The Sunday Drive - 05/05/2024 Edition [#109]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY. It’s Kentucky Derby weekend and this place is jumping!

Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

There are times when moments come together to bring meaning and joy to one’s life. It’s not always easy to tell if you meet the moment, the moment meets you, or some of both, but one way or the other, life just feels right when it happens. This week’s vibe reminds me of times like this.

This week, I’m vibin’ to Van Halen’s (Van Hagar?) 1991 hit, Right Now, recorded live in 2006. I loved vintage Van Halen, but I have to say the Sammy Hagar vocals were an amazing addition to the band.

Enjoy and be inspired, as I have always been by this song.

💭 Quote of the Week

“So what if you made a thing, that like was meant for one thing, and then, like it became the only thing for like a totally different thing, like the biggest thing in the world... You'd be Nvidia. Totally.”

– Some Random Teenager

📈 Charts of the Week

As we all know, in order to fend off and rein in inflation and inflationary expectations resulting from the pandemic in the early 2020s, the U.S. Federal Reserve bank raised short-term interest rates significantly and over a short period of time during 2022.

This has had a dramatic impact on the banking system and other sectors of the economy. However, the effects of these higher borrowing costs are being quite possibly felt in the government sector more than anywhere else.

U.S. federal debt levels have accumulated at a historic pace in recent years as a result of unprecedented fiscal and monetary stimulus during the pandemic. Although monetary stimulus has abated, federal fiscal spending has not.

With record levels of U.S. federal debt, the government is also now faced with record levels of interest payments required to service that debt. Those interest payments have nearly doubled since the beginning of the pandemic, as shown in the chart above.

This has led many, including me, to believe that if something doesn’t change fairly soon, interest payments on the debt could begin to crowd out other government spending, leading to some very difficult policy choices on the part of lawmakers (and voters).

However, there is another way to look at it which makes the situation seem somewhat less dire.

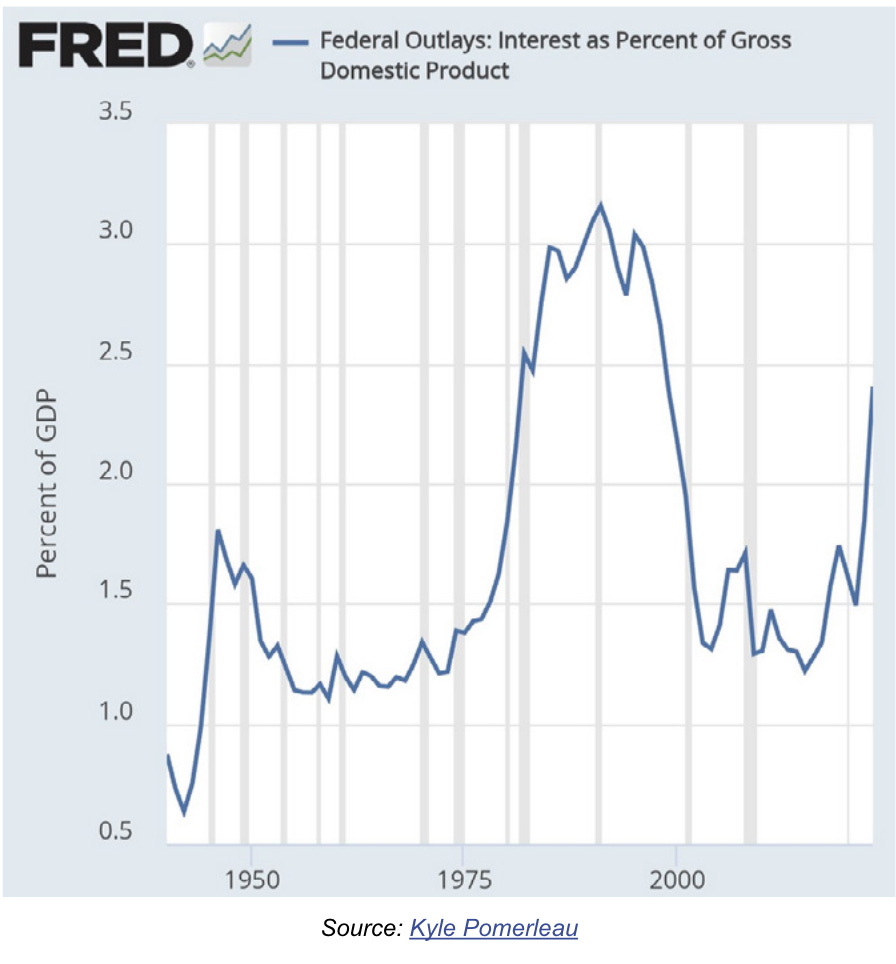

While quite high and certainly in need of attention, as the second chart shows, interest payments on the government debt when expressed as a percentage of GDP or nowhere near as high as they were at their peak in the 1980s.

Maybe with a little fiscal discipline, inflation slow enough to give the Fed cover to lower short term interest rates, and sustained, productivity-led economic growth, we might yet get this situation under control and avoid some of the hard choices mentioned above.

That’s the Goldilocks scenario many are hoping for.

🚙 Interesting Drive-By's

💡 2024 Consumer Trend Report - from Forerunner Ventures [Link]

🤔 Your Most Fulfilling Work is Ahead of You - from Modern Elder Academy [Link]

📈 META and Reasonable Doubt - from Ben Thompson [Link]

📉 Universal Capitulation and No Margin of Safety - from Hussman Funds [Link]

Note: I sometimes find it helpful to do an investing sanity check by reading a piece from a notable “perma-bear”. John Hussman is a good one.

😒 Ericsson CEO: Europe regulations will leave ‘no industry left” - from Fortune [$ Paywall Link]

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners or Cache Financials.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.