The Sunday Drive - 05/18/2025 Edition [#163]

Musings and Meanderings of a Financial Provocateur

👋🏼 Hello friends! Let's enjoy a leisurely Sunday Drive around the internet.

🎶 Vibin'

Some weeks, there’s no particular theme that relates the tune I share to the rest of the Sunday Drive. This is one of those weeks. As the kids say, “No thoughts, just vibes.”

This week, I’m vibin’ to Lily Was Here, from Dave Stewart (of Eurythmics fame) and Candy Dulfer, one of the most amazing saxaphonists I’ve ever heard. Lots of call and answer at the beginning, but if you’re impatient, fast forward to the 2:00 minute mark when she really starts cooking. Enjoy.

💭 Quote of the Week

“You can ignore reality, but you cannot ignore the consequences of ignoring reality.“

— Ayn Rand

📈 Chart of the Week

Why Most Stocks Are Riskier Than You Think

The case for diversification and long-term discipline

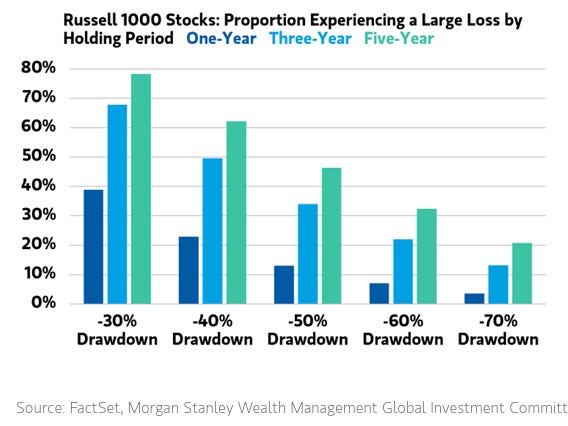

This week’s Chart spotlights a sobering reality for equity investors: individual stock drawdowns are more common—and more severe—than many realize. The Chart breaks down the percentage of Russell 1000 stocks that experienced large losses over one-, three-, and five-year periods.

The message is clear: over time, the probability that any given stock suffers a major decline is uncomfortably high.

Consider this…

Over a five-year holding period, roughly 50% of Russell 1000 stocks experienced a drawdown of 50% or more. That’s not the small-cap corner of the market—we’re talking about the 1,000 largest publicly traded U.S. companies. Stretch the time frame, and the odds of a deep drawdown grow steadily worse. Nearly 70% of these stocks fell 30% or more over five years. Even at the one-year mark, nearly 40% saw a 30% decline, and 20% dropped by 50% or more.

This reality check underscores two timeless principles:

Individual stock risk is real, and

Diversification remains among investors’ best defenses.

A concentrated portfolio, no matter how high-quality the names held may be, can expose investors to painful, prolonged losses. Diversification—across sectors, styles, and asset classes—helps mitigate that risk, smoothing the impact of any one holding blowing up.

The Chart also reinforces the emotional dimension of investing. Experiencing a 50% decline in a stock you hold—even one you believe in—can be psychologically brutal. Without a disciplined strategy and longer time horizon, the temptation to sell at the bottom becomes too great for many investors.

In the end, this week’s Chart is a reminder that investing is hard not just because markets are volatile—but because human behavior is as well. A diversified, rules-based portfolio combined with a long-term investment mindset remains the most reliable path through the noise and drawdowns.

—

Sources: Morgan Stanley Wealth Management Global Investment Committee via FactSet; Meb Faber X post: https://x.com/barchart/status/1923061037525324126

🚙 Interesting Drive-By's

💡 The Liberation of Creative Potential: The New Frontier of the Bonus Round

📈 Less Concentrated Markets Could Buoy Active Managers

🎯 Productivity Paradox: The curious case of generative AI's missing efficiency miracle — and why that's precisely the point.

🤔 The Great Rebalancing: Why Everything Feels Like It’s Breaking

💸 Even Wealthy Individuals May Claim Social Security Too Soon

👋🏼 Parting Thought

If you have any cool articles or ideas that might be interesting for future Sunday Drive-by's, please send them along or tweet 'em (X ‘em?) at me.

Please note that the content in The Sunday Drive is intended for informational purposes only, and is in no way intended to be financial, legal, tax, marital, or even cooking advice. Consult your own professionals as needed. The views expressed in The Sunday Drive are mine alone, and are not necessarily the views of Investment Research Partners.

I hope you have a relaxing weekend and a great week ahead. See you next Sunday...

Your faithful financial provocateur,

-Mike

If you enjoy the Sunday Drive, I'd be honored if you'd share it with others.

If this was forwarded to you, please subscribe and join the other geniuses who are reading this newsletter.