The Sunday Drive - 02/12/2023 Edition

👋🏻 Hello friends,

Let's take it easy and enjoy our leisurely Sunday Drive around the internet.

Vibin'

In honor of Valentine’s Day ❤️ coming up this week, I’m kinda feeling an upbeat love song for the Vibe of the Week.

From his second post-Police era solo album Nothing Like the Sun, please enjoy Sting’s We’ll Be Together from 1987.

💡 Quote of the Week

“It’s good to have people in your life who you don’t want to disappoint.“ - Warren Buffett

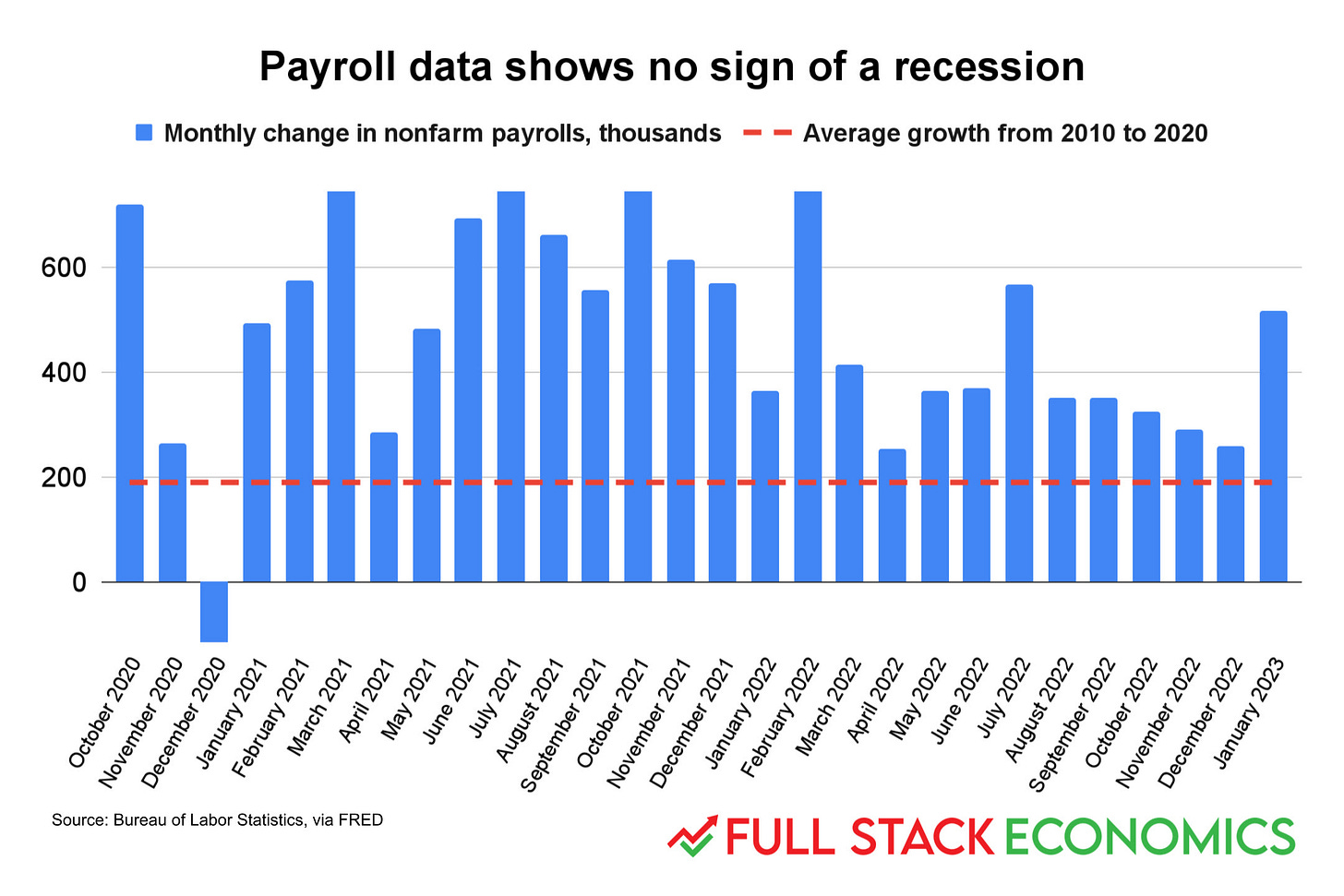

📈 Chart of the Week

One more bit of evidence of a structural change in the labor market. I’ve been harping on this for quite some time, but Fed Chairman Powell mentioned it during an interview this past week as well.

Interesting Drive-By's

🤔 The Four Horsemen of the Tech Recession - It really was jarring to see such strong employment figures (see the above Chart of the Week) the same week that tech company after tech company reported mostly disappointing earnings, and worse forecasts, all on the heels of layoffs. That’s not to say that tech is an echo chamber: all tech companies are facing unique headwinds that don’t affect most of the economy; let’s call them the four horsemen of the tech recession.

💡 Innovators Who Immigrate - Successfully immigrating is (usually) a matter of choice, selection, and luck. For the purposes of investigating the impact of immigration on innovation, that means we can’t simply compare immigrants to non-immigrants.

🧐 Longevity Risk is the Biggest Threat to a Successful Retirement - Research tells us that the biggest risk to a retirement plan is longevity: the danger of exhausting resources before the end of life. And it is the least understood by people planning for retirement. Longevity risk is rising, along with lifespans, and the income products available to hedge the risk are inadequate. Fewer retirees have the guaranteed lifetime income protection of a defined benefit pension, and mapping out safe withdrawal rates from portfolios presents thorny problems.

💸 One Trick Ponies - When you make a very significant amount of money through a very specific opportunity in a very short amount of time, you begin to look for that same opportunity everywhere.

If you made billions shorting the imminent collapse of the housing market, you’ll begin to see “imminent” collapses everywhere, from European debt crises to Asian central banks. If your bet on disruptive innovation returned 200% in 2020, you won’t think, “Oh man, these stocks are overvalued now. Let’s change it up.” You’ll think, “I was right. Let’s find some more disruptors.”

📈 Re-shoring Supply Chains: What Does It Mean for Investors? - Of all the lessons learned during the pandemic — wash your hands thoroughly, avoid crowded elevators, working from home can be productive — perhaps the most consequential lesson for companies is now obvious in hindsight: Relying on single links in the global supply chain was a mistake.

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em at me.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.