstein [Link]

💻 Windows Returns - from Ben Thompson [Link]

🤓 Looking for AI Use-cases - from Benedict Evans [Link]

🖨️ Wealth Solutions for the Next Generation - from General Catalyst [Link]

👋🏼 Parting Thought

With all of the cookouts and time with family and friends this Memorial Day weekend, let us not forget the sacrifices of those who died in the service of defending our freedoms.

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners or Cache Financials.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.

Everybody should take a moment and read Ryan Holiday's piece while vibin to Money For Nothin. I just did. It was delightful.