The Sunday Drive - 07/20/2025 Edition [#172]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let’s enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

We’re a little over half way through what has historically been a good month for the equity markets. The markets have seemingly grown resistant to tariff talk and other media noise, real or perceived. Q2 earnings season has just gotten underway, and the market feels…alright—for now.

So this week, I’m vibin’ to a live performance of Joe Cocker’s Feeling Alright. For me, the best part of the video was the “more cowbell” backup singer. She was killin’ that cowbell! Enjoy.

💭 Quote of the Week

“There are only two types of people: those who can’t time the market, and those who don’t know they can’t time the market.“

— Terry Smith

📈 Chart of the Week

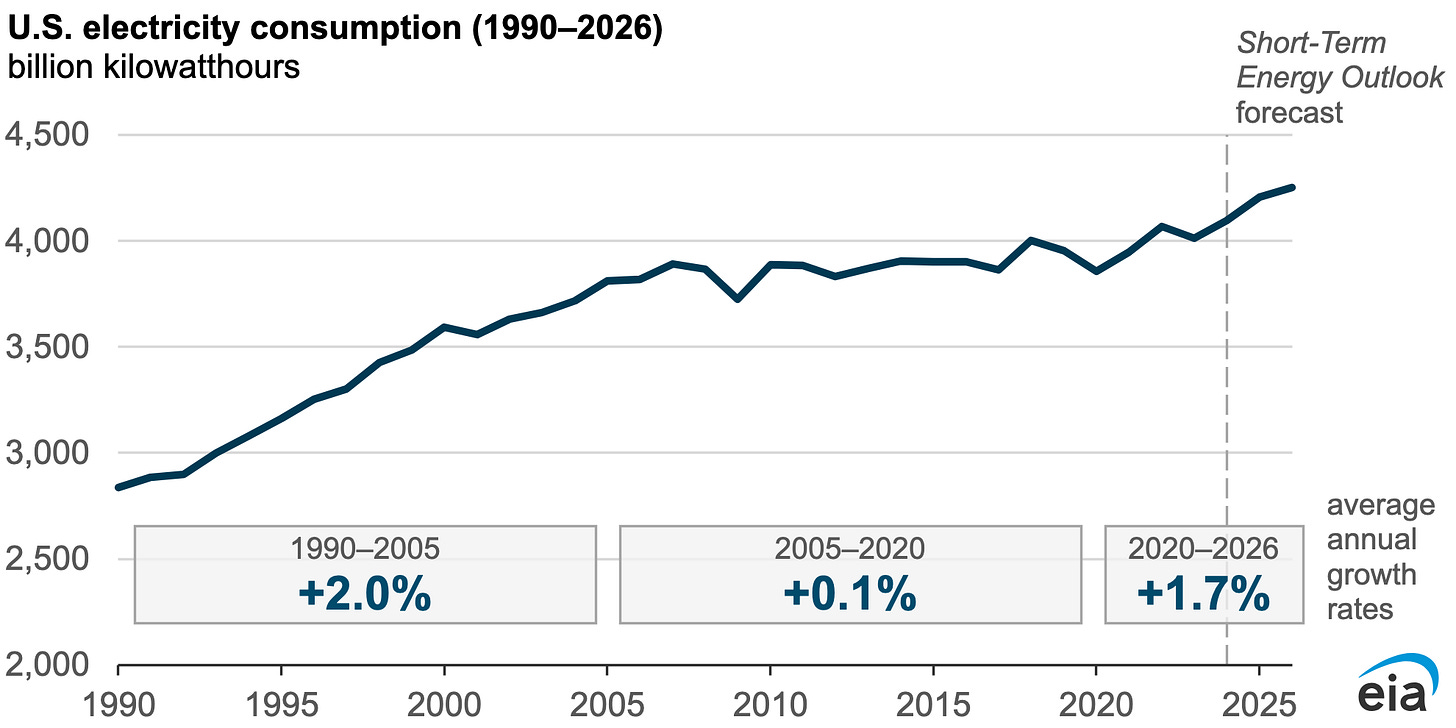

Electrifying Opportunity: AI Infrastructure and a New Energy Supercycle

For most investors, the AI narrative begins and ends with NVIDIA, OpenAI, and the so-called Magnificent Seven. But beneath the surface of model training and inference lies a growing demand curve that few are pricing in fully: electricity.

According to the U.S. Energy Information Administration (EIA), the source of this week’s Chart, U.S. electricity consumption flatlined for a decade and a half (2005–2020), growing at a mere +0.1% annually. That’s now changed. Since 2020, electricity demand is accelerating and is projected to grow +1.7% per year through 2026—and potentially accelerating even further over the next several years.

Why? You guessed it—AI-focused data centers.

AI’s Hidden Cost Driver: Power

AI infrastructure is fundamentally different from traditional cloud computing. Large language models and generative AI workloads require tens of thousands of GPUs, all running at full capacity and drawing enormous amounts of electricity. A single AI training run can consume several hundred megawatt-hours (MWh)—an order of magnitude more than traditional enterprise compute.

This demand doesn’t stop at training. Inference—the process of running AI in real-time applications—is a 24/7, always-on operation. Multiply this across sectors (finance, healthcare, manufacturing, logistics), and the implication is clear: we’re likely only at the beginning of a structural demand shift for electricity.

McKinsey notes that AI-focused data centers can consume 2x to 3x more electricity per square foot than legacy data centers.

Investment Implications: The Infrastructure Opportunity

This surge in electricity demand isn’t just an interesting anecdote—it could very well be an investable theme.

Utilities and Grid Modernization: Regulated utilities with large service territories, especially in AI-intensive regions (think Northern Virginia, Texas, the Pacific Northwest), are quietly becoming critical infrastructure partners to the AI arms race.

Power Providers and Developers: Independent power producers (IPPs), especially those with renewable portfolios and strong interconnection queues, stand to benefit from long-term power purchase agreements (PPAs) signed with hyperscalers like Amazon, Google, and Microsoft.

Data Center REITs: Select real estate investment trusts (REITs) specializing in high-power-density sites are experiencing secular demand tailwinds.

Microsoft alone is expected to spend $50 billion this year on AI data center infrastructure, with a sizable share earmarked for power procurement and grid partnerships.

From Utility Bills to Strategic Alliances

Perhaps most interestingly, we’re witnessing a transformation in the relationship between data center operators and electricity providers. No longer just ratepayers, AI companies are now forging long-term, vertically integrated partnerships with utilities.

We likely can expect to see:

Joint development of energy infrastructure

Long-dated renewable PPAs

On-site generation and storage

Electricity can account for 20% to 40% of total operating expenses for an AI data center, depending on region and cooling method. Energy price volatility and carbon intensity are now board-level concerns for every company deploying advanced AI infrastructure.

A Final Thought

The AI theme is far deeper than many investors realize. The true enablers—energy, infrastructure, and power delivery—may be where the next leg of long-term investment opportunity resides.

I believe that we could be witnessing the birth of a new energy supercycle. And unlike the last one, this time it’s being driven not by oil or steel—but by intelligence.

Sources: Energy Information Administration, McKinsey, The Information, Data Center Frontier

🚙 Interesting Drive-By's 🚙

💯 Are We Willing to Become Wiser in the Era of AI?

😊 How to Have a Happy Retirement

💸 Is Retirement a Relic of the Industrial Era?

🤔 Big Bang 2.0 - The Tokenization of Everything

💡 The Holding Companies of Our Hearts - The Art of Allocation

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.