The Sunday Drive - 01/07/2024 Edition [#92]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends,

Greetings from Saratoga Springs, NY! Welcome to 2024. Is it just me, or does if feel like this year will be more consequential for all of us than perhaps any year in our memory?

Let's kick off the new year by enjoying a leisurely Sunday Drive around the internet.

The Sunday Drive is also published at NewLanternCapital.com.

🎶 Vibin'

Long time readers of the Sunday Drive know that I’m a sucker for mashup videos. I have vibed to a number of them with you over time.

For one, they’re fun to watch.

But to me, the more impactful aspect of mashups is the additive nature of the creative process. It starts with the films from which the clips are drawn. All are complete creative endeavors on their own. Add to that a great song as the backdrop, also created by talented individuals. Lastly, we see the artistry of arranging those film clips to the music in a way that is derivative, yet still original. These types of videos are a kind of metaphor, reminding us of how most everything we do in our professional lives is built on the work of those who came before us.

This week I’m vibin’ to this movie mashup set to the Bayside Boys remix of the Los Del Rio song Macarena. I apologize in advance if you’re unable to get this song out of your head for the next week. 😉

💭 Quote of the Week

“No matter what you tell the world or tell yourself, your actions reveal your real values. Your actions show you what you actually want.”

– Derek Sivers

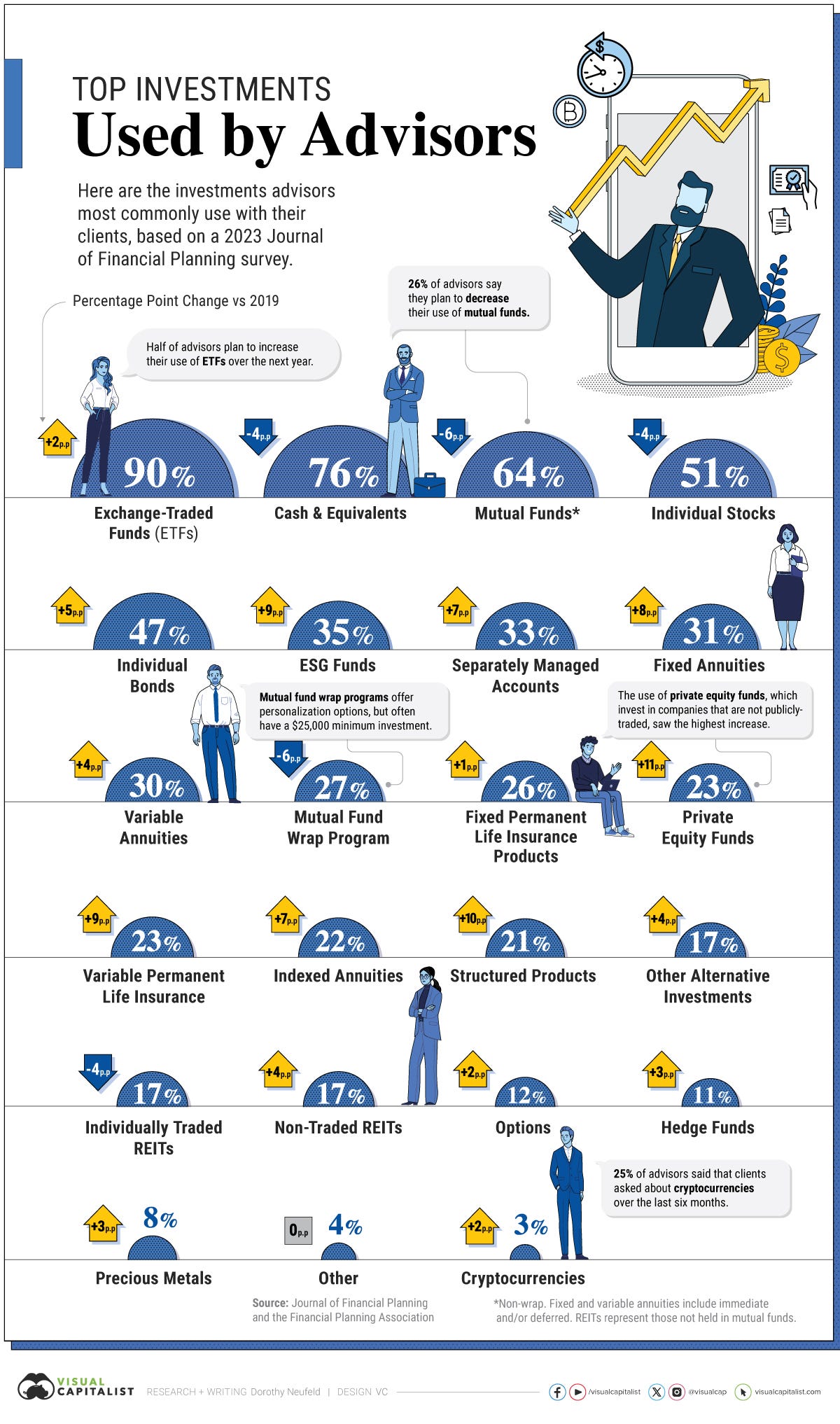

📈 Chart of the Week

This week’s Chart shows a breakdown of various investment vehicles used by Investment Advisors and how their use has changed over the last several years. I found it pretty fascinating.

In looking at the levels and changes in usage of the different products, one pattern jumped out at me. Taken together, there seems to be a significant trend toward using more illiquid and opaque products in client portfolios, from private and/or alternative strategies to a number of insurance, or insurance-based product types.

Why does this seem be the case?

A cynic might say that perhaps it’s because the nature of many of these products doesn’t easily translate to an AUM (“Assets Under Management”) based fee structure, allowing the advisor to charge their clients higher fees that are difficult to compare to industry norms.

While I don’t completely discount that argument, at least in a some cases, I think there could be a more client-focused way of thinking about it. Perhaps it’s because clients benefit from higher returns via an illiquidity premium and non-traditional strategies. Perhaps structured investment vehicles allow for a more customized, solution-based approach to achieving desired client outcomes. This allows the advisor to serve their clients in a way that adds more value to their lives - financially, psychologically, and emotionally.

🚙 Interesting Drive-By's

This week we have articles on life lessons, unretirement, taking action, intellectual property, and 2024 predictions:

🤔 Byron Wien’s 20 Life Lessons - from Blackstone

I was scheduled to speak about the world outlook at an investment conference in 2012, and shortly before my time slot, the conference organizer said the audience was more interested in what I had learned over the course of my career than what I had to say about the market. I jotted a few notes down and later expanded and edited what I said that day. Others have since encouraged me to share my thoughts with a broader audience. In the decade since, I have come back to them time and again to test their resonance and staying power, and find them still broadly applicable.

Here are some of the lessons I learned in my first 80 years, which I continue to practice as I enter my 90’s… [link]

💡 2024: The Year “Unretirement” Goes Mainstream - from Brian Clark

We saw important developments in the longevity economy last year, most notably the launch of Longevity Gains. 😉

But even I was surprised by the acceleration in mainstream coverage about issues related to older people, our aging population, and the power of 50+ consumers. This year looks to raise awareness up another significant notch, if early indications hold.

This may be the year everything breaks wide open. That means everyone starts chasing “the next big thing,” which in this case will continue for decades if not become a permanent reordering of the world economy.

That means your primary new year’s resolution should be to start a business focusing on older consumers, or pivot some (or all) of your marketing strategy toward the 50+ market. We’re clearly past the “it’s too early” phase and are now on the cusp of the longevity economy going mainstream.

To that point, the top predicted trends for 2024 were assembled and published by LinkedIn. The top two prognostications are aimed squarely at our subject matter here at Longevity Gains, and that alone will help change perceptions. Plus, the unretirement trend that’s been on slow boil for a decade is becoming mainstream. [link]

📈 Now or Never: Why Your Next Action is Everything - from Ed Williams

Your next action is all you have.

The future isn’t real - it’s speculative fiction.

The past is done, extinct, kaput.

Your only real touchpoint with the universe lies in the actions you take *right now.*

It’s counterintuitive, isn’t it? We get so caught up in our futures and our pasts. What we should have done. Where we want to be. Where we aim to go. We forget that this is all a mirage, a hazy, amorphous wisp of smoke that dissipates around our hands the moment we try to grasp it. [link]

🤓 The Mouse is Free: Steamboat Willie and Intellectual Property - from Peter Jacobson

You’ve likely already seen him freely used across the Internet over the last two days. As of 2024, Steamboat Willie, the cartoon which introduced Mickey Mouse, entered the public domain.

This means that Steamboat Willie and its depictions of Mickey Mouse is fair game for any usage (I’d guess Disney likely will still try to be protective of modern renditions of Mickey). You can make and sell your own Steamboat-era Mickey shirts. You could produce your own Steamboat Willie shorts on TikTok. You could even release Steamboat Willie horror video games and movies (personally I recommend the title Steamboat Willies).

How did this happen? It may be hard to believe it in our regime of universal intellectual property (IP), but artistic works like drawings, art, and songs are all on the path to becoming public domain as soon as they are copyrighted.

It would be nice if I could give a simple rule explaining how many years it is before works join the public domain, but it isn’t that easy. Depending on the year the work was created and the status of authorship, the rules change. [link]

🔮 What Will Happen in 2024 - from avc.eth

As we enter 2024, the capital markets have found their footing and are moving higher. The Fed has taken interest rates as far as they want at this time and inflation has come down. It seems that a “soft landing” is likely. That is good news for the innovation economy because healthy capital markets are a necessary support system.

However, optimistic capital markets are necessary but not sufficient for a healthy innovation economy. We also need innovation. The good news is we have a lot of that and more is coming in 2024. I have never seen an environment with more innovation in the forty years I have been in the tech sector. It is breathtaking to see. [link]

👋🏼 Parting Thought

It’s 2024…

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.