The Sunday Drive - 02/16/2025 Edition [#150]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends!

I hope that the combination of Valentine’s Day on Friday and President’s Day on Monday makes for an extra long weekend of enjoying time with someone you love and who loves you. ❤️

Let's enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

In keeping with the spirit of this Valentine’s weekend, I’m vibin’ to Bob Marley’s 1978 classic, Is This Love. Enjoy…

💭 Quote of the Week

“A bell is no bell 'til you ring it, a song is no song 'til you sing it. And love in your heart wasn’t put there to stay. Love isn’t love 'til you give it away.“

— Oscar Hammerstein II from "Sound of Music"

📈 Chart of the Week

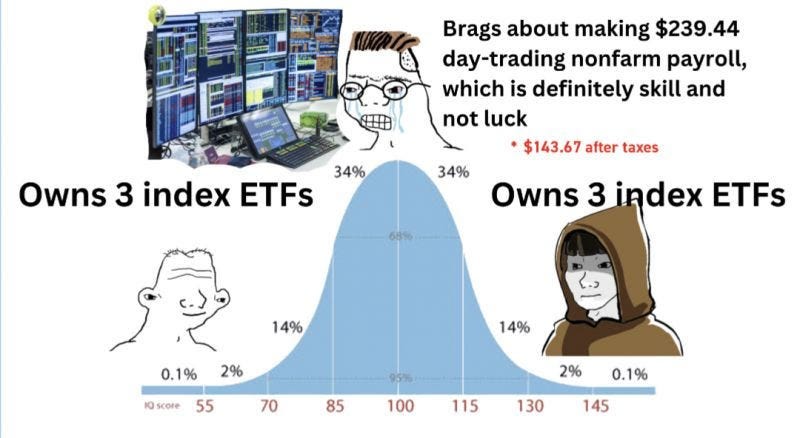

Why Time in the Market Beats Timing the Market

Investing in the stock market can be an emotional rollercoaster, but history consistently rewards those who remain patient. This week’s Chart, illustrating the S&P 500’s total return from 1928 to 2024, underscores a fundamental truth: the longer you stay invested, the greater your probability of success.

At any given moment, market movements are unpredictable. A one-day holding period has nearly the same odds as a coin flip—just 53% of days end in positive territory. Stretch that to a month, and the probability rises to 62%. But the real magic happens over longer time frames. Hold for a decade, and history shows a 94% chance of positive returns. Extend to 20 or 30 years? The market has never produced a negative return over those periods.

This is why market timing is a fool’s errand. Trying to predict short-term swings is not just difficult—it’s costly. Investors who sell in fear often miss the market’s best days, which disproportionately drive long-term gains. Instead of obsessing over when to buy or sell, the data supports a different approach: staying invested and letting time do the heavy lifting.

A long-term investment horizon offers two key advantages. First, it allows the power of compounding to work in your favor, exponentially growing wealth over decades. Second, it smooths out volatility—short-term market noise becomes irrelevant when viewed through the lens of a 20- or 30-year time frame.

The lesson? The stock market rewards patience, and history is clear—those who stay the course have a much better of achieving their investment objectives.

🚙 Interesting Drive-By's

📈 How to Invest as the Global Population Ages

💡 The Longevity Paradox: Living for the Future Without Losing the Present

⏱️ A Short Explanation of the Four Turnings

👀 The Strategic Genius of Taylor Swift

🤔 The Intimate World and the Remote World

👋🏼 Parting Thought

H/t to my friend, Brent Sullivan:

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.

Hey! I recognize that meme!