The Sunday Drive - 01/18/2026 Edition [#198]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a Sunday Drive around the internet.

🎶 Vibin'

I’ll bet you didn’t know that Elvis Presley wasn’t the first artist to record the classic Hound Dog. No, that honor belongs to Willie Mae “Big Mama” Thornton, who was (finally!) inducted into the Rock and Roll Hall of Fame in 2024.

This week I’m vibin’ to her 1953 OG version of the hit song made even more famous by Elvis three years later. Enjoy.

💭 Quote of the Week

📈 Charts of the Week

Performance, Construction and Diversification

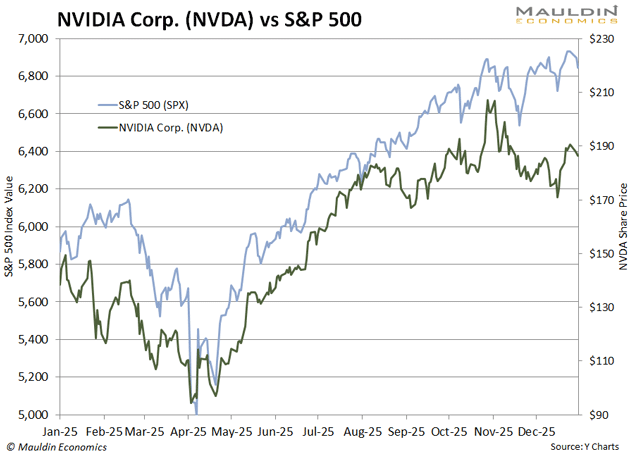

You’ve probably seen headlines crowning NVIDIA as the unstoppable force powering the stock market in 2025. It was the largest contributor to the S&P 500 Index’s total return last year, a title it earned not by being the best performer, but by performing reasonably well and being the biggest company in the index. That’s the message of the first Chart this week.

Here’s the nuance that most financial media coverage misses: NVIDIA wasn’t even in the top decile of 2025’s S&P 500 constituents (Source: YCharts). 74 S&P 500 stocks outperformed NVIDIA last year. Yet because of its gargantuan index weight, the stock still ranked #1 in contribution to index performance, a reminder that size can trump performance in a market-cap weighted index.

Let that sink in: 74 stocks beat NVIDIA in total return, but the stock carried the market more than any other stock because it’s nearly 8% of the index all by itself.

Broken Concentration

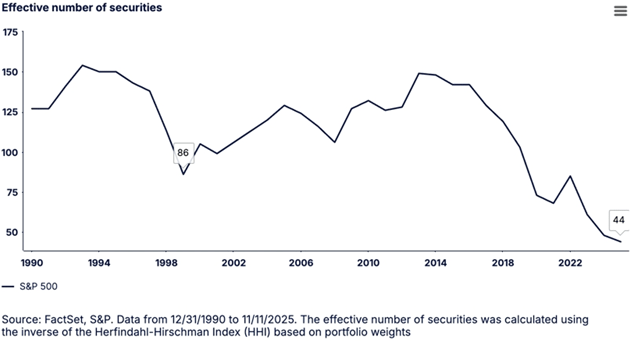

While we picked on NVIDIA, highlighting it as an example of the impact one stock can have on S&P 500 performance, the second Chart this week shows just how concentrated the index has become.

When most investors invest in the S&P 500, they believe they’re buying a diversified basket of 500 companies. The reality is much narrower.

The top 10 stocks now command around 40% of the index’s market cap, a level never before seen.

More strikingly, only about 44 names are driving the index’s returns, the lowest effective number of contributors in roughly 35 years.

Having a handful of mega-caps rowing the boat is not very effective diversification, in my opinion.

This dynamic explains why the S&P 500 can climb even when most of its constituents aren’t breaking new ground. Passive flows reinforcing the largest weights, combined with the sheer scale of tech earnings and buybacks, create a feedback loop that elevates a few names to de facto market leadership.

Mag Seven Reality Check

The so-called Magnificent Seven: Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and NVIDIA dominate the market narrative. But even here, performance is mixed: only two of the Mag Seven outperformed the S&P 500 in 2025, reminding us that sheer size and media messaging don’t always align with performance outcomes.

So How Does This Resolve Itself?

What feels like 500 stocks can behave like 40 — or fewer. In markets where concentrated leadership can both elevate and destabilize, understanding the mechanics behind why the index moves matters just as much as what moves it.

It seems to me that this concentration situation can resolve itself in one of two ways:

Mean Reversion: The mega-caps underperform significantly, taking the overall market down with them and passive flows reverse, which would exacerbate equity declines.

Leadership Broadens: The mega-caps underperform, but not by so much that they tank the market, allowing everything else time to catch up, likely outperforming significantly and passive flows continue to support equities.

If the goal is more effective diversification, investors should shift to broader exposure to other indices, geographies and asset classes.

🚙 Interesting Drive-By's 🚙

📈 Concentrated Risk = Generational Wealth?

💯 Humanoid Robots Arrive Just As Humans Stop Showing Up

💡 Location Independence Is the New 401(k)

🤔 The Apprenticeship Severance: AI Eliminated Entry-Level Jobs and Nobody Saw It Happening

💰 From Capital Gains to Dividend Income

👋🏼 Parting Thought

Diversification…

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.

Brilliant breakdown on the cap-weighted paradox! The stat about 74 stocks beating NVIDIA yet it still drives the most return really exposes the illusion of diversificaton in modern index investing. I've seen too many investors assume they're well-protected just beacuse they hold 'the whole S&P', when in reality they're loaded up on 40-ish names. The feedback loop from passive flows is kinda scary since it just keeps inflating the megacaps whether fundamentals justify it or not.

The NVDA section is a good reality check on how diversification has become in a cap‑weighted world. I still prefer that over a price-weighted cap, though. But yes, the fact that 74 S&P names outperformed it last year, yet the company still drove more of the index’s return than any other? It really makes you see how much of the market story is about the size of a few companies rather than stock‑picking. And that's considering an index with only 500 names.