The Sunday Drive - 02/15/2026 Edition [#202]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a Sunday Drive around the internet.

🎶 Vibin'

As we all know, yesterday was Valentine’s Day. ❤️ So, I’m vibin’ to a collaboration between Ed Sheeran and Taylor Swift - Happy Valentine.

Only it’s not…

Ready for the plot twist? The whole thing - the song, the video, all of it - was generated by AI.

It’s absolutely amazing to me how quickly things are moving in the world of creative content creation. There are those who are afraid of it, but I am not one of them. I choose to embrace it and imagine how beautiful the creative works of the future will be given the tools that are rapidly becoming available to creators. Enjoy.

💭 Quote of the Week

“The best motivator in life is having a few people you really don’t want to disappoint.“

— Morgan Housel

📈 Chart of the Week

Navigating Markets Through the Lens of Dunning–Kruger

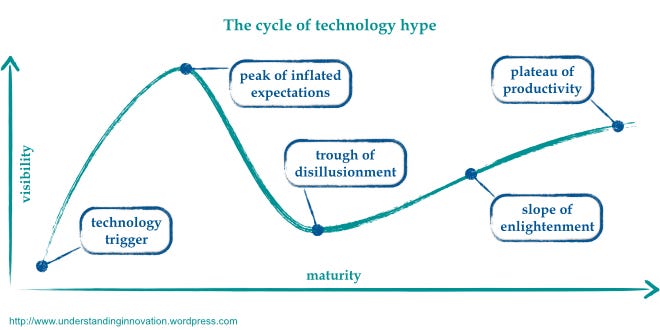

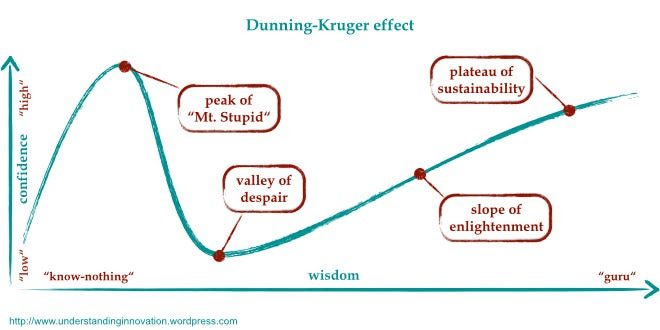

The first Chart above shows a graphical version of Gartner’s Technology Hype Cycle that is very familiar to many investors. Interestingly, it is quite similar to the Dunning-Kruger effect shown in the second Chart.

In a world of AI-driven angst and optimism, retail investor-driven meme stocks, concentrated stock indexes, and fiscal and monetary policy uncertainty, I think it’s worth considering how investors ought to be thinking about the navigational challenges of the current environment.

The Behavioral Cycle Behind Market Cycles

The Dunning–Kruger effect describes a cognitive bias in which individuals with limited knowledge overestimate their competence, while true expertise often brings humility. Markets can exhibit the same arc:

Technology Trigger / “Know-Nothing” Phase → A new theme emerges (AI, crypto, EVs). Early adopters understand the nuance; the crowd does not.

Peak of Inflated Expectations / “Mt. Stupid” → Prices detach from fundamentals as narrative overwhelms analysis.

Trough of Disillusionment / Valley of Despair → Reality intervenes. Capital is destroyed. Weak hands exit.

Slope of Enlightenment → Survivors refine business models; investors regain discipline.

Plateau of Productivity / Sustainability → Cash flows validate the theme; long-term winners compound.

If you think about it, this is really less a technology cycle than a human behavior cycle.

Using Dunning–Kruger as an Investing Construct

Most investors try to identify what will win. But I think a more durable edge can come from understanding where we are on the curve.

1. Avoid buying confidence; buy competence.

The best opportunities often emerge when confidence collapses but underlying adoption continues. Think Amazon post-2000 or cloud software in 2009–2012. Today’s analogs may exist within AI infrastructure, industrial automation, or energy systems supporting data centers.

2. Narrative intensity is a contrary indicator.

When taxi drivers, TikTok influencers, and your dentist are day-trading the same theme, you are likely near the peak. Elevated retail participation and options activity often signal late-cycle speculation rather than early-cycle discovery.

3. The valley is where institutions are built.

Capital scarcity forces discipline. Companies shift from “growth at any cost” to unit economics and free cash flow. This is where durable compounders are born.

4. Expertise requires surviving the valley.

Investors who endure drawdowns without abandoning their original thesis develop the pattern recognition that separates process from outcome.

A Practical Framework for Today

I think that we may be oscillating between the peak and early disillusionment in parts of the AI ecosystem, particularly in application layers, while infrastructure and power generation may be earlier in the slope of enlightenment. However, it does seem as though semiconductors may still be at or near the peak of expectations.

Rather than attempting to time changes in market sentiment, investors might consider:

Scaling into positions during narrative fatigue

Favoring balance sheets over storytelling

Tracking adoption metrics instead of price momentum

Separating enabling infrastructure from end-user hype

Final Thought

Markets don’t simply price cash flows, they also price confidence. The Dunning–Kruger lens reminds us that the greatest risk is not ignorance, but the illusion of understanding. Investors who recognize where confidence diverges from competence can potentially create a structural investing edge.

🚙 Interesting Drive-By's 🚙

💯 Buying Futures, Renting the Past: How Speculation and Nostalgia Became the Economy

🤔 What the Team Behind Cursor Knows About the Future of Code

💰 Anthropic’s Historic $30bn Funding Round

👋🏼 Parting Thought

A (half) joking comment on the challenges facing Gen Z…

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.