The Sunday Drive - 05/19/2024 Edition [#111]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Ellicottville, NY. Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

With Q1 earnings season largely behind us, corporate share repurchases back in full swing, and a recent spate of fairly benign economic indicators, equity markets have turned eerily placid.

Despite the Quote of the Week below, I would say the operative term for describing current market sentiment is complacency rather than greed. However, if the current course continues, greedy markets are sure to come absent something that comes along to upset things.

So this week, I’m vibin’ to the 1959 instrumental hit, Sleep Walk by the brother duo, Santo and Johnny. Enjoy, but try to stay awake… literally and figuratively.

💭 Quote of the Week

“Be fearful when others are greedy, and greedy when others are fearful.”

– Warren Buffett

📈 Chart of the Week

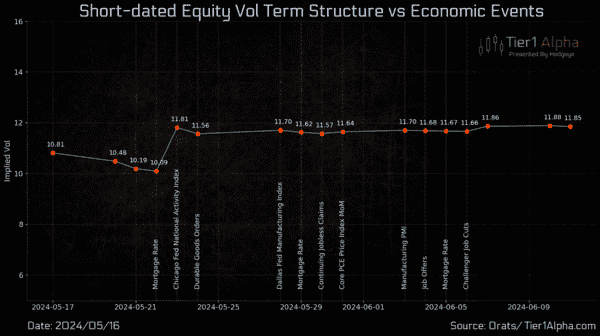

The Chart of the Week is a bit wonky, but makes the point of this week’s theme of market complacency. It shows how the term structure of volatility (the options market’s expression of implied volatility), is pricing upcoming economic events.

As you can see, not only are absolute levels of implied volatility quite low by historical standards - in the 12ish range versus a long term average of nearly 20, but the volatility curve is very flat going out in time. The message we can take from this is that there appears to be a significant absence of fear in the equity markets.

This is worrisome.

To quote Joseph Heller from the book Catch-22, “Just because you’re paranoid doesn’t mean they aren’t out to get you.”

I believe unforeseen trouble could very well lie ahead.

Okay…. What are thoughtful investors to do then?

Perhaps one should stay the course but remain vigilant. Many excellent returns have been forgone in the past by investors who chickened out and ran for the hills prematurely.

However, another action that investors might take is to incorporate a prudent hedging program into their portfolios. The time to buy “insurance” is when it’s really cheap, i.e. when you don’t think you need it. In this low volatility environment, hedges are likely to be quite cost effective.

Food for thought anyway…

🚙 Interesting Drive-By's

💡 Strive for Mastery Not Money - from Frederik Gieschen [Link]

🤔 Demographic Winter is Coming - from Michael Snyder [Link]

💯 The Great Flattening - from Ben Thompson [Link]

🤓 The Modern Curse of Overoptimization - from Freddie Deboer [Link]

⏱️ It’s Time for Women to Rewrite the Narrative on Aging - from Maddy Dychtwald [Link]

👋🏼 Parting Thought

Haunting words from the 1987 movie, Predator…

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners or Cache Financials.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.