The Sunday Drive - 01/25/2026 Edition [#199]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a Sunday Drive around the internet.

🎶 Vibin'

With the renewed tariff chatter this past week, Greenland for sale(?), and all the other chaotic banter in Davos, navigating the markets seems to have gotten very… tricky.

So this week, I’m vibin’ to Run DMC’s 1986 classic, It’s Tricky and reminiscing about the days when rap was still fun.

💭 Quote of the Week

“Micro is what we do, macro is what we put up with.“

— Charlie Munger

📈 Chart of the Week

A “Normal” Japan and the Unwinding of the Carry Trade

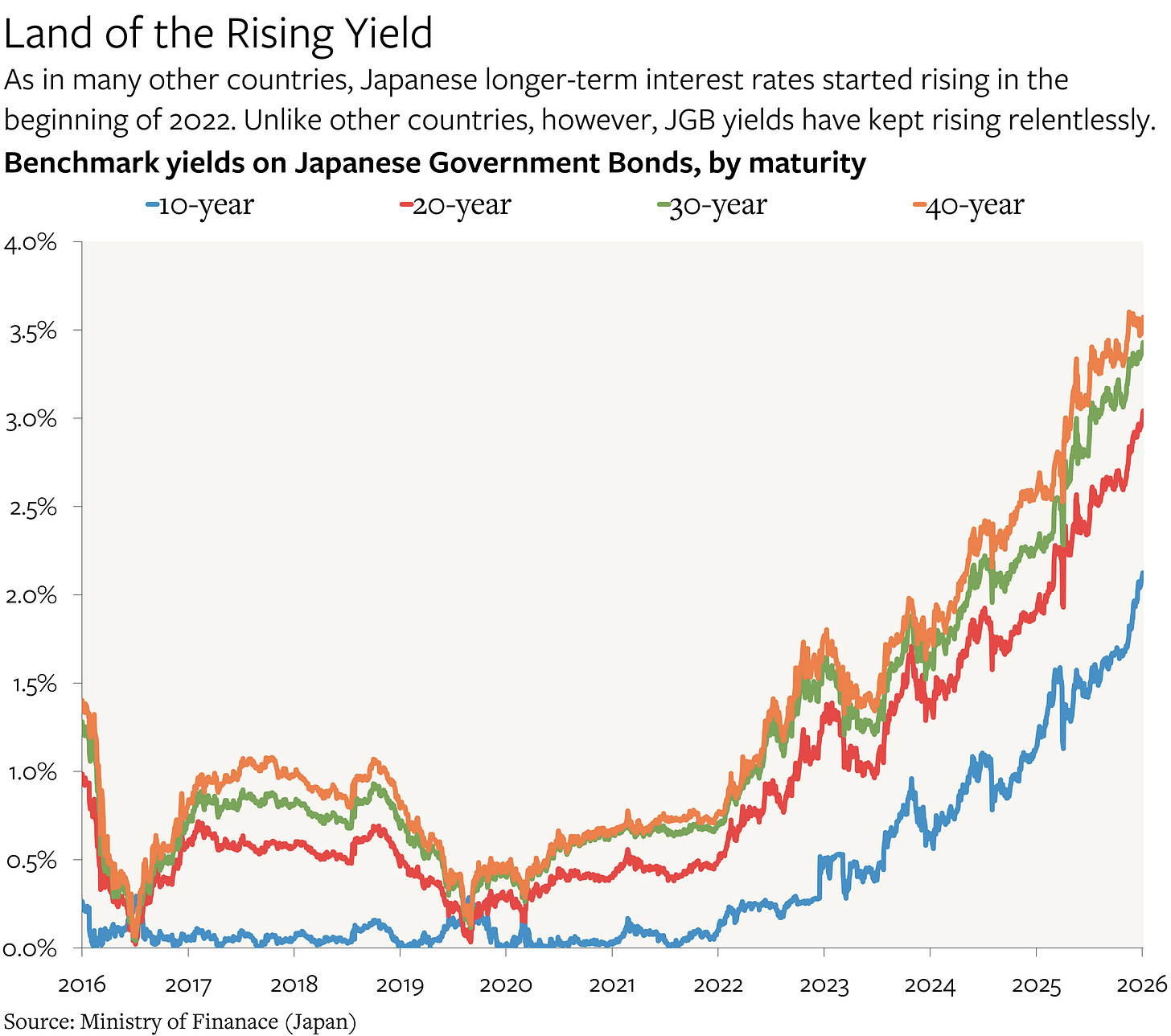

This week’s Chart shows that following the global inflation scare of 2021-22, long term interest rates in Japan have continued to rise, but unlike in other countries, at an accelerating pace.

Some say this is due to Japan’s reemergence as a “normal” economy which is being framed as a curiosity: an end to deflation, a long-overdue policy shift, a local story.

That framing misses the point. I believe that’s really happening is the dismantling of a 30-year global funding regime, i.e. the so-called carry trade, and that should matter deeply to anyone managing portfolios for investors approaching or already in retirement.

Carry Me…

For decades, Japan’s zero-rate policy quietly subsidized global risk-taking. The yen wasn’t just a currency. Yen-based debt was capital: cheap, abundant, and reliably available. That mattered because it helped suppress volatility, compress yields, and mitigate drawdowns, conditions that retirement portfolios came to implicitly rely on.

To see why, let’s consider how the yen carry trade has historically worked.

One version was conservative but massive in scale: borrow yen at near-zero rates, hedge the currency, and buy higher-yielding U.S. Treasuries or investment-grade credit. Japanese institutions did this relentlessly. The result? Persistent demand for global bonds and downward pressure on yields.

Another version was more aggressive: borrow yen, don’t hedge the currency, and deploy the capital into equities, high yield bonds, emerging markets, or, more recently, tech stocks and crypto. As long as the yen stayed weak and volatility stayed low, leverage paid off. And for years, it did.

That trade is now starting to break down.

Japan’s policy rate is near 0.75%, long-term yields are rising as the Chart shows, and global rate differentials are narrowing just as U.S. and European central banks approach the downshift phase of their cycles.

Deleveraging By Another Name

The carry is evaporating. When carry disappears, leverage doesn’t gently fade—it unwinds.

This matters for retirement portfolios because many of the assumptions embedded in “balanced” allocations were built in a world where:

Volatility was structurally suppressed

Global liquidity flowed one way

Drawdowns were shorter and recoveries faster

Those assumptions are fragile in a post-carry-trade world.

As yen-funded leverage retreats, three risks rise simultaneously:

Higher volatility

Carry trades dampen volatility on the way in and amplify it on the way out.

Correlation creep

When leverage unwinds, diversification often fails at the worst possible time. Assets that looked uncorrelated suddenly move together.

Valuation compression

Many assets, especially equities, benefited from a global discount rate artificially lowered by carry flows. Remove the subsidy, and multiples could come under pressure.

Think Different(ly)

This doesn’t mean markets will collapse. It means the tailwinds quietly supporting traditional portfolios could be weaker, while left-tail risks could become stronger.

For retirement-oriented investors, the takeaway isn’t tactical, it’s structural.

Risk management can’t continue to rely on backward-looking volatility measures or static 60/40 logic. It has to acknowledge that a major shock absorber in the global system is being removed.

Japan being “normal” again is not a footnote. It’s a reminder that regimes change, and retirement portfolios built for the last one will need protection for the next.

Sources: RSM US, LLP; World Economic Forum, Financial Times, The Overshoot

🚙 Interesting Drive-By's 🚙

💯 The American Dream Needs a Factory Reset

💣 BOOM: Congress Imposes Public Utility Rules on UnitedHealth, CVS, and Cigna

🥩 Mark Hyman: At Last, the Truth About Food

🇺🇸 America’s 250th Isn’t Just a Birthday

🤔 Yes, We’re Growing Old, But We’re Also Growing Whole

💰 The Great Bifurcation: How a Broken Labor Market and Seven Companies Became the American Economy

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.