The Sunday Drive - 01/11/2026 Edition [#197]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a Sunday Drive around the internet.

🎶 Vibin'

Despite burgeoning pockets of softness in the labor market and emerging signs of consumer weakness in household debt metrics, somehow the economy keeps on trucking along, with no recession apparently in sighteven . In fact, there is some evidence that shows that GDP growth might accelerate over the course of 2026.

So with that in mind, this week I’m vibin’ to the Grateful Dead and their classic, Truckin’. Enjoy.

💭 Quote of the Week

“A hungry stomach, an empty wallet, and a broken heart can teach you the best lessons in life.“

— Robin Williams

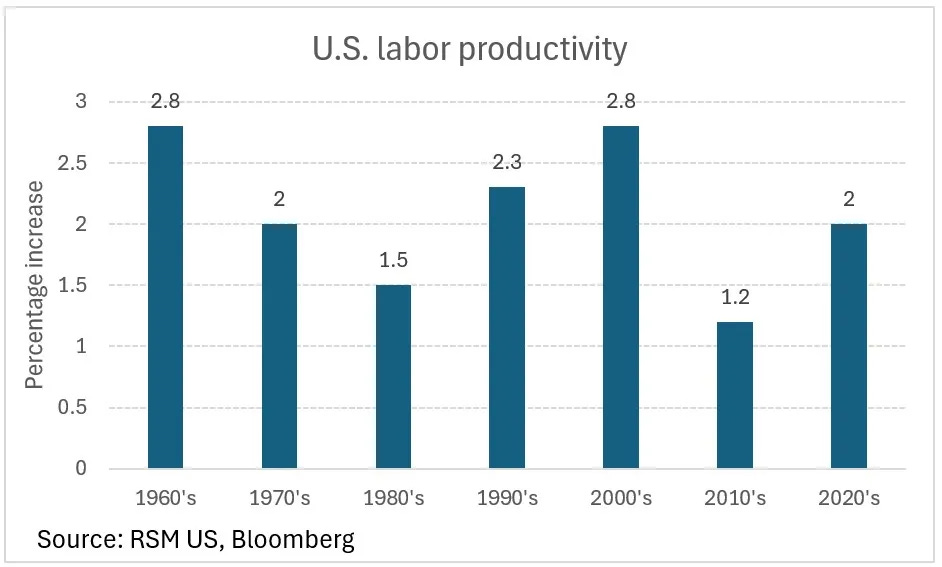

📈 Chart of the Week

Thoughts on Productivity-Led Economic Growth

This week’s Chart shows a marked upturn in productivity in the first half of this decade as compared to the last.

While still below the levels of the mid-1990s to mid-2000s during the height of the internet-driven “New Economy”, I believe that productivity is poised to go even higher from current levels, perhaps reaching or exceeding prior levels. Many would agree that we are in the early days of an AI-driven “Next New Economy” with much progress to come.

I’ve been thinking and reading a lot about the reasons why productivity has increased so much this early into the current innovation cycle. What will be the impacts on demand growth, interest rate policy, inflation, and the like? Recently, I ran across an interesting term related to these questions and I thought it was worth discussing.

The “Tenure Dividend”

In recent labor market commentary, “tenure dividend” refers to a productivity boost that firms are experiencing because their current workforce has above-average tenure, meaning fewer new hires and quits, and a larger share of employees who are already fully onboarded and have experience and familiarity with the firm’s operations. This dynamic can mechanically raise output per hour worked because experienced workers are more productive relative to new hires who need weeks or months to ramp up.

Why Is It Showing Up Now?

Several related labor market trends are creating conditions for a tenure dividend:

Hiring and quit rates have trended down. Businesses are reducing headcount more through attrition than layoffs, and have shown a hesitancy to hire younger workers. That leaves a workforce skewed toward longer-tenured employees.

Reduced onboarding costs. Firms aren’t needing to spend as much on training and ramping up new workers, a non-trivial drag on productivity in normal times. Some reports suggest that new hires take ~6 months to reach full productivity, with some taking up to 12–18 months. With fewer new starts, average productivity per hour worked is elevated.

Composite labor quality increases. Experienced workers know firm-specific processes, internal tools, and corporate cultural norms that reduce friction and accelerate problem-solving relative to new hires. This contributes to an experienced workforce effect that elevates output measures relative to total hours worked.

This is essentially short-run efficiency gain from composition and scale: even if hiring is weak and total employment growth is slow, the composition of employment, more seasoned workers and fewer novices, can temporarily lift productivity metrics without a broader cyclical rebound.

Is Too Much Of a Good Thing a Bad Thing?

Not always positive for innovation or long-run productivity. Some research suggests that very long tenure can correlate with reduced innovation or slower organizational change, especially if labor markets are rigid and mobility is low. This could offset or reverse the tenure dividend over time.

Measured productivity doesn’t always reflect broader quality gains. The tenure dividend is primarily about measured output per hour worked. It doesn’t necessarily signal fundamental improvements in growth capacity, investment, or human-capital accumulation. It’s partly a statistical/composition effect.

Tenure overall is not rising steadily. Longer average employer tenure isn’t universal; U.S. median tenure is still relatively low by historical standards (~3.9 years in early 2024), though older cohorts show much higher tenure.

What Does This Mean For Investors?

Short-term productivity bump: Firms may report higher measured productivity (e.g., output per hour, unit labor costs) even in a sluggish macro environment, simply because the workforce has fewer novices and fewer separations.

Signal for cost containment: Low hiring and quitting often accompany broader caution on demand; the tenure dividend can thus be a cost-efficiency artifact rather than a demand-driven productivity boom.

Caveat on innovation and adaptability: While experienced workers reduce training costs and friction, over-reliance on long tenure could dampen fresh ideas and adaptability, potentially weighing on long-run competitive dynamics.

The tenure dividend may help firms sustain earnings growth and profit margins, even in a sluggish demand environment. However, I don’t believe it will be a long term driver of investment returns by itself. We’ll also need demand-led growth for markets to be sustained.

🚙 Interesting Drive-By's 🚙

🤔 What Couples Need To Know About Retirement

📈 Why Advisors Are Increasing ETF Allocations

💯 The Most Underrated Trend of the 2020s

💡 The Great Repricing of Risk - Across Rates, Credit, AI, and Crypto

🩺 Your AI Doctor Will See You Now

👋🏼 Parting Thought

Flashback to middle school, when we were taught some pretty valuable lessons…

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.