The Sunday Drive - 03/16/2025 Edition [#154]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let's enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

It was another hairy week in the financial markets as investors continue to digest economic news and the potential impact of tariffs on the growth of the U.S. economy.

As the old naval saying goes, “The beatings will continue until morale improves.”

So this week, I’m vibin’ to Mollly Hatchet’s 1979 hit, Flirtin’ with Disaster. Just sayin’…

💭 Quote of the Week

“There are two requirements for success on Wall Street. One, you have to think correctly; and, secondly, you have to think independently.“

— Benjamin Graham

📈 Chart of the Week

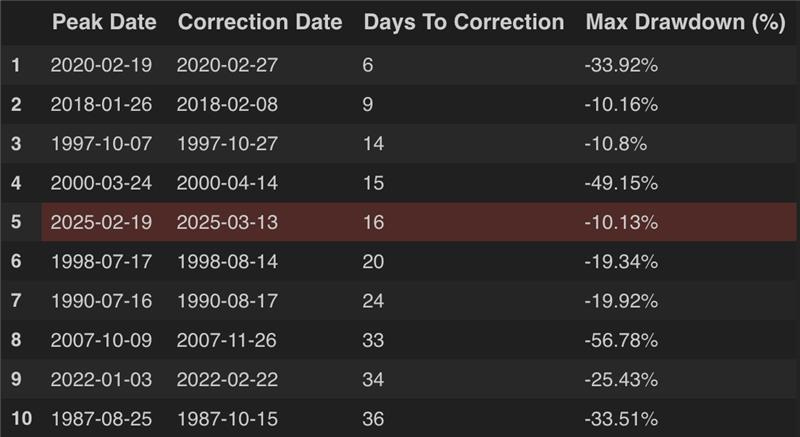

The Acceleration of Market Declines: Why Corrections Seem to be Happening Faster and What To Do About It

The speed of the S&P 500’s recent 16-day decline from its peak on February 19th is noteworthy. It marked the 5th fastest -10% correction in the last 50 years and highlights what appears to be a clear trend: market drawdowns seem to be happening at an increasingly rapid pace.

In fact, three of the five fastest corrections have occurred in just the last six years, including Volmageddon (2018), the COVID crash (2020), and now this latest downturn. What’s driving this acceleration?

1. The Rise of Algorithmic and High-Frequency Trading (HFT)

Market structure has fundamentally changed. A substantial portion of daily trading volume—some estimates suggest 60-70%—is now driven by algorithmic trading (Zhang, 2020). These algorithms react instantly to data, headlines, and order flow, exacerbating price moves. Unlike human traders who may digest news over hours or days, algos adjust positioning within milliseconds, increasing the speed of declines.

2. Option Market Feedback Loops and Volatility Targeting

Derivatives markets play a crucial role in amplifying market moves. Volatility targeting strategies and risk-parity funds are forced to de-risk as volatility rises, creating forced selling. A classic example is the 2018 Volmageddon event, where short-volatility strategies imploded in a single day. As we saw in 2020 and now in 2025, when the Cboe Volatility Index (“VIX”) spikes rapidly, dealers offload positions, deepening the downturn.

3. Retail Trading and Social Media-Driven Panic

The rise of retail trading, fueled by zero-commission platforms and social media, has increased the herd effect. Platforms like X (formerly Twitter) and Reddit create instant feedback loops, where negative sentiment spreads faster than ever before, triggering panic-selling en masse.

4. Central Bank Policy and Liquidity Regimes

Decades of accommodative monetary policy have created an environment where markets are hyper-sensitive to liquidity conditions. As central banks withdraw liquidity or signal tightening, risk assets react violently. The lack of a liquidity “cushion” means when corrections start, they accelerate quickly.

The combination of structural shifts in market mechanics, increased leverage, and the speed of information dissemination ensures that fast corrections aren’t an anomaly—they’re the new normal.

So What’s an Investor To Do?

There’s an old investment maxim that states that markets ride up an escalator but fall down an elevator shaft. The market structure changes mentioned above surely seem to be making that more and more the case.

Can investors do something to potentially turn these developments to their advantage?

Yes. Just use good old fashioned investing common sense.

Be prepared. Be opportunistic. Be patient. Be focused on your goals.

Sources:

• Zhang, X. (2020). High-Frequency Trading and Market Volatility. Journal of Financial Economics.

• BIS Report (2023). Algorithmic Trading and Market Liquidity.

• CBOE VIX Data & Market Structure Analysis (2024).

🚙 Interesting Drive-By's

💡 Brooke Shields: “I’m never going to retire.”

📈 The Last Lecture of Benjamin Graham

📉 Are we on the verge of a population collapse?

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.