The Sunday Drive - 02/22/2026 Edition [#203]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy another Sunday Drive around the internet.

🎶 Vibin'

Recent events in my life have reminded me just how grateful I am to have such an amazing family - both personally and professionally. My friends and colleagues at Investment Research Partners are an amazing group and I count myself as exceedingly fortunate to have them in my life.

So this week, I’m vibin’ to Neil Young’s classic, Heart of Gold.

💭 Quote of the Week

“Life is like a ten speed bicycle. Most of us have gears we never use.“

— Charles Schulz

📈 Chart of the Week

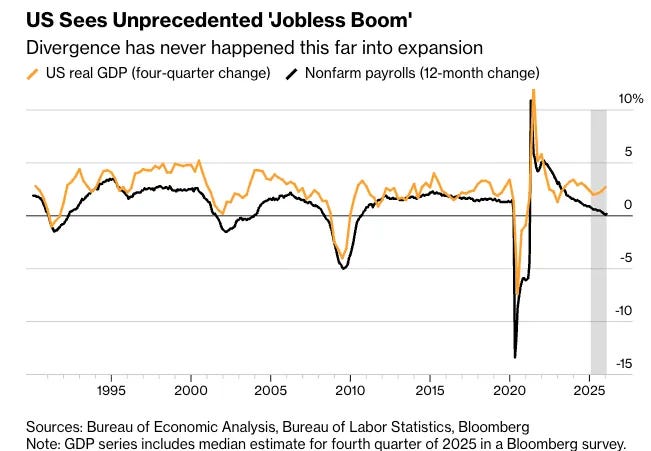

Timing is Everything: The Lag Between Productivity Growth and Job Growth

One mistake investors often make is assuming that economic progress and labor-market health move in lockstep. History suggests otherwise. Productivity can surge while job growth stalls.This week’s Chart shows just such an example: strong real GDP growth alongside weakening payroll gains deep into an expansion.

This divergence isn’t a bug. It’s a feature of technological change.

Technology Moves Fast. Labor Markets Move Slowly.

Major technological shifts, from electrification to the internet to today’s AI buildout, follow a familiar pattern. Productivity improves first. Employment adjusts later.

Why? Because capital moves faster than human skills evolve.

A firm can deploy AI copilots, automation software, or robotics in months. Retraining a workforce takes years. Educational pipelines, credentialing systems, and social expectations are slow-moving institutions. The result is a temporal mismatch: output rises while labor growth lags.

We saw versions of this in the early 2000s productivity boom, and again in the post-Global Financial Crisis recovery, when GDP rebounded faster than employment. What feels different today is the speed and scope. AI doesn’t just automate routine tasks, it compresses the skill curve across knowledge work, from coding to legal research to marketing.

In other words, we are not just automating labor. We are redefining what it means to be skilled.

The Jobless Boom as a Transitional Phase

The phrase “jobless boom” sounds a bit dystopian, but I think it describes a transitional phase rather than a permanent condition.

When productivity surges, firms initially produce more with the same or fewer workers. Margins expand. Output rises. Earnings growth accelerates.

But over time, new industries emerge. Entire job categories, unimaginable at the outset, begin to absorb displaced or sidelined labor. The lag can span years or even decades. The automobile eliminated blacksmith jobs but created mechanics, highway engineers, and logistics networks. The internet destroyed travel agencies but birthed digital marketing and e-commerce ecosystems.

The key variable is timing.

Investors who misread this lag risk extrapolating short-term labor weakness into long-term economic pessimism, or conversely, assuming that productivity gains will immediately translate into wage growth and consumption strength.

Neither happens on schedule.

AI and the Collapse of Barriers to Entry

I also think there is an underappreciated second-order effect at work here: AI may lower barriers to entrepreneurship faster than it displaces jobs.

Historically, starting a business required capital, specialized labor, and operational infrastructure. Today, AI tools can function as a fractional workforce, handling coding, design, customer service, marketing copy, and financial modeling.

A single founder can now operate with leverage that once required a team of ten.

This shift matters. If displaced workers can redeploy themselves as entrepreneurs, enabled by AI, the employment recovery may not come from traditional payrolls but from a proliferation of small, highly productive firms.

Think fewer employees per firm, but more firms overall.

Investment Implications: Watching the Lag

For investors, I think the main takeaways are:

Productivity booms do not immediately translate into job growth.

Labor-market weakness during technological transitions may mask underlying economic strength.

The future of work may skew toward AI-enabled entrepreneurship rather than traditional employment recovery.

Timing is everything—not just in markets, but in how innovation diffuses through society.

And if history rhymes, the current “jobless boom” may prove less a warning sign than a waypoint on the path to a more productive and more decentralized economic future.

🚙 Interesting Drive-By's 🚙

🎯 The Lobster Revolution: Why 24/7 AI Agents Just Changed Everything

💡 Bayes and Base Rates: How History Can Guide Our Assessment of the Future

🤓 R.I.P. chatbot era (2023 – 2025)

📈 Software Not a Macro Problem

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.