The Sunday Drive - 05/04/2025 Edition [#161]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! It’s Kentucky Derby weekend. 🐎 So, let’s put on a fancy hat, hoist a mint julep and enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

After a tumultuous month for investors, I’m thinking about all the financial advisors out there doing their best to soothe client nerves and keep them focused on their investing goals. So, this week I’m vibin’ to the one hit wonder Billy Swan and his 1974 hit song, I Can Help, because I think a lot of folks could sure use it right about now.

💭 Quote of the Week

”Ask yourself who you’d want to spend the last day of your life with and then meet with them as often as you can.”

— Warren Buffett

BONUS QUOTE OF THE WEEK

“If you’re going to be successful, you have to live and breathe this business.“

— Bob Baffert, trainer of multiple Kentucky Derby winners

📈 Chart of the Week

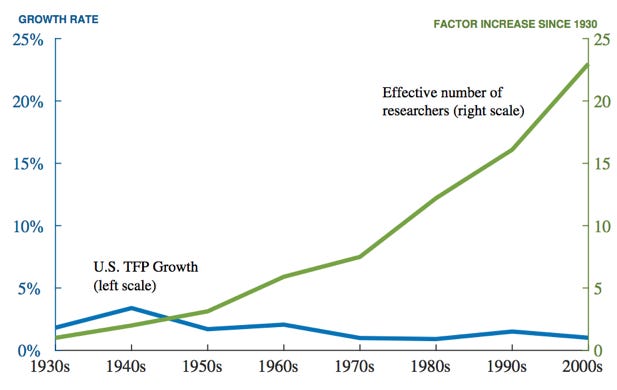

From Patents to Productivity: Bridging the Execution Gap

This week is a bit of a departure from recent articles about volatility and asset correlations.

Nope, this week I’m going on a bit of a growth rant.

It’s important that we spend at least some time thinking about long term economic growth drivers, and not get lost in the noise of tariff talk and the like.

Ideas are easy to come by. Executing on them is the hard part.

America is awash in ideas. Our universities churn out patents, our labs push the boundaries of science, and our entrepreneurs dream big. Yet, despite this intellectual abundance, economic growth remains somewhat sluggish. The problem isn’t a lack of innovation; it’s a failure to execute effectively. This issue will become increasingly important going forward given the convergence of an aging workforce and AI as a needed productivity driver of economic growth.

A recent Census Bureau study highlights this disconnect: while patent filings are robust, their translation into broad economic impact is limited. This suggests that our challenge lies not in generating ideas but in bringing them to fruition.

Historically, the U.S. excelled at turning ideas into tangible outcomes. The post-WWII era saw rapid industrialization and infrastructure development, fueled by a synergy between public investment and private enterprise. Today, that synergy has weakened.

Several factors contribute to this execution gap:

Regulatory Hurdles: Complex and often outdated regulations can stifle innovation, making it difficult for new ideas to gain traction.

Infrastructure Deficiencies: Aging infrastructure hampers the deployment of new technologies and the scaling of innovative solutions.

Talent Mismatch: There’s a growing disconnect between the skills our workforce possesses and those required to implement cutting-edge ideas.

To bridge this gap, we must focus on enhancing our execution capabilities. This involves streamlining regulations, investing in modern infrastructure, and aligning education with the demands of a rapidly evolving economy.

In the investment world, the value of an idea is only realized through effective execution. For the U.S. to truly harness its innovative potential, we must prioritize the mechanisms that turn ideas into reality.

The path forward requires a concerted effort to rebuild the bridges between innovation and implementation. Only then can we unlock the full economic benefits of our collective ingenuity.

Sources:

“Why American growth falters despite abundant ideas” - Faster, Please!

“Economic Growth Depends On The Flow Of People And Ideas” - Forbes

“Ideation to execution: Scaling new ideas for growth” - Cognizant

🚙 Interesting Drive-By's

💡 New Study Shows Late Midlife as a Time of Joy

💯 When Is the Perfect Time to Start a Business? - Aristotle’s Opinion

🤔 Permissionless Innovation in the Age of AI

💸 Millionaires Are Fleeing Britain: “Capital will always go where it’s welcome and stay where it’s well treated. Capital is not just money. It’s also talent and ideas. They, too, will go where they’re welcome and stay where they are well treated.” - Walter Wriston, former CEO of Citibank

🐎 Complete List of Triple Crown Winners

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.