The Sunday Drive - 03/26/2023 Edition

👋🏻 Hello friends,

Let's take it easy and enjoy a leisurely Sunday Drive around the internet.

Vibin'

I believe that it’s never too late for one to take a classic and make it one’s own. This week, I’m vibin’ to Sally Barker’s imaginative and beautiful rendition of It’s Not Unusual by Sir Tom Jones. I hope that you are as moved by it as I was.

💡 Quote of the Week

"The greatest thing that we can do is to help somebody know that they're loved and capable of loving." - Mister Rogers

💡 Bonus Quote of the Week

"A fine is a tax for doing wrong. A tax is a fine for doing well." - Mike's Fortune Cookie

📈 Charts of the Week

Here’s a great take on the above chart from Jared Dillian. He explains it better than I ever could:

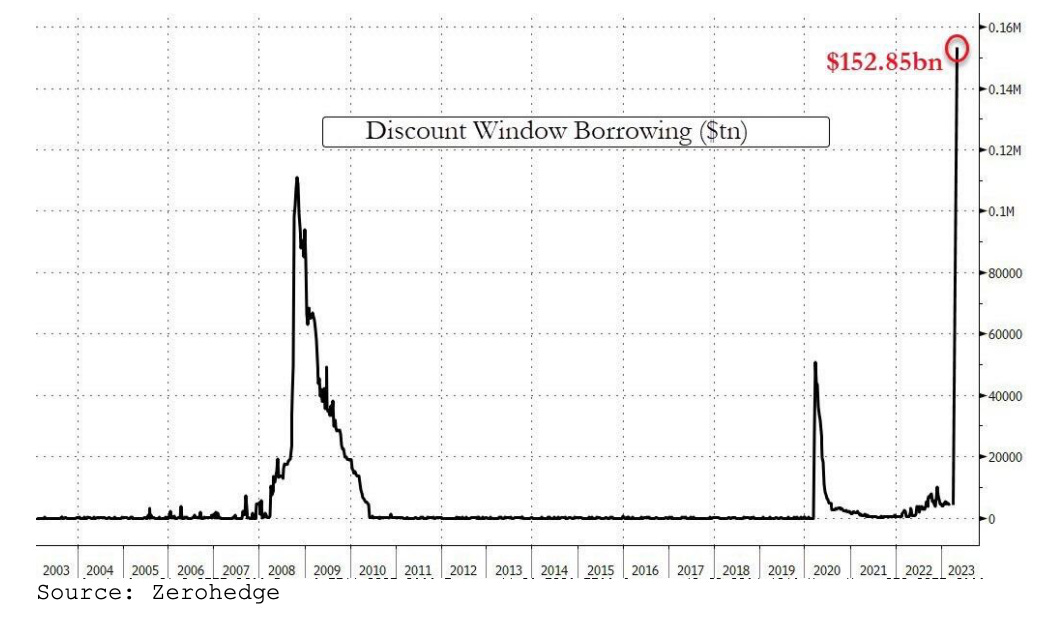

This is a chart of banks accessing the discount window at the Fed.

A quick tutorial: banks can borrow directly from the Fed at the discount window at a penalty rate. They tend not to do it unless it is an emergency, because the interest rate is high (4.75% I believe) and it eventually becomes public who borrowed at the discount window, so there is some stigma attached to it. As you can see, there is more discount window borrowing than during the financial crisis.

Where there’s smoke, there’s fire. This is very well worth watching.

On a related note…. Consider the chart above.

I believe that a very important thing for investors to keep an eye on in the coming months is the risk to the small and regional banks posed by commercial real estate. If there is a monster under the bed of the economy and the banking system, it’s the potential for significant damage to the financial health of the smaller and regional banks from non-performing loans in the commercial sector - particularly office buildings.

The equity markets aren’t yet particularly focused on this, but the credit markets certainly are starting to be. We may need to buckle our seat belts. It could very well be a bumpy ride ahead.

🚙 Interesting Drive-By's

🤔 Silicon Valley Bank was a Hedge Fund in Disguise - The financial world continues to grapple with the fallout from last week’s stunning collapse of Silicon Valley Bank. However, SVB was more like a hedge fund than a bank. In fact, when the dust settles, SVB might turn out to be a glorified Ponzi scheme with poor risk management that relied on continued tech-driven growth and low interest rates to fuel its expansion.

🤓 Remote Banking Crisis - Banks tried to kill remote work. Now, remote work is trying to kill banks.

💰 Worker’s Poker - Remember Salomon Brothers? The fantastically profitable trading house exemplified 1980s Wall Street swagger.

That same swagger ultimately killed the firm. For a time, though, Salomon was king of the mountain.

🙌🏻 The Rise of Texas - Texas now has more than 30 million people. Its GDP is $2 trillion — bigger than Canada’s. It would be the world’s ninth-biggest economy if it were independent (which it was for ten years in the 19th century). The state racked up $486 billion in exports in 2022, almost a quarter of America’s total and more than Taiwan. And only about half of Texas’s exports are fossil fuels and chemicals; the state also makes parts for computers and aircraft and much else besides. Remarkable flows into US money market mutual funds of late suggest that funds have indeed been leaving deposits and heading for a place that’s easy to reach where they can earn a better return for a while.

👋🏼 Parting Thought

That feeling like you have too many balls in the air:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.