The Sunday Drive - 04/07/2024 Edition [#105]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Let’s enjoy a leisurely Sunday Drive around the Internet.

🎶 Vibin'

As you may remember from last week’s Sunday Drive which focused a lot on teamwork, a number of things have recently aligned for me professionally. There is much clarity now in terms of my long term strategic direction.

In that vein, this week I’m vibin’ to the classic tune, I Can See Clearly Now, originally recorded by Johnny Nash in 1971. However, I like the Jimmy Cliff version from the 1993 film, Cool Runnings soundtrack, which celebrated the trials and triumphs of the Jamaican Bobsled team at the 1998 Winter Olympics in Calgary. Enjoy.

💭 Quote of the Week

“Nothing in life is as important as you think it is when you are thinking about it”

– Daniel Kahneman

📈 Chart of the Week

This week’s Chart is a busy one, but I found the conclusion you can draw from it to be quite interesting and worth sharing.

We’ve all heard the phrase, T-Bill and Chill as a quasi-humorous reference to the current attraction of owning 90 day Treasury bills as a risk-free replacement for bonds and potentially stocks as well.

The Chart seeks to evaluate the attractiveness of global equities relative to short and long-term US treasuries by adjusting for risk and inflation and comparing the yields on bonds to the 12 month forward earnings yield for equities. The gray line represents U.S. equities. The orange line represents non-US equities (Developed world). The red line represents long-term (7 to 10 years) treasury bonds, and the light blue line represents short term treasuries with maturities of one to three years.

Typically, the earnings yield on equities is higher than the yields on bonds, reflecting what is known as the Equity Risk Premium (ERP). This is the extra return required by investors to invest in equities which historically are more risky (volatile) than bonds.

However, that is not what we see today. U.S. stocks offer a negative risk-adjusted real return. One could argue that the U.S. equity market is expensive because of the rich valuations on the Magnificent 7, actually now the Fab Four, but that doesn’t tell the whole story. Non-US equities are more attractively valued than U.S. equities but still offer no positive ERP.

The conclusion one can draw from the Chart is that short term treasuries currently offer a 2.5% real yield premium, adjusted for risk and inflation. This a level typically offered by reasonably valued equity markets.

Which brings us back to 3 month T-Bills, the yield on which is often referred to by most investors as the risk-free rate, the rate against which all other financial assets are valued.

For now at least, T-bills, which are currently yielding over 5%, appear to be the most attractively valued asset across the investing landscape.

Enjoy it while it lasts. A free lunch never does.

🚙 Interesting Drive-By's

This week we have articles on technological progress, planning, the allocation economy, and gratitude:

📈 Techno-Optimistic Media - from Packy McCormick

Can you feel the acceleration?

Last Monday, Extropic released its whitepaper, Ushering in the Thermodynamic Future. On Tuesday, Cognition AI released its AI Software Engineer, Devin. On Wednesday, Figure shared a video of its humanoid robot, Figure 01, having a full conversation while completing tasks on-command. On Thursday, SpaceX successfully launched its Starship rocket into orbit.

Last week was a historically uncommon week of the sort that is becoming increasingly common.

Technology is accelerating, and we’re witnessing it in real-time, thanks to the emergence of new channels for founders to share what they’re building, unfiltered. The stories above weren't published through mass media channels. Instead, they were broadcast directly from the source, straight to the people most eager to hear about them – and they were amplified by Techno-Optimistic Media.

[Read More…]

🤔 The Futility of Planning - from Jared Dillian

If you make your living in the financial markets, you are familiar with the ways of chaos. We all have plans for trades. I’m going to buy it at X and sell it at Y and make Z. How often does that work out? [Read More…]

💡 The Knowledge Economy Is Over, Welcome to the Allocation Economy - from Chain of Thought

In the age of AI, every maker becomes a manager. [Read More…]

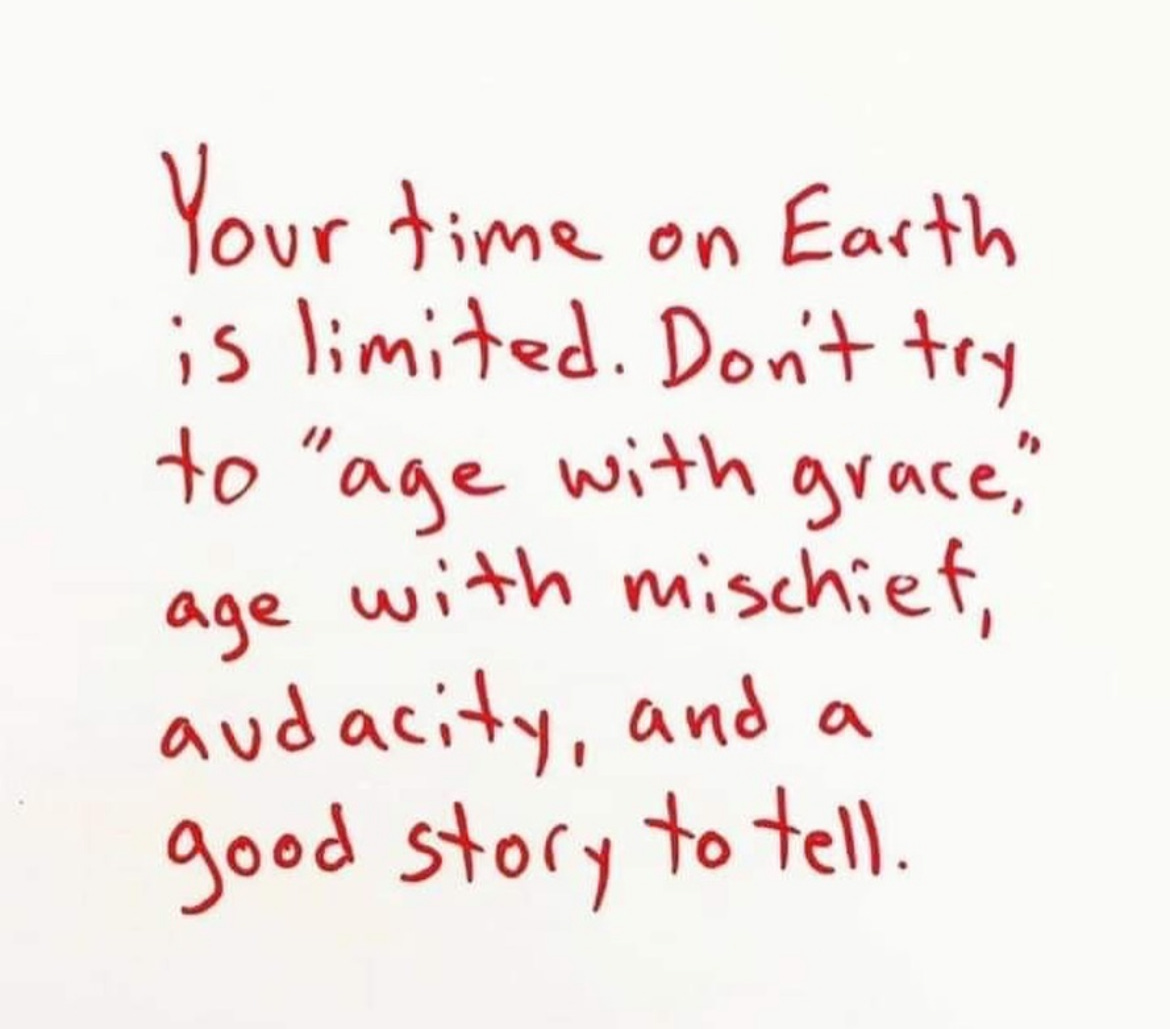

💯 Finding Gratitude, Confidence and Joy After 50 - from The Wisdom Well

I will turn 50 later this year, and for the first time, I’m ready to say, out loud, that I am glad. [Read More…]

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.