The Sunday Drive - 05/25/2025 Edition [#164]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! As we prepare to enjoy a leisurely Sunday Drive around the internet, let us first take a moment on this Memorial Day to remember those who made the ultimate sacrifice for our freedoms.

🎶 Vibin'

As the Administration’s so-called “One Big Beautiful Bill Act” (yes, that’s it's official name) winds its way through Congress, I can’t help but imagine previously smoke-filled rooms containing Congress-critters of all stripes and be reminded of an oldie but a goodie.

So, this week I’m vibin’ to You’re Rockin’ the Boat from the 1955 musical, Guys and Dolls. Enjoy.

💭 Quote of the Week

“No society ever thrives because it had a visionary plan. It thrives because it corrected its mistakes.“

— David Brooks

📈 Chart of the Week

More With Less, But Who’s Left to Work?

I think it is important that from time to time, we zoom out from all the sound bite driven micro-market events and look at the big map—the long term drivers of economic growth and investment returns.

As those who’ve been reading the Sunday Drive for a while probably know, some of the major focuses have been the role of technological advancement, writ large—e.g. biotech, quantum computing, and of course AI—and the role of demographics in the economy of the future.

The most important question to which I continually seek an answer, or at least some insight is…

What happens as those two waves collide?

So, this week we return to our ongoing discussion of productivity, labor, and demographics.

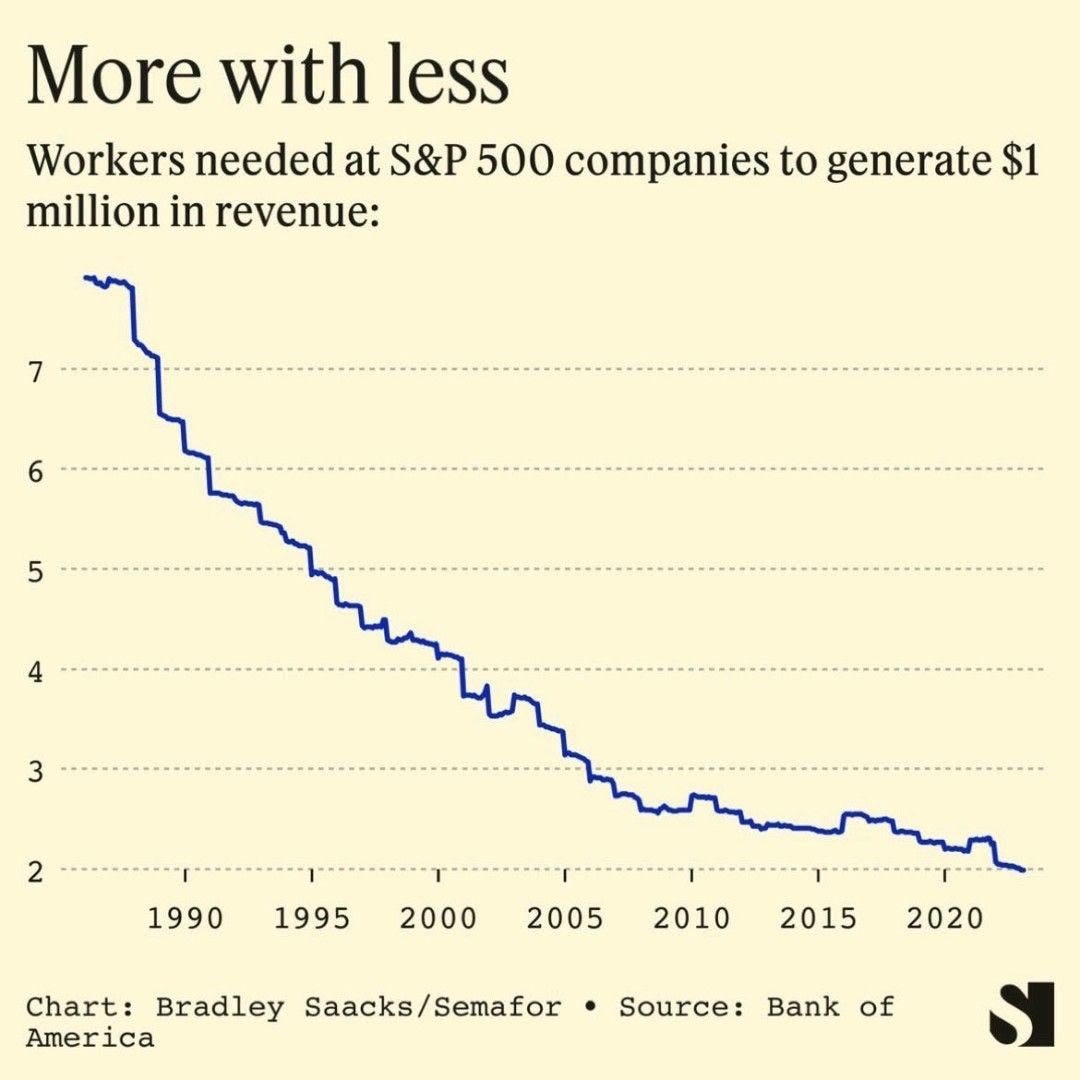

This week’s Chart shows that since the mid-1980s, the number of workers needed at S&P 500 companies to generate $1 million in revenue has fallen dramatically—from over seven employees to just above two today.

At first glance, it’s a story of progress. Companies are doing more with less. But the forces behind this trend—and the implications going forward—are far more complex.

The Productivity Boom That Didn’t Raise All Boats

For decades, corporate America has pursued efficiency with religious fervor. Lean manufacturing, global supply chains, digitization, robotics, and now generative AI—these innovations have relentlessly reduced the need for human labor per dollar of output. Capital has increasingly supplanted labor, driving higher margins and returns to shareholders.

But the benefits haven’t been evenly distributed. Real wages have stagnated even as productivity has soared. The falling worker-to-revenue ratio is a symptom of an economy where capital increasingly captures the value created. Labor, meanwhile, sees less of the pie—even when it’s growing.

The Missing Piece: Demographics

This trend collides head-on with another seismic shift: the aging U.S. workforce. In 1990, workers over age 55 made up just 12% of the labor force. Today, that number is over 25%, and rising. As baby boomers retire en masse over the next decade, the U.S. could very well experience a structural labor shortage.

But it’s not just about fewer workers—it’s about different workers. Older employees may prefer part-time work or lack the skills for an increasingly digital economy. Meanwhile, younger generations are smaller in number and entering the labor force more slowly. Many of them have been educated in a system that has not left them well prepared with the skills that will be required in an evolving economy.

So we find ourselves with a paradox: at the national level, labor is scarce. At the firm level, the drive to automate and reduce labor intensity is stronger than ever.

Scarcity Meets Surplus

The result is what has become a bifurcated labor market. Skilled tech-savvy workers have been in high demand and well compensated.

At the same time, less adaptable workers have been increasingly sidelined. Companies aren’t hiring more—they’re automating faster. And they’re not doing it because labor is cheap and plentiful, but because it’s scarce and costly.

One wonders if the labor market could begin to shift the other direction over the coming years, as an AI-driven productivity boom starts eating away at previously well compensated skills. We’re already seeing a softening in demand for software developers as AI lowers the bar for coding skills.

On the other hand, areas which require the most human of human capital—e.g. plumbers, electricians, skilled nurses—are seeing shortages of labor supply and stronger wage growth.

Investment and Policy Implications

From an investment standpoint, companies that can scale without labor are at a structural advantage—especially in a demographically challenged environment. These are the firms best positioned to convert scarcity into pricing power and margin durability.

I believe that we are entering an era where efficiency alone won’t be enough. The challenge ahead is not just doing more with less—but ensuring there’s enough to go around and in the right places.

Sources:

🚙 Interesting Drive-By's

💡 Adapting to Survive: How Leaders Succeed

🎯 The Upheaval Coming for the Internet Economy

🤔 As AI Takes Over the Workplace…

💸 Dividend Chasers… YOU are the Yield

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.