The Sunday Drive - 02/11/2024 Edition [#97]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Let's enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

This week, we lost singer/songwriter Toby Keith at the age of 62, having battled stomach cancer for two years. He left behind his wife of 40 years and three adult children.

What many people don’t know about Toby was that he discovered a then 15-year old Taylor Swift and signed her to his record label, bringing another gifted artist into the spotlight.

So this week, I’m vibin’ to his first hit single from his self titled 1993 debut album, Should’ve Been a Cowboy. RIP, Toby.

💭 Quote of the Week

“Touch the grass.

Don’t photograph your hand touching the grass and then post it.

Don’t write about touching the grass and belittle those who (you believe) touch less grass than you.

Just touch the grass.”

– Thomas J. Bevan

📈 Charts of the Week

The S&P 500 crossed the 5000 mark this week. If history is any guide, when milestones like this are surpassed, stock market returns in the months following are generally pretty strong. So we might have that to look forward to.

But….

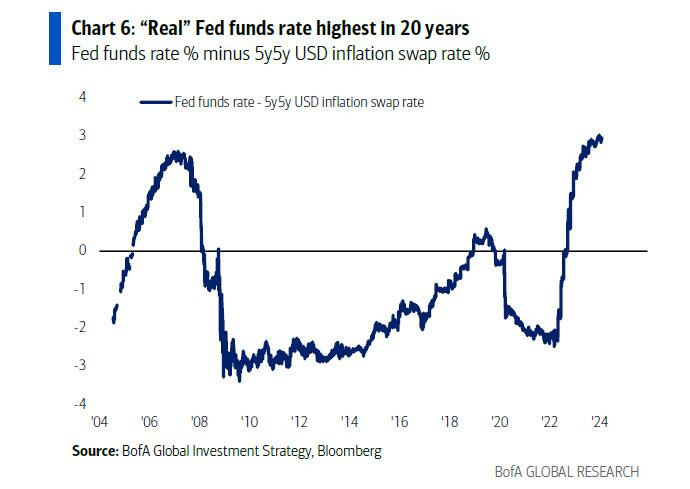

Inflation has come down but short term interest rates have not…yet.

My view is that rates must come down, or something in the financial system will eventually break. Banks? Private credit? Commercial real estate? 🤷🏼♂️

🚙 Interesting Drive-By's

This week we have articles on demographics, AI, remote work, and prosperity :

🤔 Humanity’s Great Fight for the Future: Demographics vs. AI - from James Pethokoukis

The year 2040 sounds, at least to my ears, like a time in the distant future. Just think about the science fiction that takes place around then:

I, Robot (2035)

The Martian (2035)

Looper (2044)

Ready Player One (2044)

Event Horizon (2047)

Blade Runner 2049 (2049)

Of course, 2040 really isn’t that far away. I mean, 16 years in the past only brings us back to 2008. To me, the Global Financial Crisis and Great Recession still seem pretty fresh.

Still, a lot can happen in a decade and half. And while that’s always true, it may be especially true now, given the factors highlighted in the analysis “Megatrends and the U.S. economy, 1890-2040” by two researchers from investment giant Vanguard, Joseph H. Davis, the company’s global chief economist, and investment strategist Lukas Brandl-Cheng. [link]

💡 The End of Economic Growth? Unintended Consequences of a Declining Population - from Charles I. Jones

In many models, economic growth is driven by people discovering new ideas. These models typically assume either a constant or growing population. However, in high income countries today, fertility is already below its replacement rate: women are having fewer than two children on average. It is a distinct possibility that global population will decline rather than stabilize in the long run. In standard models, this has profound implications: rather than continued exponential growth, living standards stagnate for a population that vanishes. Moreover, even the optimal allocation can get trapped in this outcome if there are delays in implementing optimal policy. [link]

💰 Remote Work Won - from Adam Singer

Bad managers and CRE bagholders lost, competent employees and internet-savvy teams won ...arbitrary authoritarian control over your work-life is so 1900s.

I previously wrote what is still going to be my final post on remote work, at least the work part. In it, I went through the reasons why competent teams will be distributed for bits work, today and into the future (for atoms work we still need a human presence — for now). I’ve nothing really to add to that part of the conversation, remote work isn’t even new, people have been doing it since the 90s.

But in the time since I wrote the above post, remote work won and became a normal part of life for a large cohort of the population. This will only continue to grow, and so I wanted to comment a bit more on the topic as some are still strangely in denial. [link]

😊 An oldie, but a goodie from Louis CK, who reminds us that things aren’t really all that bad…

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.